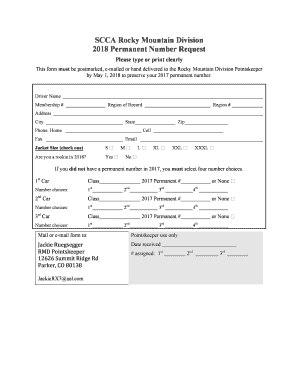

Get the free FFEIC FCRA Examination Procedures - fdic

Show details

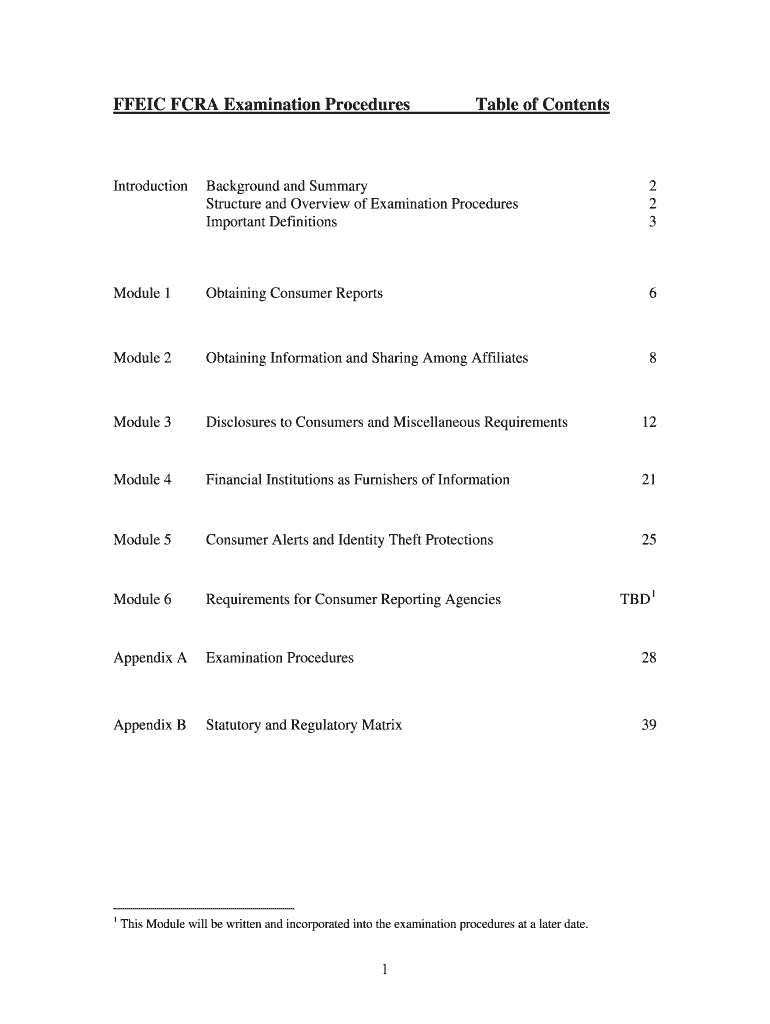

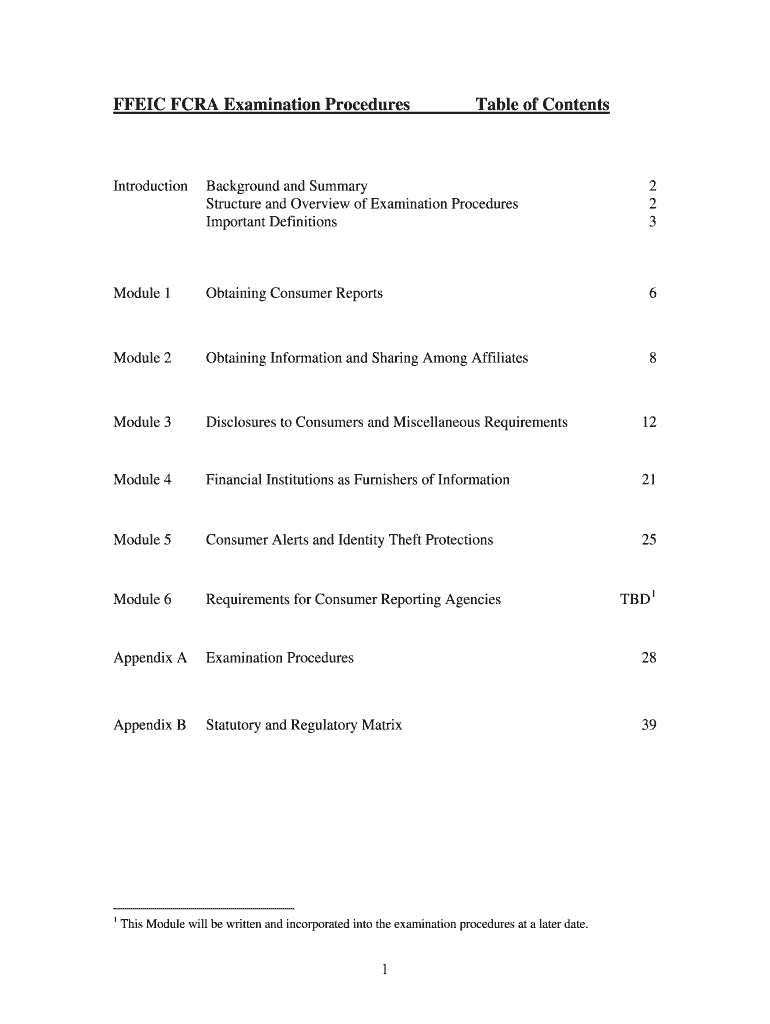

FF EIC FCRA Examination ProceduresTable of ContentsIntroductionBackground and Summary

Structure and Overview of Examination Procedures

Important Definitions2

2

3Module 1Obtaining Consumer Reports6Module

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ffeic fcra examination procedures

Edit your ffeic fcra examination procedures form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ffeic fcra examination procedures form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ffeic fcra examination procedures online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ffeic fcra examination procedures. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

What does FCRA check for?

The FCRA For “Employment Purposes” Consumer reports can include a broad range of categories, including driving records, criminal records, credit reports, and other reports from third parties, such as drug tests.

Who must comply with the FCRA?

The FCRA requires any prospective user of a consumer report, for example, a lender, insurer, landlord, or employer, among others, to have a legally permissible purpose to obtain a report. Legally Permissible Purposes.

How do you comply with the FCRA?

Four Basic Steps to FCRA Compliance Step 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must: Step 2: Certification To The Consumer Reporting Agency. Step 3: Provide Applicant With Pre-Adverse Action Documents. Step 4: Notify Applicant Of Adverse Action.

What are the guidelines for FCRA?

The FCRA specifies those with a valid need for access. reporting agency may not give out information about you to your employer, or a potential employer, without your written consent given to the employer. Written consent generally is not required in the trucking industry.

What are the obligations under the FCRA?

FAIR CREDIT REPORTING ACT/REGULATION V. Section 623 of the FCRA and Regulation V generally provide that a furnisher must not furnish inaccurate consumer information to a CRA, and that furnishers must investigate a consumer's dispute that the furnished information is inaccurate or incomplete.

What is the 623 of the FCRA?

FCRA 623(a)(5)(A) This "date of delinquency" determines how long the debt can be reported on a consumer's credit report. Generally, a CRA may report a delinquent debt for seven years from the date of delinquency. If the debt was discharged in bankruptcy, however, a CRA may report it for 10 years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get ffeic fcra examination procedures?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the ffeic fcra examination procedures in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I complete ffeic fcra examination procedures online?

