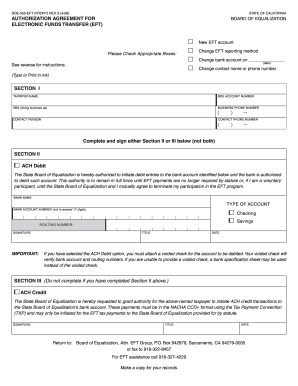

CA CDTFA-555-ST (Formerly BOE-555-EFT) 2017-2025 free printable template

Get, Create, Make and Sign the boe 555 form

Editing boe555 eft transfer fill online

Uncompromising security for your PDF editing and eSignature needs

CA CDTFA-555-ST (Formerly BOE-555-EFT) Form Versions

How to fill out CA CDTFA-555-ST Formerly BOE-555-EFT

How to fill out CA CDTFA-555-ST (Formerly BOE-555-EFT)

Who needs CA CDTFA-555-ST (Formerly BOE-555-EFT)?

Video instructions and help with filling out and completing boe555 eft form pdf

Instructions and Help about CA CDTFA-555-ST Formerly BOE-555-EFT

Hi my name is Stefan going of EFT Alive calm and finding the love you want calm in this video I'm going to talk about how EFT works and how to do the EFT basic recipe the basic premise of EFT and energy psychology is that all negative emotions are caused by a disturbance in our body's energy system now the energy system of talking about here is the same energy system that acupuncturists use acupuncturists talked about there being 14 energy pathways in the body which they call meridians, so the idea is anytime you're experiencing negative emotion whether it's anger or sadness or fear or shame these negative emotions are going to be caused by a disturbance in one or more of your fourteen energy meridians so how does EFT work them if T works by clearing out the disturbances in your men are in your meridians in your energy pathways when you've completely clear out all the disturbance in your energy pathways you will notice that all your negative emotions go away so in the simplest case and the simplest sense what you do is you intentionally focus on the negative emotions you're having whether it's from a painful memory or something that's happening today you will know at that point that there's energy disturbances in your meridians that are activated, and then you'll tap on a set of ten acupuncture points which are designed to impact all 14 meridians and as you're tapping on these acupuncture points this tapping process will gradually release the disturbance in those meridians in all 14 meridians and what you'll experience is that the negative emotions you're having which could start out to be very intense gradually just drain away until they're completely gone which can be quite an amazing experience, so I talked about there being 10 acupuncture points to affect all 14 meridians the reason why there's only 10 instead of 14 is that some acupuncture points are intersections of two meridians, so they're able to impact two meridians at once, so we only need ten to do all 14 reasons so what are the ten tapping points so let's go over those now so the first tapping point is on the top of your head and at the exact location you can find by sticking your thumbs in your ears being straight up and then living your middle fingers meet on the top now in order so that we don't have to do that every time what we're going to do instead just Pat the top of your head with all four fingers kind of like you know wherever yours humming and patting your head okay that way you'll definitely get the point without have to worry about exactly where it is now the way you do the tap and all the points is quick little thunks, so it's pretty quick it's tough to have like that, and you wouldn't do it firm enough that there's that their little percussion that there's a little of percussion involved which is why calm little thugs but not hard enough that you're going to get tender if you keep tapping there but also not little feather touches either just little thunks, so that's...

People Also Ask about

What is CDTFA Schedule C?

What kind of tax is CDTFA?

What is CDTFA 531 q?

Who needs to file CDTFA?

Can I file CDTFA 65 online?

Do I need to file a Schedule C?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CA CDTFA-555-ST Formerly BOE-555-EFT directly from Gmail?

How can I fill out CA CDTFA-555-ST Formerly BOE-555-EFT on an iOS device?

Can I edit CA CDTFA-555-ST Formerly BOE-555-EFT on an Android device?

What is CA CDTFA-555-ST (Formerly BOE-555-EFT)?

Who is required to file CA CDTFA-555-ST (Formerly BOE-555-EFT)?

How to fill out CA CDTFA-555-ST (Formerly BOE-555-EFT)?

What is the purpose of CA CDTFA-555-ST (Formerly BOE-555-EFT)?

What information must be reported on CA CDTFA-555-ST (Formerly BOE-555-EFT)?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.