Get the free FDIC 7200/06 - fdic

Show details

This document is a declaration submitted to the FDIC to determine insurance coverage for an account at a closed financial institution, requiring detailed information about the accountholder and their

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fdic 720006 - fdic

Edit your fdic 720006 - fdic form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fdic 720006 - fdic form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fdic 720006 - fdic online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fdic 720006 - fdic. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fdic 720006 - fdic

How to fill out FDIC 7200/06

01

Obtain the FDIC 7200/06 form from the FDIC website or your financial institution.

02

Identify the type of transaction you are reporting.

03

Complete the 'Institution Information' section with accurate details about your bank.

04

Fill in the 'Reporting Period' with the appropriate dates.

05

Provide your name and contact information in case there are questions.

06

Enter the required financial data as instructed in the form.

07

Review all entries for accuracy before signing.

08

Submit the completed form by the due date specified by the FDIC.

Who needs FDIC 7200/06?

01

Banks and financial institutions that are FDIC-insured.

02

Any institution that has deposit accounts and needs to report specific financial information to the FDIC.

03

Institutions involved in activities that require compliance with FDIC regulations.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean if your money is FDIC NCUA insured up to $250000?

The standard maximum deposit insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. The FDIC insures deposits that a person holds in one insured bank separately from any deposits that the person owns in another separately chartered insured bank.

What happens if you have more than 250k in the bank?

If the member shares are not assumed by another credit union, all verified member shares are typically paid within five days of a credit union's closure.

Can credit unions seize your money if the economy fails?

Both the NCUA and FDIC are responsible for insuring funds in the event that a financial institution fails. But are credit unions FDIC insured? Credit unions aren't insured by the FDIC because they are insured by the NCUA. Insures checking, savings, and money market accounts, CDs and IRAs.

What's the difference between member FDIC and FDIC-insured?

Financial & Regulatory Reporting - FDIC Cert #33124.

Why does my say FDIC?

The Federal Deposit Insurance Corporation (FDIC) is an independent agency created by the Congress to maintain stability and public confidence in the nation's financial system.

What does FDIC NCUA insured up to $250000 mean?

Both NCUA insurance and FDIC insurance protect the cash you keep in eligible deposit accounts up to $250,000. Neither the NCUA nor the FDIC covers stocks, bonds, mutual funds, or cryptocurrency investments. Both NCUA and FDIC insurance coverage is also automatic.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

