Get the free Direct Loan Refunds of Cash - ifap ed

Show details

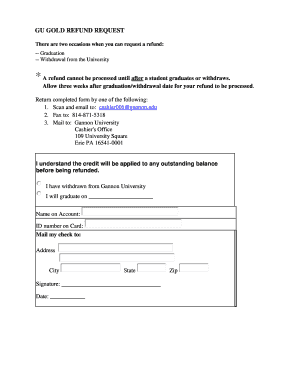

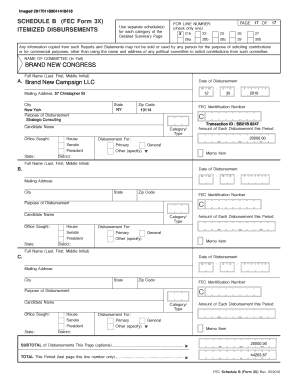

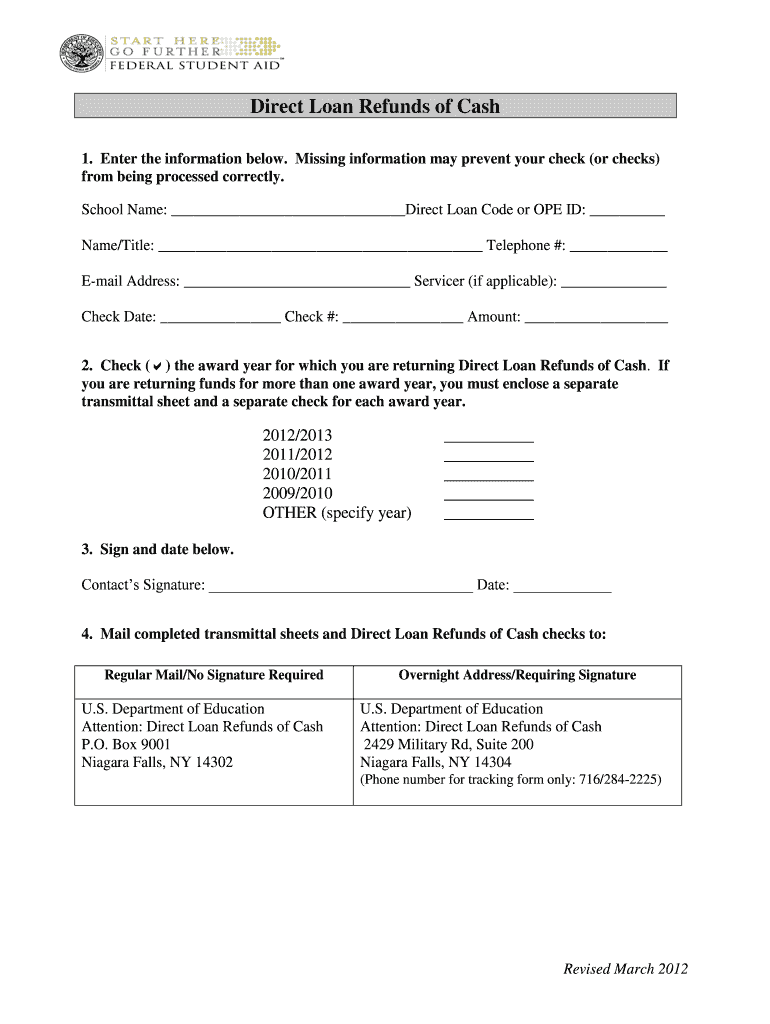

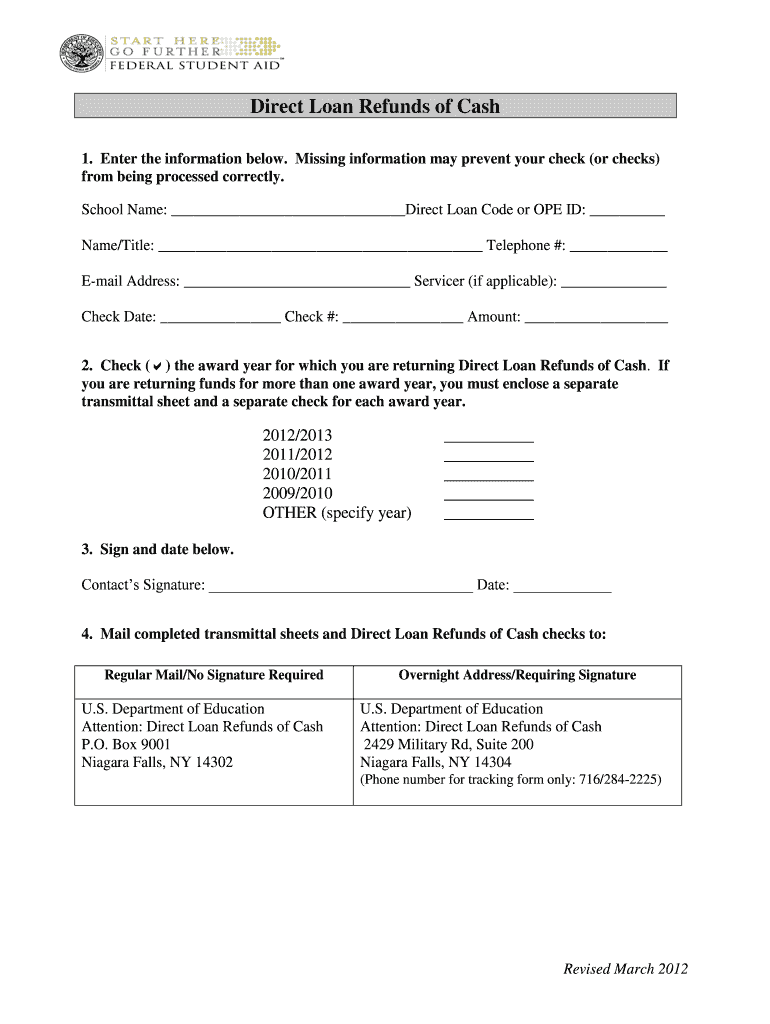

This form is used to return Direct Loan Refunds of Cash to the U.S. Department of Education, including details about the school and award year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign direct loan refunds of

Edit your direct loan refunds of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your direct loan refunds of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing direct loan refunds of online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit direct loan refunds of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out direct loan refunds of

How to fill out Direct Loan Refunds of Cash

01

Gather necessary documents including your Direct Loan information and any required refund forms.

02

Visit the appropriate website or portal for submitting Direct Loan Refunds of Cash.

03

Complete the required fields in the refund application form accurately, ensuring all amounts are correct.

04

Attach any necessary documentation that supports your claim for a refund.

05

Review your application for any errors or missing information before submitting.

06

Submit the completed refund application and keep a copy for your records.

07

Monitor the status of your refund application through the provided tracking options.

Who needs Direct Loan Refunds of Cash?

01

Students who have overpaid on their Direct Loans.

02

Borrowers who have withdrawn from school and are eligible for a refund.

03

Individuals seeking reimbursement for canceled loans or loans that were not fully disbursed.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to pay back a federal direct loan?

Yes, it is usually worth it. The unsubsidized loan will still come with a lower interest rate than private loans. You might think ``I don't need the money this year,'' but you are limited to how much you can take it in a given year.

Why did I get a federal student loan refund check?

Direct Unsubsidized Loan Eligible students may borrow up $20,500 per year, with a lifetime borrowing limit of $138,500 (including any Federal Direct Loans for both undergraduate and graduate education). Fixed interest rate (8.08% for loans made in 2024–2025).

What is William D. Ford Federal Direct loan Direct loan Program loans?

A large refund might come from any number of things. Maybe you received maximum Pell and your tuition was lower than what you received. Maybe you took out the maximum amount in federal student loans and are receiving the excess, in which case be careful because you'll need to pay that back at some point.

