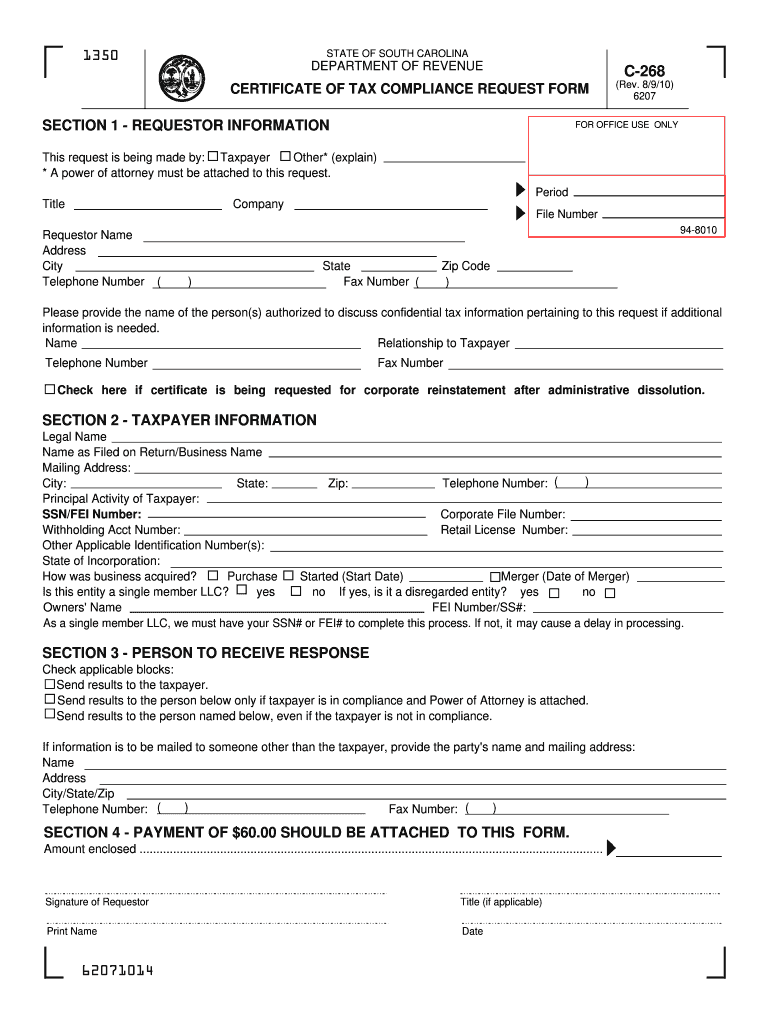

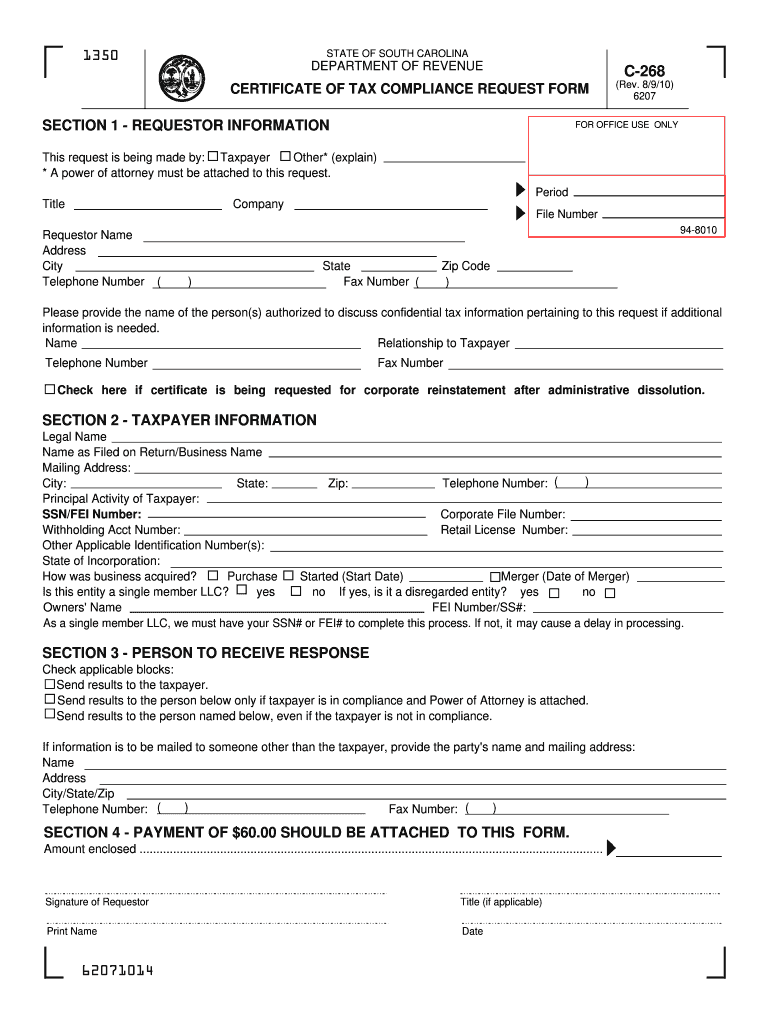

SC DoR C-268 2010 free printable template

Get, Create, Make and Sign south carolina department of

Editing south carolina department of online

Uncompromising security for your PDF editing and eSignature needs

SC DoR C-268 Form Versions

How to fill out south carolina department of

How to fill out SC DoR C-268

Who needs SC DoR C-268?

Instructions and Help about south carolina department of

Hi this is Mr. Andersen, and today I'm going to show you how to draw a Lewis dot diagram Lewis dot diagrams are going to look like this if we start with cesium is a metal it's got an atomic number of 55, but it's in the first column and so that makes it really easy on the periodic table that means it has one valence electron so if I had to draw it, so it's a Lewis dot diagram it'd look like this you're going to have CS for the atomic symbol of cesium then you're going to have one dot and that represents one valence electron now that one valence electron makes it really, really reactive and so if you mix cesium with water let's take a look at this video let's try cesium f it out Lyman you get a huge explosion and the reason you get that huge explosion is due to that one valence electron so by the end of this video you should be able to draw Lewis dot diagrams, and you also should be able to draw Lewis dot diagrams for molecules in other words when you mix cesium with water you're going to make cesium hydroxide you're going to make hydrogen gas, and so we should be able to draw those Lewis dot structures for molecules as well so let's get started if we look on the periodic table the first thing you want, and you'll keep jumping back to the periodic table over and over and over again so just get used to that so if we look at it the first thing that jumps out is that there are these this verticality in other words all of these alkali metals right here have the same properties and that's because they all have one valence electron and so learn this right away that there are one valence electrons in the