Get the free Loan Counseling Guide

Show details

This document provides detailed information and guidelines for schools regarding the requirements for entrance and exit loan counseling for students, focusing on managing student loans, understanding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan counseling guide

Edit your loan counseling guide form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan counseling guide form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loan counseling guide online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit loan counseling guide. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

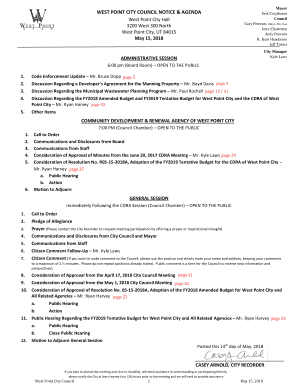

How to fill out loan counseling guide

How to fill out Loan Counseling Guide

01

Read the instructions thoroughly before starting.

02

Gather all necessary financial documents, including income statements and debts.

03

Fill out personal information such as name, address, and contact details.

04

Provide detailed information about your income sources and amounts.

05

List all current debts, including credit cards, mortgages, and loans.

06

Indicate any assets you hold, such as savings accounts or properties.

07

Complete sections on monthly expenses to give a clearer financial picture.

08

Review all provided information for accuracy.

Who needs Loan Counseling Guide?

01

Individuals considering taking out a loan.

02

Borrowers seeking to better understand their financial situation.

03

People looking to consolidate their debts.

04

Those planning to apply for any government-backed loans.

05

Anyone facing financial difficulties and seeking assistance.

Fill

form

: Try Risk Free

People Also Ask about

How long does FAFSA loan counseling take?

call the Federal Student Aid Information Center (FSAIC) at 1-800-433-3243.

What is the 7 year rule for student loans?

Not completing the exit loan counseling after dropping below half time can put you at risk for not getting anymore financial aid. Just get it done, it doesn't take too long, and will not hold you back from obtaining aid in the Spring.

How long does FAFSA loan entrance counseling take?

Entrance Counseling takes about 30 minutes to complete and it must be completed in a single session.

How long does it take for FAFSA loans to be approved?

Overall, FAFSA takes about 3 days to 3 weeks to process depending on if you filled out your form online or by hand. From there, the schools will use the data received to prepare your financial aid package.

What happens if you don't do exit loan counseling?

The entire counseling takes about 20-30 minutes and it must be completed in a single session.

Do parents who make $120000 still qualify for FAFSA?

There is no set income limit for eligibility to qualify for financial aid through. You'll need to fill out the FAFSA every year to see what you qualify for at your college. It's important to make sure you fill out the FAFSA as quickly as possible once it opens for the following school year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Loan Counseling Guide?

The Loan Counseling Guide is a resource designed to help borrowers understand the loan process, their rights, and the responsibilities involved in taking out a loan.

Who is required to file Loan Counseling Guide?

Individuals seeking financial assistance or applying for specific types of loans, such as student loans or mortgages, may be required to complete the Loan Counseling Guide as part of the application process.

How to fill out Loan Counseling Guide?

To fill out the Loan Counseling Guide, borrowers typically need to provide personal information, details about their financial situation, and any necessary documentation related to their income and loan application.

What is the purpose of Loan Counseling Guide?

The purpose of the Loan Counseling Guide is to educate borrowers about loan terms, help them make informed decisions, and ensure they comprehend the implications of borrowing funds.

What information must be reported on Loan Counseling Guide?

Information that must be reported on the Loan Counseling Guide generally includes borrower identification details, income information, loan type, loan amount, and an understanding of repayment terms.

Fill out your loan counseling guide online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Counseling Guide is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.