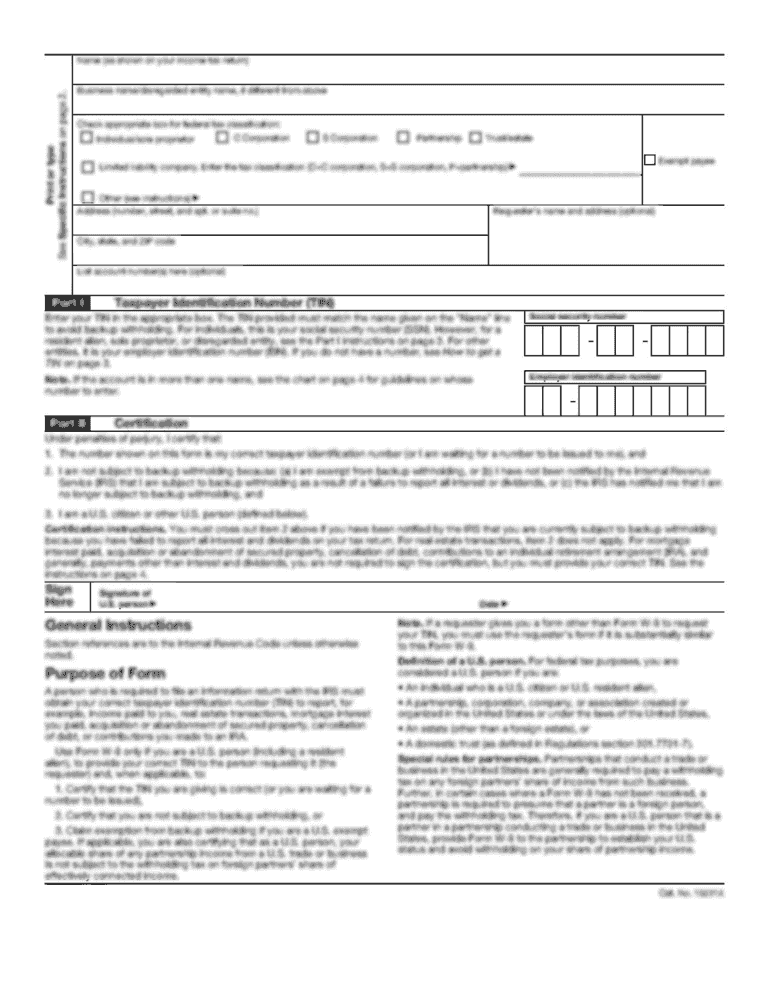

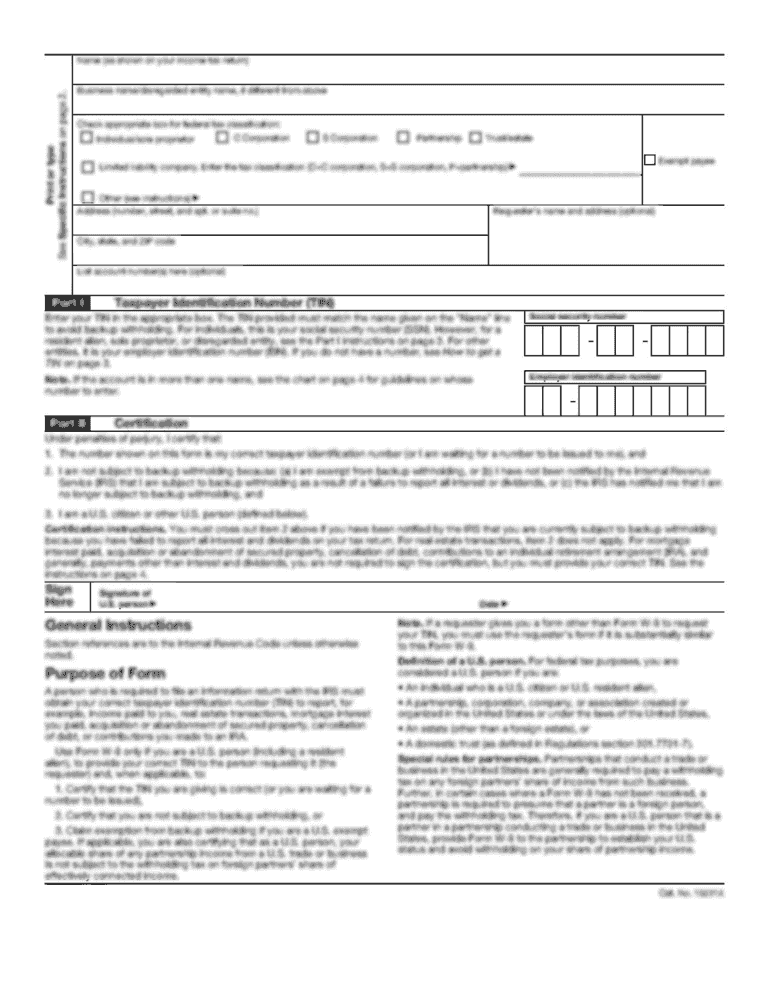

What is FDIC 7200/06?

FDIC 7200/06 is a form used by banks and financial institutions to report certain types of transactions and activities as required by the Federal Deposit Insurance Corporation (FDIC).

Who is required to file FDIC 7200/06?

Banks, thrifts, and other financial institutions that are insured by the FDIC must file FDIC 7200/06 when they engage in certain transactions that require reporting.

How to fill out FDIC 7200/06?

To fill out FDIC 7200/06, the institution must provide detailed information regarding the transactions, including amounts, dates, and involved parties. Instructions and specific fields to complete are provided with the form.

What is the purpose of FDIC 7200/06?

The purpose of FDIC 7200/06 is to ensure transparency and compliance with federal regulations regarding financial transactions, aiding in the oversight of monetary activities by the FDIC.

What information must be reported on FDIC 7200/06?

Information that must be reported on FDIC 7200/06 includes transaction details such as the amount, type of transaction, involved parties, dates, and any other relevant identifiers needed for accurate reporting.

Fill out your fdic 720006 - fdic online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fdic 720006 - Fdic is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.