Get the free HECM Fixed Rate Model Loan Agreement - Final

Show details

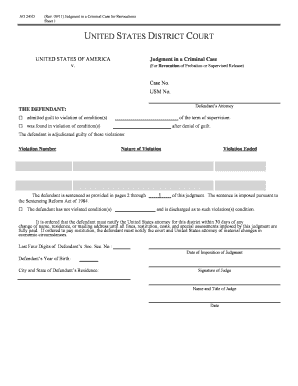

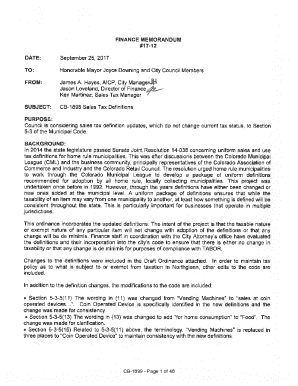

Published 2/12/15. Please review Mortgagee Letters 201421 and 201502 for the effective dates of the new language in these model documents. FHA Case No. HOME EQUITY CONVERSION MORTGAGE LOAN AGREEMENT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hecm fixed rate model

Edit your hecm fixed rate model form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hecm fixed rate model form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hecm fixed rate model online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit hecm fixed rate model. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hecm fixed rate model

How to fill out HECM fixed rate model:

01

Start by gathering all the necessary information and documentation, such as your Social Security number, proof of homeownership, and income verification.

02

Contact a HUD-approved HECM counselor to discuss your options and receive guidance on the application process.

03

Fill out the HECM fixed rate model application form accurately and completely. Make sure to provide all the required information, including your personal details, property information, and loan preferences.

04

Double-check your application for any errors or missing information before submitting it. Incomplete or incorrect applications can delay the process.

05

Submit the completed application to your chosen HECM lender along with any additional documentation they may require.

06

Wait for the lender to review your application and provide you with a loan estimate that outlines the terms and conditions of the HECM fixed rate model.

07

If you're satisfied with the loan estimate, proceed with the appraisal process. The lender will order an appraisal to determine the value of your property.

08

Review the final loan documents and disclosures provided by the lender before signing them. Ensure that you understand all the terms and conditions of the HECM fixed rate model.

09

Close the loan by signing the necessary paperwork in the presence of a notary public or an authorized representative.

10

Once the loan is closed, you'll have access to the funds according to the agreed-upon terms of the HECM fixed rate model.

Who needs HECM fixed rate model:

01

Individuals who are 62 years of age or older and own a primary residence.

02

Homeowners who are looking for a way to access the equity in their homes without having to sell or move out.

03

Seniors who wish to supplement their retirement income or fund large expenses, such as medical bills or home renovations.

04

Those who want to eliminate their monthly mortgage payments or have a more steady and predictable stream of income.

05

Individuals who want to protect themselves against future inflation or market fluctuations through a fixed interest rate HECM loan.

06

Homeowners who want to remain in their homes for as long as possible without the worry of running out of money.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete hecm fixed rate model online?

pdfFiller has made it easy to fill out and sign hecm fixed rate model. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I fill out the hecm fixed rate model form on my smartphone?

Use the pdfFiller mobile app to complete and sign hecm fixed rate model on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete hecm fixed rate model on an Android device?

Use the pdfFiller app for Android to finish your hecm fixed rate model. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is hecm fixed rate model?

The HECM fixed rate model is a type of Home Equity Conversion Mortgage that offers a fixed interest rate for the life of the loan.

Who is required to file hecm fixed rate model?

Lenders and financial institutions offering HECM fixed rate models are required to file the necessary paperwork.

How to fill out hecm fixed rate model?

To fill out a HECM fixed rate model, the lender or financial institution must include all required borrower and loan information in the appropriate sections of the form.

What is the purpose of hecm fixed rate model?

The purpose of the HECM fixed rate model is to provide borrowers with a stable and predictable loan option for accessing their home equity.

What information must be reported on hecm fixed rate model?

The HECM fixed rate model requires information such as borrower details, loan terms, interest rate, and repayment schedule to be reported.

Fill out your hecm fixed rate model online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hecm Fixed Rate Model is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.