Get the free Increased Cost of Compliance Proof of Loss

Show details

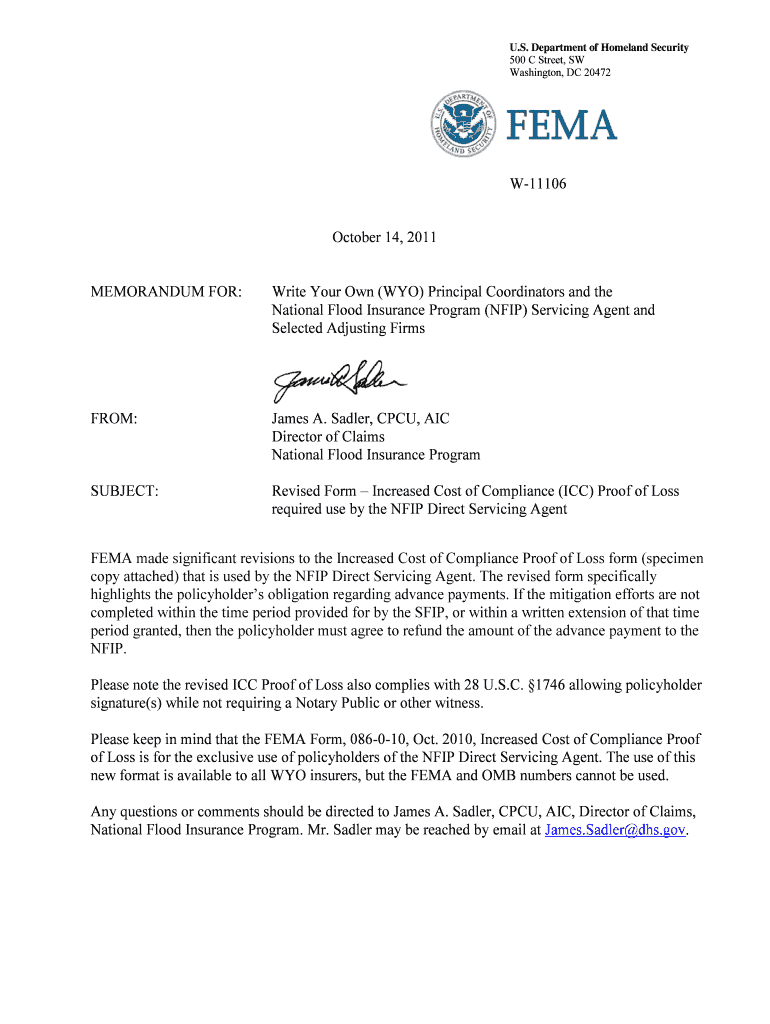

This memorandum provides information on the revised Increased Cost of Compliance Proof of Loss form required for use by the NFIP Direct Servicing Agent, including the policyholder's obligations and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign increased cost of compliance

Edit your increased cost of compliance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your increased cost of compliance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing increased cost of compliance online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit increased cost of compliance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out increased cost of compliance

How to fill out Increased Cost of Compliance Proof of Loss

01

Obtain the Increased Cost of Compliance Proof of Loss form from your insurance provider.

02

Read the instructions carefully to understand the requirements.

03

Fill out your personal and policy information at the top of the form.

04

Specify the type of loss or damage incurred due to increased compliance costs.

05

Document the specific costs you are claiming, providing detailed descriptions and supporting documents.

06

Make sure to include receipts, invoices, or other evidence of the expenses.

07

Sign and date the form to certify the accuracy of the information provided.

08

Submit the completed form along with any required documentation to your insurance company.

Who needs Increased Cost of Compliance Proof of Loss?

01

Business owners who have incurred additional costs due to compliance with new laws or regulations.

02

Individuals or organizations affected by changes in regulations that impact their operational costs.

03

Policyholders who have purchased insurance covering increased costs of compliance.

Fill

form

: Try Risk Free

People Also Ask about

Who is eligible for FEMA disaster assistance?

Only United States citizens, non-citizen nationals, or qualified aliens are eligible to receive assistance from FEMA.

What does ICC mean for insurance?

Increased Cost of Compliance (ICC) Coverage: Guidance for State and Local Officials. Determining Who is Eligible. In addition to being insured under the NFIP, a building must meet one of two conditions to be eligible to receive ICC coverage; it must have been either. 1) determined to be substantially damaged or.

What is ICC in compliance?

Increased Cost of Compliance (ICC) Overview. National Flood Insurance Program (NFIP) policyholders are eligible for an Increased Cost of Compliance (ICC) claim benefit provided that certain eligibility criteria are satisfied. Compliance activities include elevation, flood-proofing, relocation, and demolition.

What are the general eligibility requirements for FEMA?

Individuals and Households Program Eligibility The applicant must be a U.S. citizen, non-citizen national, or qualified non-citizen. FEMA must be able to verify the applicant's identity. The applicant's insurance, or other forms of disaster assistance received, cannot meet their disaster-caused needs.

What is FEMA ICC?

Increased Cost of Compliance (ICC) coverage is one of several resources for flood insurance policyholders who need additional help rebuilding after a flood.

Who is eligible for FEMA ICC?

Are You Eligible to File a Claim for ICC? Yes, if: 1) You have an NFIP flood insurance policy; and 2) Your community building department determines your home is substantially or repetitively damaged by flooding; and 3) The flood damage to your home is equal to 50 percent of the pre-flood market value.

Which of the following may be eligible for ICC coverage?

Are You Eligible to File a Claim for ICC? Yes, if: 1) You have an NFIP flood insurance policy; and 2) Your community building department determines your home is substantially or repetitively damaged by flooding; and 3) The flood damage to your home is equal to 50 percent of the pre-flood market value.

What does increase cost of compliance mean?

Increased Cost of Compliance (ICC) coverage is one of several resources for flood insurance policyholders who need additional help rebuilding after a flood. It provides up to $30,000 to help cover the cost of mitigation measures that will reduce flood risk.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Increased Cost of Compliance Proof of Loss?

Increased Cost of Compliance Proof of Loss is a document submitted to verify additional expenses incurred to meet new regulations or compliance standards following a covered loss event.

Who is required to file Increased Cost of Compliance Proof of Loss?

Policyholders who have incurred extra costs in order to comply with local, state, or federal regulations due to a loss covered by an insurance policy are required to file this proof.

How to fill out Increased Cost of Compliance Proof of Loss?

To fill out Increased Cost of Compliance Proof of Loss, policyholders should provide detailed descriptions of the compliance costs incurred, attach supporting documentation such as invoices or estimates, and ensure they complete all required sections of the form accurately.

What is the purpose of Increased Cost of Compliance Proof of Loss?

The purpose of Increased Cost of Compliance Proof of Loss is to formally document and claim reimbursement for additional costs incurred due to regulatory changes or compliance requirements resulting from a covered insurance loss.

What information must be reported on Increased Cost of Compliance Proof of Loss?

The information that must be reported includes the nature of the compliance cost, the date the cost was incurred, the amount spent, the reason for the increased cost, and any relevant documentation to support the claim.

Fill out your increased cost of compliance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Increased Cost Of Compliance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.