Get the free Consolidated Reports of Condition and Income for A Bank With Domestic Offices Only a...

Show details

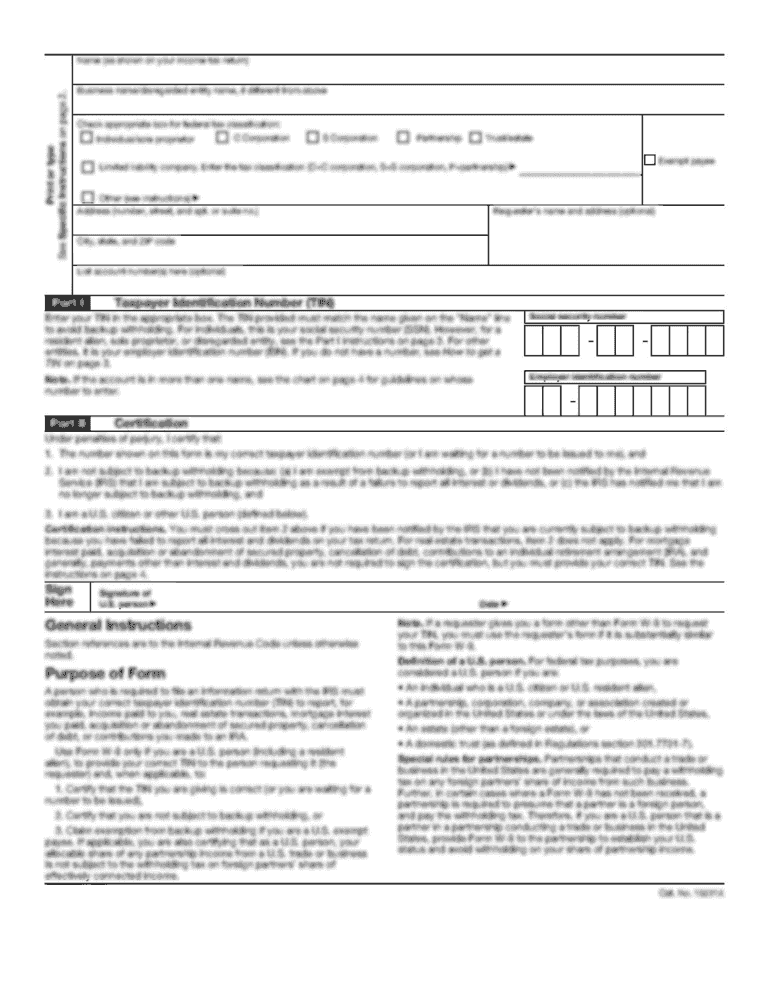

This report is required by law and must be filed by banks with domestic offices only and total assets less than $100 million, providing detailed financial information such as balance sheets and income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consolidated reports of condition

Edit your consolidated reports of condition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consolidated reports of condition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit consolidated reports of condition online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit consolidated reports of condition. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consolidated reports of condition

How to fill out Consolidated Reports of Condition and Income for A Bank With Domestic Offices Only and Total Assets of Less Than $100 Million

01

Gather the necessary financial data, including balance sheets, income statements, and other relevant documentation for the reporting period.

02

Access the appropriate report template specific for banks with domestic offices and total assets of less than $100 million.

03

Complete the balance sheet section by entering accurate amounts for assets, liabilities, and equity based on your gathered data.

04

Fill out the income statement section by reporting total income, expenses, and net income according to your financial records.

05

Review each section for accuracy, ensuring that all numbers are correctly entered and comply with reporting standards.

06

Sign and date the report as required, indicating that the information is true and correct to the best of your knowledge.

07

Submit the completed report to the appropriate regulatory agency, ensuring it is delivered by the deadline.

Who needs Consolidated Reports of Condition and Income for A Bank With Domestic Offices Only and Total Assets of Less Than $100 Million?

01

Banks with domestic offices that report assets of less than $100 million are required to file Consolidated Reports of Condition and Income to comply with regulatory requirements.

02

Financial institutions needing to track and report their fiscal health and stability to stakeholders such as regulators, investors, and customers.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between FFIEC 031 and 041?

