CA DE 660 2015 free printable template

Show details

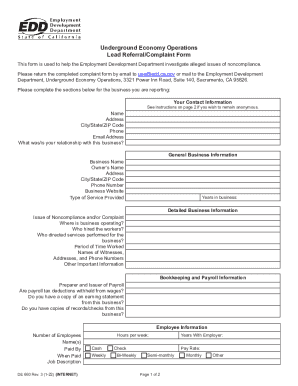

UNDERGROUND ECONOMY OPERATIONS LEAD REFERRAL/COMPLAINT FORM Please include as much information as possible on this form to help us investigate and correct the alleged noncompliance. You may remain

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign de 660 - edd

Edit your de 660 - edd form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your de 660 - edd form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit de 660 - edd online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit de 660 - edd. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA DE 660 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out de 660 - edd

How to fill out CA DE 660

01

Obtain the CA DE 660 form from the California Department of Employment Development website or your local office.

02

Enter your personal information in the designated fields, including your name, address, and Social Security number.

03

Provide details about your employment history, including job titles, employers, and dates of employment.

04

Fill out any additional information requested, such as education and skills relevant to your job application.

05

Review your completed application for accuracy and completeness.

06

Sign and date the application at the bottom.

07

Submit the application to the appropriate department or employer as instructed.

Who needs CA DE 660?

01

Individuals applying for employment in California who need to verify their eligibility and job qualifications.

02

Job seekers seeking assistance from the Employment Development Department (EDD).

03

Employers requiring employment information from applicants for verification purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is EDD tax?

As one of the largest tax collection agencies in the nation, the California Employment Development Department (EDD) administers California's payroll tax programs, including: •• • • •

Who pays EDD tax?

Unemployment Insurance (UI) Tax UI is paid by the employer. Tax-rated employers pay a percentage on the first $7,000 in wages paid to each employee in a calendar year. The UI rate schedule and amount of taxable wages are determined annually.

What does EDD mean in payroll?

The Employment Development Department (EDD) offers a wide variety of services to millions of Californians under Unemployment Insurance (UI), State Disability Insurance (SDI), workforce investment (Jobs and Training), and Labor Market Information programs.

Do I need to file EDD taxes?

Annual unemployment compensation must be reported to the federal Internal Revenue Service (IRS). The Form 1099G is provided to people who collected unemployment compensation from the EDD so they can report it as income on their federal tax return.

What is a de6 form California?

What is the DE 6 Form? The DE 6 Form is the Quarterly Wage and Withholding Report, which is a required report that must be completed by California employers on a quarterly basis.

How do I report someone working under the table in California?

Underground Economy Operations Call our toll-free hotline: 1-800-528-1783. Fax: 1-916-227-2772. Submit a Fraud Report online. Complete and mail a UEO Lead Referral/Complaint Form to us. English (DE 660) (PDF) | Spanish (DE 660/S) (PDF) | Vietnamese (DE 660/V) (PDF) Review Help Us Fight Fraud (DE 2370) (PDF)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my de 660 - edd directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your de 660 - edd as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I edit de 660 - edd from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including de 660 - edd, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get de 660 - edd?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific de 660 - edd and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

What is CA DE 660?

CA DE 660 is a form used by the State of California for reporting specific financial information required by the Department of Employment Development.

Who is required to file CA DE 660?

Employers who are subject to California's payroll tax laws and have employees working in California are required to file CA DE 660.

How to fill out CA DE 660?

To fill out CA DE 660, you need to provide accurate payroll information, including employee details, wages paid, and any deductions. It should be submitted according to the instructions provided by the California Employment Development Department.

What is the purpose of CA DE 660?

The purpose of CA DE 660 is to collect necessary tax information from employers to ensure compliance with state employment tax obligations.

What information must be reported on CA DE 660?

Information that must be reported on CA DE 660 includes the employer's identification details, employee wage information, hours worked, and any applicable deductions for payroll taxes.

Fill out your de 660 - edd online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

De 660 - Edd is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.