Get the free Consent Order FDIC-10-630b - fdic

Show details

This document serves as a consent order issued by the FDIC and the Florida Office of Financial Regulation to Central Florida State Bank regarding compliance measures and operational responsibilities

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consent order fdic-10-630b

Edit your consent order fdic-10-630b form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consent order fdic-10-630b form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing consent order fdic-10-630b online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit consent order fdic-10-630b. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consent order fdic-10-630b

How to fill out Consent Order FDIC-10-630b

01

Start by obtaining the Consent Order FDIC-10-630b form from the official FDIC website.

02

Review the instructions provided on the form carefully.

03

Fill in your institution's name and address in the designated fields.

04

Provide the date the Consent Order is being filled out.

05

Include the contact information of the individual responsible for compliance.

06

Clearly state the terms of the consent agreement as outlined by the FDIC.

07

Include any relevant details or amendments as required.

08

Ensure that all required signatures are obtained.

09

Submit the completed form to the appropriate FDIC office as directed.

Who needs Consent Order FDIC-10-630b?

01

Financial institutions that have been issued a consent order by the FDIC.

02

Banks or depository institutions facing regulatory compliance issues.

03

Institutions seeking to formalize a settlement or agreement with the FDIC.

Fill

form

: Try Risk Free

People Also Ask about

Are bank consent orders public?

Since August 1989, the Federal Reserve has made all final enforcement orders public in ance with the Financial Institutions Reform, Recovery, and Enforcement Act of 1989; since November 1990, it has made written agreements public in ance with the Crime Control Act of 1990.

What does it mean when a bank gets a consent order?

A consent order is a binding legal order issued by financial regulators that requires an institution to formally address significant violations of regulatory standards.

What happens when a bank gets a consent order?

Understanding FDIC Bank Consent Orders The receiving party is required to implement particular corrective measures and compliance steps to address issues stated in the order. These measures typically involve implementing new policies and procedures, enhancing risk management practices, or improving internal controls.

What is the purpose of a consent order?

A consent order (also known as a consent decree ) is a decree or order made by a judge with the consent of all parties . It is not strictly a judgment , but rather a settlement agreement approved by the court .

What was the main purpose of the FDIC?

Formal actions are notices or orders issued by the FDIC against IDIs or IAPs. Formal actions are legally enforceable. Most notices and final orders are published after issuance, as required by law. Informal actions are voluntary commitments made by an IDI's BOD or an IAP.

What is a consent order from the Fed?

Understanding FDIC Bank Consent Orders An FDIC (Federal Deposit Insurance Corporation) bank consent order is an injunctive type of order that may be issued to a bank for violations of laws, rules, regulations, or unsound banking practices.

What does it mean when a bank gets a consent order?

A consent order is a binding legal order issued by financial regulators that requires an institution to formally address significant violations of regulatory standards.

What is a consent order in FDIC?

Cease-and-desist orders issued by the FDIC are titled “Consent Order” if the respondent stipulates to the issuance of the order, and titled “Order to Cease and Desist” if issued through litigation following the issuance of a notice of charges, an administrative enforcement hearing, an administrative law judge

What is the purpose of a consent order?

A consent order (also known as a consent decree ) is a decree or order made by a judge with the consent of all parties . It is not strictly a judgment , but rather a settlement agreement approved by the court .

What is the difference between a consent order and an order?

Unlike financial orders, consent orders are not legally binding unless they have been approved by the court. This means that if either party does not follow through on their obligations as outlined in the agreement, then there is no legal recourse available to enforce it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Consent Order FDIC-10-630b?

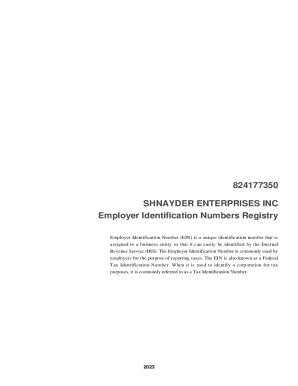

Consent Order FDIC-10-630b is a regulatory action taken by the Federal Deposit Insurance Corporation (FDIC) against a financial institution that outlines specific compliance requirements and corrective actions the institution must undertake.

Who is required to file Consent Order FDIC-10-630b?

The financial institution that is subject to regulatory scrutiny by the FDIC and has been issued the Consent Order is required to file Consent Order FDIC-10-630b.

How to fill out Consent Order FDIC-10-630b?

To fill out Consent Order FDIC-10-630b, the designated officials of the financial institution must provide accurate and complete information as outlined in the order, addressing all specified compliance and corrective actions.

What is the purpose of Consent Order FDIC-10-630b?

The purpose of Consent Order FDIC-10-630b is to ensure that the financial institution adheres to regulatory standards, corrects deficiencies, and improves its operations and risk management practices.

What information must be reported on Consent Order FDIC-10-630b?

The information that must be reported on Consent Order FDIC-10-630b includes details about compliance actions taken, progress reports on corrective measures, and any additional data required by the FDIC to assess the institution's adherence to the order.

Fill out your consent order fdic-10-630b online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consent Order Fdic-10-630b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.