The amount of detail required to be reported varies between the three versions of the Call Report forms, with the report form for banks with foreign offices or with total consolidated assets of $100 billion or more (FFIEC 031) having more detail than the report form for banks with domestic offices only and total

What is the FFIEC 031 Report?

Description: This report collects basic financial data from commercial banks in the form of a balance sheet, an income statement, and supporting schedules. The Report of Condition schedules provide details on assets, liabilities, and capital accounts.

What is an FFIEC call report?

A call report is a quarterly report known as the Consolidated Report of Condition and Income that all commercial banks and similar financial institutions in the United States are required to file at the end of each calendar quarter.

What is the difference between FFIEC 031 and 041?

The amount of detail required to be reported varies between the three versions of the Call Report forms, with the report form for banks with foreign offices or with total consolidated assets of $100 billion or more (FFIEC 031) having more detail than the report form for banks with domestic offices only and total

What is the purpose of the FFIEC?

FFIEC is an acronym for the Federal Financial Institutions Examination Council. Established in 1979, the FFIEC is an inter-agency group that creates guidelines for standardizing federal audits of financial institutions by the following organizations: the Board of Governors of the Federal Reserve System (FRB)

Which is the quarterly Report of condition and Income for a Bank with domestic and foreign offices?

The bank must begin filing the FFIEC 031 report form (Consolidated Reports of Condition and Income for a Bank with Domestic and Foreign Offices) for the first quarterly report date following the commencement of operations by the "foreign" office.

What is the purpose of the FFIEC?

FFIEC is an acronym for the Federal Financial Institutions Examination Council. Established in 1979, the FFIEC is an inter-agency group that creates guidelines for standardizing federal audits of financial institutions by the following organizations: the Board of Governors of the Federal Reserve System (FRB)

What is the FFIEC 031?

This report collects basic financial data from commercial banks in the form of a balance sheet, an income statement, and supporting schedules. The Report of Condition schedules provide details on assets, liabilities, and capital accounts. The Report of Income schedules provide details on income and expenses.

What is FFIEC 041?

Consolidated Reports of Condition and Income for a Bank with Domestic Offices Only.

Which Report also known as a consolidated Report of condition and Income?

The Consolidated Reports of Condition and Income are commonly referred to as the Call Report. For purposes of these General Instructions, the Financial Accounting Standards Board (FASB) Accounting Standards Codification is referred to as “ASC.”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Consolidated Reports of Condition and Income for A Bank With Domestic Offices Only and Total Assets of Less Than $100 Million?

The Consolidated Reports of Condition and Income, commonly known as Call Reports, for banks with domestic offices only and total assets of less than $100 million, are regulatory documents that financial institutions must file to provide a snapshot of their financial condition. These reports include details on assets, liabilities, income, and expenses, reflecting the bank’s financial health and operational results.

Who is required to file Consolidated Reports of Condition and Income for A Bank With Domestic Offices Only and Total Assets of Less Than $100 Million?

Banks that operate with domestic offices only and have total assets of less than $100 million are required to file these reports. This generally includes community banks and small financial institutions that fall under the size thresholds set by regulatory authorities.

How to fill out Consolidated Reports of Condition and Income for A Bank With Domestic Offices Only and Total Assets of Less Than $100 Million?

To fill out the Consolidated Reports of Condition and Income, banks must gather their financial data, including balance sheets and income statements. They must then accurately complete the report forms by providing detailed information in specific sections that correspond to assets, liabilities, income, and expenses. It’s essential for banks to follow the instructions provided by their regulatory authority and ensure accuracy in reporting.

What is the purpose of Consolidated Reports of Condition and Income for A Bank With Domestic Offices Only and Total Assets of Less Than $100 Million?

The purpose of the Consolidated Reports of Condition and Income is to provide regulators, stakeholders, and the public with transparent insights into a bank’s financial status. These reports help in assessing the bank's stability, performance, and compliance with regulatory requirements and also aid in risk assessment and decision-making.

What information must be reported on Consolidated Reports of Condition and Income for A Bank With Domestic Offices Only and Total Assets of Less Than $100 Million?

The reports must include detailed information on the bank's assets, liabilities, equity, income, and expenses. Specific data points typically reported include loans and leases, deposits, investments, charges, non-interest income, provisions for loan losses, and general operating expenses, among others.

Fill out your consolidated reports of condition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consolidated Reports Of Condition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.