PA REV-1737-1 2018-2026 free printable template

Show details

EX (0315)REV17371

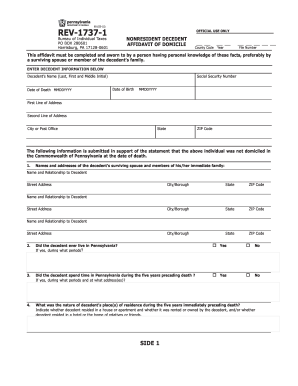

Bureau of Individual TaxesOFFICIAL USE ONLYNONRESIDENT DECEDENT

AFFIDAVIT OF DOMICILE PO BOX 280601

Harrisburg, PA 171280601County CodeYearFile Numbers affidavit must be completed

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign rev 1737 download form

Edit your rev 1737 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA REV-1737-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PA REV-1737-1 online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PA REV-1737-1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA REV-1737-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA REV-1737-1

How to fill out PA REV-1737-1

01

Obtain the PA REV-1737-1 form from the official website or local tax office.

02

Fill out the personal information section, including name, address, and Social Security number.

03

Provide details about your income sources and amounts for the reporting period.

04

Complete the sections regarding deductions and credits if applicable.

05

Review the form for accuracy and completeness.

06

Sign and date the form at the designated section.

07

Submit the completed form to the appropriate tax authority by the specified deadline.

Who needs PA REV-1737-1?

01

Individuals or businesses who wish to amend their Pennsylvania tax returns.

02

Taxpayers claiming certain deductions or credits related to state taxes.

03

Those who have changes in their income or filing status that affect their tax liability.

Fill

form

: Try Risk Free

People Also Ask about

What is PA Form Rev 516?

Form REV-516 "Notice of Transfer"(Stocks,Bonds, Securities or Security Accounts held in Beneficiary Form) to request Waiver Notice of Transfer, must be completed and submitted to Form REV-998 and Form REV-999 have replaced PA Schedule D(P/S).

How do I avoid Pennsylvania inheritance tax?

How To Avoid Inheritance Tax. One way to avoid inheritance tax in PA is to make an asset joint. For example, if you have $30,000 in your name alone, and through your will, you give it to a friend of yours, it would be taxed at 15% or they would owe $4,500 in taxes.

Who has to pay inheritance tax in PA?

The rates for Pennsylvania inheritance tax are as follows: 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger; 4.5 percent on transfers to direct descendants and lineal heirs; 12 percent on transfers to siblings; and.

Who needs to file a PA inheritance tax return?

An inheritance tax return must be filed for every decedent (or person who died) with property that may be subject to PA inheritance tax. The tax is due within nine months of the decedent's death. After nine months, the tax due accrues interest and penalties.

What is a PA rev 1543?

The purpose of REV-1543 is to make sure that the tax on a joint bank account is paid regardless of whether an estate files a REV-1500. The purpose of checkbox E on the REV- 1543 is to deflect tax collection efforts away from the surviving joint owner toward the estate, so that the tax is not being collected twice.

Do non residents pay Pennsylvania inheritance tax?

In the case of a nonresident decedent, all real property and tangible personal property located in Pennsylvania at the time of the decedent's death is taxable. Intangible personal property of a nonresident decedent is not taxable.

Who must file a PA 41?

The fiduciary of an estate or trust is required under Pennsylvania law to file a PA-41 Fiduciary Income Tax Return, and pay the tax on the taxable income of such estate or trust. If two or more fiduciaries are acting jointly, the return may be filed by any one of them.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the PA REV-1737-1 in Gmail?

Create your eSignature using pdfFiller and then eSign your PA REV-1737-1 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I edit PA REV-1737-1 on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing PA REV-1737-1 right away.

How do I complete PA REV-1737-1 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your PA REV-1737-1 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is PA REV-1737-1?

PA REV-1737-1 is a form used in Pennsylvania for reporting certain tax-related information.

Who is required to file PA REV-1737-1?

Any entity or individual that has transactions requiring tax reporting in Pennsylvania is required to file PA REV-1737-1.

How to fill out PA REV-1737-1?

To fill out PA REV-1737-1, one must provide accurate financial information, including income details, deductions, and any applicable credits as outlined in the form's instructions.

What is the purpose of PA REV-1737-1?

The purpose of PA REV-1737-1 is to ensure proper tax reporting and compliance with Pennsylvania tax laws.

What information must be reported on PA REV-1737-1?

The information that must be reported includes the taxpayer's identification details, income figures, and any deductions and credits claimed.

Fill out your PA REV-1737-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA REV-1737-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.