Easy online ffeic fcra examination procedures completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an eSignature for the ffeic fcra examination procedures in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your ffeic fcra examination procedures and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is ffeic fcra examination procedures?

FFIEC FCRA examination procedures refer to the set of guidelines and instructions issued by the Federal Financial Institutions Examination Council (FFIEC) regarding the examination of financial institutions' compliance with the Fair Credit Reporting Act (FCRA). These procedures outline the steps and criteria that examiners should follow during the evaluation of a financial institution's FCRA practices.

Who is required to file ffeic fcra examination procedures?

Financial institutions, including banks, credit unions, and other entities that fall under the jurisdiction of the FFIEC, are required to adhere to the FFIEC FCRA examination procedures. These institutions must conduct regular self-assessments and examinations to ensure compliance with the FCRA and they need to file the examination procedures as per the FFIEC guidelines.

How to fill out ffeic fcra examination procedures?

Filling out FFIEC FCRA examination procedures involves a comprehensive assessment of a financial institution's compliance with various aspects of the FCRA. The procedures typically entail reviewing the institution's policies, procedures, documentation, and practices related to consumer credit reporting, dispute resolution, identity theft prevention, and other FCRA compliance requirements. It is recommended to follow the detailed instructions provided by the FFIEC and ensure accurate and complete reporting.

What is the purpose of ffeic fcra examination procedures?

The main purpose of FFIEC FCRA examination procedures is to ensure that financial institutions comply with the provisions of the Fair Credit Reporting Act. These procedures aim to assess and evaluate the adequacy of a financial institution's policies, procedures, systems, and practices related to consumer credit reporting, protecting consumer rights, preventing identity theft, and handling consumer disputes. The procedures help identify areas of non-compliance and suggest corrective measures to improve FCRA compliance.

What information must be reported on ffeic fcra examination procedures?

FFIEC FCRA examination procedures require financial institutions to report various information related to their compliance with the Fair Credit Reporting Act. This may include details on the institution's policies and procedures for obtaining and handling consumer credit reports, adherence to identity theft prevention measures, dispute resolution practices, compliance training programs, and any corrective actions taken to address previous non-compliance issues. The exact information to be reported is outlined in the FFIEC guidelines.

Fill out your ffeic fcra examination procedures online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ffeic Fcra Examination Procedures is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.