first column two valence and in the LERX next one, so this would be three and four and five and six and seven and eight so all of these you probably know this these are called the noble gases are very stable and that's because they have eight valence electrons whereas these alkali metals and these halogens right here are incredibly unstable, and then we have kind of a combination in it'all what use what you just notice is that I ignored all of these the transition metals and their electron configurations are a little more complex, but please learn this right away 1 2 3 4 5 6 7 8 valence electrons you can't do Lewis dot diagrams unless you know how many valence electrons they have so let's start with the first one this is my method I can't remember where I picked this up but first thing I do is I in my brain I draw crosshairs across the symbol, so we're going to do neon let's jump back again to the periodic table where's neon is going to be way over here's neon and so it's going to have how many valence electrons eight so let's do the biggest one right away eight valence electrons, so again I've drawn this in my head I have this crosshair, so I'm just going to start putting in electrons like this so here's one valence electron seven to go here's two three four now it doesn't matter if I start on the top or if I start on the right or the bottom doesn't...

People Also Ask about

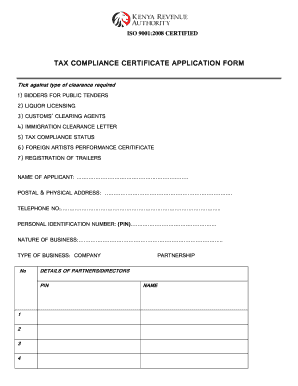

How do I get a tax clearance certificate from the IRS?

What is US tax compliance certificate?

What is a tax compliance document?

What is an IRS tax compliance check?

What is an example of tax compliance?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit south carolina department of online?

How do I edit south carolina department of in Chrome?

Can I create an eSignature for the south carolina department of in Gmail?

What is SC DoR C-268?

Who is required to file SC DoR C-268?

How to fill out SC DoR C-268?

What is the purpose of SC DoR C-268?

What information must be reported on SC DoR C-268?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.