Get the free sample chapter 7 cases and illustrative forms 1, 2, and 3

Show details

SAMPLE CHAPTER 7 CASES AND

ILLUSTRATIVE FORMS 1, 2, AND 3SAMPLE CHAPTER 7 CASE #1 AND ILLUSTRATIVE FORMS 1, 2 AND 3Sam Martin, DBA Martin Cards (Debtor), filed bankruptcy on November 20, 2002, in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sample chapter 7 cases

Edit your sample chapter 7 cases form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sample chapter 7 cases form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sample chapter 7 cases online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sample chapter 7 cases. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sample chapter 7 cases

How to fill out sample chapter 7 cases:

01

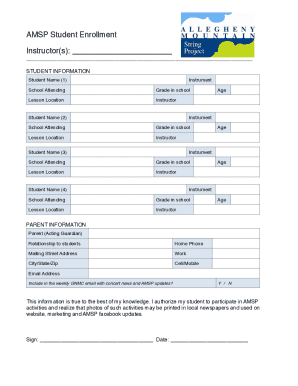

Gather all relevant financial information: Begin by collecting all necessary financial records, including income statements, balance sheets, tax returns, and a list of assets and liabilities. This information will be crucial when completing the necessary forms for the chapter 7 bankruptcy case.

02

Determine eligibility: It is important to determine if you meet the eligibility criteria for filing a chapter 7 bankruptcy. The means test is typically used to assess your income and determine if you qualify for this type of bankruptcy. If you pass the means test, you can proceed with the filing.

03

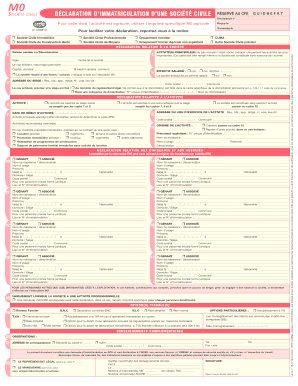

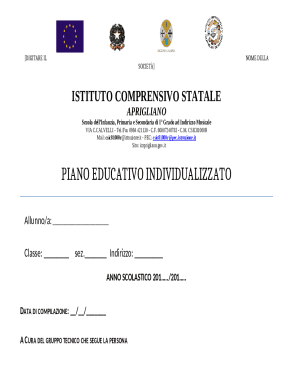

Complete the necessary forms: You will need to fill out various forms to initiate the chapter 7 bankruptcy case. The most important form is the official bankruptcy petition (Form B1), which provides details about your financial situation, income, expenses, and assets.

04

Provide supporting documentation: Alongside the forms, you will need to submit supporting documentation. This may include pay stubs, bank statements, tax returns, and other relevant financial records. Make sure to organize and label these documents appropriately for easy reference.

05

Attend mandatory credit counseling: Before filing for chapter 7 bankruptcy, it is mandatory to attend credit counseling from an approved agency. This counseling will help you understand the implications and alternatives to bankruptcy, ensuring you make an informed decision.

06

File the forms with the bankruptcy court: Once you have completed all the necessary forms and gathered the required documentation, file everything with the bankruptcy court in the district where you reside. Ensure you understand any specific filing requirements and fees that may apply.

07

Cooperate with the trustee assigned to your case: After filing, a trustee will be assigned to oversee your chapter 7 bankruptcy case. Cooperate fully with the trustee, providing any additional information or documents they may request. Failure to cooperate can lead to your case being dismissed.

Who needs sample chapter 7 cases:

01

Individuals facing overwhelming debt: Sample chapter 7 cases are particularly helpful for individuals struggling with overwhelming debt, such as credit card debt, medical bills, or unsecured loans. Filing for chapter 7 bankruptcy can provide a fresh start and help eliminate or reduce these debts.

02

Small business owners: Sole proprietors or owners of small businesses who are unable to meet their financial obligations may also find sample chapter 7 cases relevant. This type of bankruptcy allows for the liquidation of business assets to pay off debts and potentially close the business.

03

Individuals seeking a financial reset: Sometimes, unforeseen circumstances or poor financial decisions can lead to a downward spiral of debt. Sample chapter 7 cases can be useful for individuals seeking a fresh start, allowing them to discharge their debts and rebuild their financial lives.

In summary, filling out sample chapter 7 cases involves gathering financial information, determining eligibility, completing necessary forms, providing supporting documentation, attending credit counseling, filing with the bankruptcy court, and cooperating with the assigned trustee. These cases are typically relevant for individuals facing overwhelming debt, small business owners in financial distress, and those seeking a financial reset.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sample chapter 7 cases to be eSigned by others?

When you're ready to share your sample chapter 7 cases, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make edits in sample chapter 7 cases without leaving Chrome?

sample chapter 7 cases can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for signing my sample chapter 7 cases in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your sample chapter 7 cases right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is sample chapter 7 cases?

Chapter 7 bankruptcy cases involve the liquidation of assets of an individual or business to pay off debts.

Who is required to file sample chapter 7 cases?

Individuals or businesses who are unable to repay their debts may file for Chapter 7 bankruptcy.

How to fill out sample chapter 7 cases?

To fill out a Chapter 7 bankruptcy case, individuals or businesses must gather financial information, complete required forms, and file them with the bankruptcy court.

What is the purpose of sample chapter 7 cases?

The purpose of Chapter 7 cases is to provide individuals or businesses with a fresh start by eliminating most of their debts through the liquidation process.

What information must be reported on sample chapter 7 cases?

Information on assets, liabilities, income, expenses, and any contracts or leases must be reported on Chapter 7 bankruptcy forms.

Fill out your sample chapter 7 cases online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Chapter 7 Cases is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.