Get the free ( ) Non-Profit (Free)

Show details

() Nonprofit (Free) () General Entry $40 Contact Person Email Address Phone # Address City Zip Approx # in Group Approx Lineup area Needed FEET (Average Pickup Truck 15) By my signature below I acknowledge

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-profit

Edit your non-profit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-profit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-profit online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit non-profit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

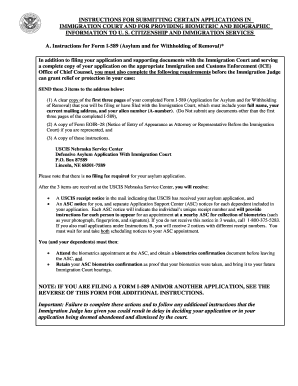

How to fill out non-profit

How to fill out non-profit:

01

Research and understand the requirements: Begin by familiarizing yourself with the regulations and guidelines for non-profit organizations in your country or state. This may include determining the specific forms and documents that need to be filled out.

02

Choose a legal structure: Decide on the legal structure that best fits your non-profit's mission and goals. Common options include a charitable trust, a non-profit corporation, or an unincorporated association. Consider consulting with a lawyer to ensure compliance with legal and tax requirements.

03

Develop a mission statement: Clearly define the purpose and mission of your non-profit organization. This statement will guide your activities and help stakeholders understand the impact you aim to make.

04

Establish a board of directors: Form a board of directors consisting of individuals who are passionate about your cause and possess diverse skills and expertise. They will play a crucial role in governing and guiding the organization.

05

Create bylaws and organizational policies: Draft bylaws that outline the internal rules and procedures of your non-profit. This typically includes details about board responsibilities, decision-making processes, membership, and conflict resolution.

06

Obtain necessary licenses and permits: Identify any licenses or permits required to operate your non-profit. This may include obtaining tax-exempt status, registering with appropriate government agencies, or applying for fundraising licenses.

07

Develop a budget and financial plan: Create a comprehensive budget that outlines your expected income and expenses. Establish financial policies and procedures to ensure transparency and accountability.

08

File necessary paperwork: Complete and submit the required forms and documents to register your non-profit. This typically includes completing an application for tax-exempt status with the appropriate authority.

09

Develop a fundraising strategy: Identify potential sources of funding, such as grants, donations, or fundraising events. Create a strategic plan to attract financial support and sustain your organization's activities.

10

Establish a marketing and outreach plan: Develop a strategy to promote your non-profit's mission and impact. This may involve leveraging social media, organizing awareness campaigns, and building partnerships with other organizations.

Who needs non-profit:

01

Charitable organizations: Non-profits are commonly used by charitable organizations that aim to address social, educational, environmental, or health-related issues.

02

Community-based initiatives: Local community projects often benefit from being structured as non-profit organizations. These initiatives can involve providing support to disadvantaged populations, organizing cultural events, or creating recreational opportunities.

03

Advocacy groups: Non-profit organizations play a critical role in advocating for various causes, whether it be civil rights, animal welfare, environmental conservation, or public health. These groups rely on non-profit status to support their activities and campaigns.

04

Religious and faith-based organizations: Many religious or faith-based organizations operate as non-profits. They use their non-profit structure to carry out their spiritual or religious missions, provide education, and offer charitable services to their communities.

05

Education and research institutions: Non-profit organizations are commonly used to establish educational institutions, schools, colleges, and universities. It allows them to operate for the purpose of advancing knowledge, research, and educational opportunities.

Overall, non-profit organizations are essential for individuals and groups seeking to make a positive impact in their communities, advocate for important causes, or establish institutions focused on education, research, or faith-based activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my non-profit directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your non-profit along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I complete non-profit online?

pdfFiller has made filling out and eSigning non-profit easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit non-profit on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share non-profit on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is non-profit?

Non-profit organizations are entities that use their surplus revenues to achieve their goals rather than distributing them as profit or dividends.

Who is required to file non-profit?

Non-profit organizations are required to file with the appropriate government agency, usually the Internal Revenue Service (IRS) in the United States.

How to fill out non-profit?

To file as a non-profit, organizations typically need to complete the necessary forms and provide detailed information about their activities and finances.

What is the purpose of non-profit?

The purpose of non-profit organizations is to serve the public interest, such as providing charitable, educational, religious, or scientific services.

What information must be reported on non-profit?

Non-profit organizations are typically required to report on their activities, finances, governance structure, and any conflicts of interest.

Fill out your non-profit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Profit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.