How does the direct loan program work?

Direct Subsidized Loans are given to undergraduate students who demonstrate financial need. You won't pay or collect interest while you are in school and during the grace period after you leave school. The Department of Education pays the loan's interest on your behalf during that time.

Why did I receive a student loan refund check?

The William D. Ford Federal Direct Loan (Direct Loan) Program is a federal student loan program under which eligible students and parents borrow directly from the U.S. Department of Education at participating schools.

Why is financial aid giving me a refund?

Some loan forgiveness programs are taxable and some are not. Under current law, the amount forgiven generally represents taxable income for income tax purposes in the year it is written off. There are, however, a few exceptions.

What is William D. Ford Federal Direct loan Direct loan Program?

The William D. Ford Federal Direct Loan (Direct Loan) Program is a federal student loan program under which eligible students and parents borrow directly from the U.S. Department of Education at participating schools.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Direct Loan Refunds of Cash?

Direct Loan Refunds of Cash refer to the process of returning excess cash received from direct loans, typically when a borrower has overpaid or when a school returns unutilized funds to the federal government.

Who is required to file Direct Loan Refunds of Cash?

Schools that have received Federal Direct Loan funds and need to return any excess cash to the U.S. Department of Education are required to file Direct Loan Refunds of Cash.

How to fill out Direct Loan Refunds of Cash?

To fill out Direct Loan Refunds of Cash, institutions need to provide the required details on the form, including the loan type, borrower information, and the amount to be refunded, ensuring accuracy and compliance with federal regulations.

What is the purpose of Direct Loan Refunds of Cash?

The purpose of Direct Loan Refunds of Cash is to ensure proper management of federal funds by allowing institutions to return excess loan amounts and to maintain the integrity of financial aid disbursements.

What information must be reported on Direct Loan Refunds of Cash?

The information that must be reported includes the loan identification number, borrower's name, the amount of cash being refunded, and the reason for the refund.

Fill out your direct loan refunds of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Direct Loan Refunds Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.