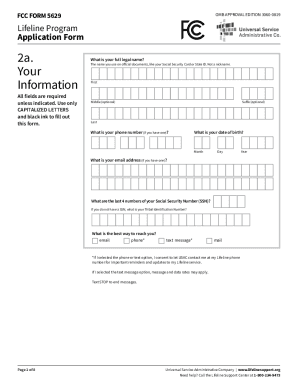

FCC Form 5629 2018 free printable template

Get, Create, Make and Sign FCC Form 5629

How to edit FCC Form 5629 online

Uncompromising security for your PDF editing and eSignature needs

FCC Form 5629 Form Versions

How to fill out FCC Form 5629

How to fill out FCC Form 5629

Who needs FCC Form 5629?

Instructions and Help about FCC Form 5629

Hey everyone Mike to bliss here welcome back to the webinar I'm your lifeline for form 8938 were now up to module 4 in the webinar series here in module four were going to cover the form 8938 penalties as well as the statute of limitations as tempting as it might be to look up in the sky in total exasperation over the maze of form 8938 requirements and put down whatever comes to mind on a form 8938 merely to appease the IRS this my friends would be a recipe for disaster very simply it could trigger a number of parade of horrible and were going to get into some of those parade of horrible in these slides like other penalties in the international arena the form 8938 penalties brings with it all the fury of a gigantic tidal wave pounding the shore relentlessly now I realize that that's a powerful metaphor, but it is very appropriate for the type of penalties that attacks payer faces for failing to file or form 8938 lets begin with the first penalty that the taxpayer can expect the IRS to assert upon failing to file form 8938 now there are others so what were going to do is start with the first type of penalty and then discuss the others that may or may not apply very simply if the taxpayer fails to file form 8938 in a tie we manner then he must pay a penalty of ten thousand dollars what does the IRS mean by a timely manner well very simply by the filing deadline so if the filing deadline for the taxpayers form 8938 comes and goes without the taxpayer filing that form then he must pay a penalty of ten thousand dollars and as we all know the IRS is a stickler is a stickler for enforcing the timeliness of all of its reporting forms not just the 8938 so even if the form is submitted a day after the day after the due date the taxpayer still has to pay the ten-thousand-dollar penalty now of course there are defenses and well get into some defenses towards the end of this webinar now we get into the chance of other penalties that apply the penalty increases if the taxpayer doesn't fix the problem expeditiously after the IRS brings it to his attention and the penalty increases not just a little but dramatically in this case so the string that's attached here is that the taxpayer receives a notice from the IRS about the missing return now this doesn't always happen as a matter of fact it's rare that the IRS actually sends a notice to the taxpayer about the missing return but when it does happen that's when the possibility of an additional or additional penalties exists so here you can see a quick and dirty example lets assume that the taxpayer does not file form 8938 and let's assume that the IRS has sent the taxpayer a notice about the missing return well here show it works the IRS gives the taxpayer a 90-day grace period to cure the defect what I mean by cure the defect is to file form 8938 within 90 days after the day on which the IRS and the notice and if the taxpayer does that then there if there is no additional 10000 there's no additional penalty...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out FCC Form 5629 using my mobile device?

Can I edit FCC Form 5629 on an Android device?

How do I complete FCC Form 5629 on an Android device?

What is FCC Form 5629?

Who is required to file FCC Form 5629?

How to fill out FCC Form 5629?

What is the purpose of FCC Form 5629?

What information must be reported on FCC Form 5629?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.