Get the free GAIN Report #CH3811

Show details

Foreign Agricultural Service GAIN Report Global Agriculture Information NetworkVoluntary Report public distributional: 4/14/2003 GAIN Report #CH3811China, Peoples Republic of Retail Food Sector Shanghai

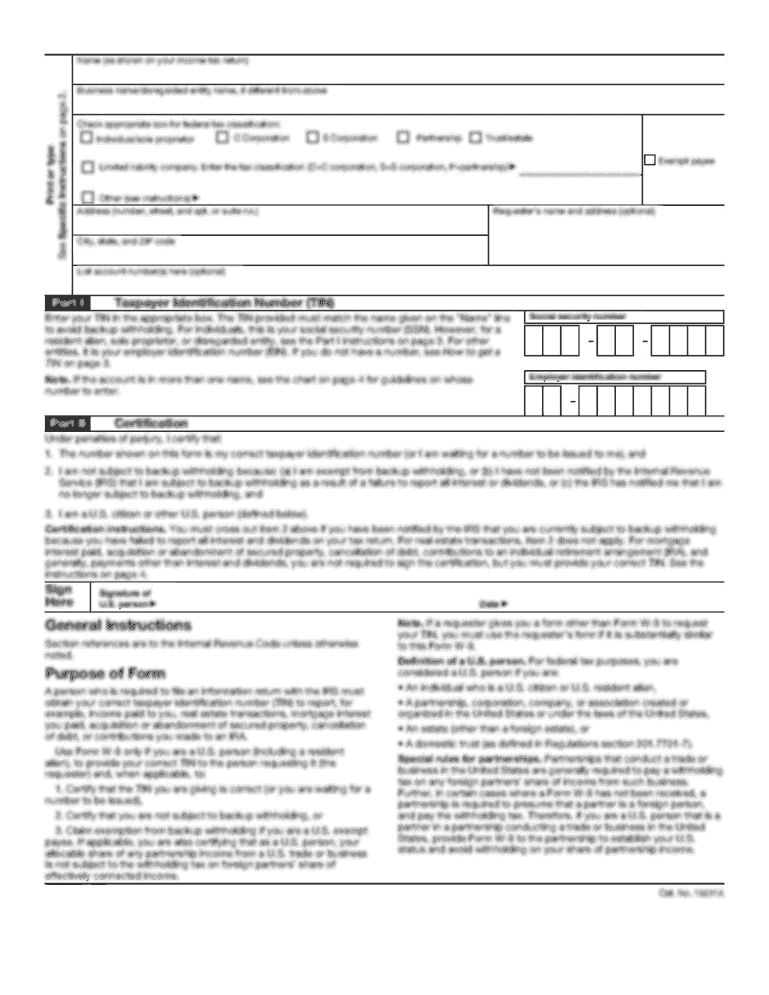

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gain report ch3811

Edit your gain report ch3811 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gain report ch3811 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gain report ch3811 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit gain report ch3811. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gain report ch3811

How to fill out gain report ch3811:

01

Begin by identifying the purpose and scope of the report. Gain report ch3811 is typically used to document gains made in a specific area or field.

02

Fill out the header section of the report, which includes important information such as the report title, date, and author.

03

Provide an introduction that highlights the objectives and background of the report. This helps to set the context for the gains being reported.

04

Clearly outline the criteria or measurements used to determine the gains. This could be in the form of specific metrics, data analysis, or comparisons.

05

Present the findings and gains achieved in a structured and organized manner. Create separate sections or subsections to highlight different areas or aspects of the gains.

06

Include any relevant charts, graphs, or visual representations to support the gains reported. These can help to enhance the understanding and impact of the report.

07

Conclude the report by summarizing the key findings and emphasizing the significance of the gains. Discuss any implications or recommendations for future action if necessary.

08

Finally, review and proofread the report to ensure accuracy and clarity.

Who needs gain report ch3811:

01

Businesses or organizations that want to track and document their progress in a specific area.

02

Managers or executives who need to report on the gains achieved by their teams or departments.

03

Stakeholders or investors who are interested in understanding the positive outcomes or growth of a particular project or initiative.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send gain report ch3811 to be eSigned by others?

gain report ch3811 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I complete gain report ch3811 online?

Filling out and eSigning gain report ch3811 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How can I edit gain report ch3811 on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing gain report ch3811, you need to install and log in to the app.

What is gain report ch3811?

Gain report ch3811 is a form used to report gains from the sale of assets.

Who is required to file gain report ch3811?

Individuals or businesses who have realized gains from the sale of assets are required to file gain report ch3811.

How to fill out gain report ch3811?

To fill out gain report ch3811, you will need to provide details about the asset sold, the purchase price, the sale price, and any other relevant information.

What is the purpose of gain report ch3811?

The purpose of gain report ch3811 is to report and calculate the tax liability on gains from the sale of assets.

What information must be reported on gain report ch3811?

On gain report ch3811, you must report details such as the date of sale, description of the asset, purchase price, sale price, and any deductions or credits applicable.

Fill out your gain report ch3811 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gain Report ch3811 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.