Get the free Sba loan application - Pacific Commerce Bank

Show details

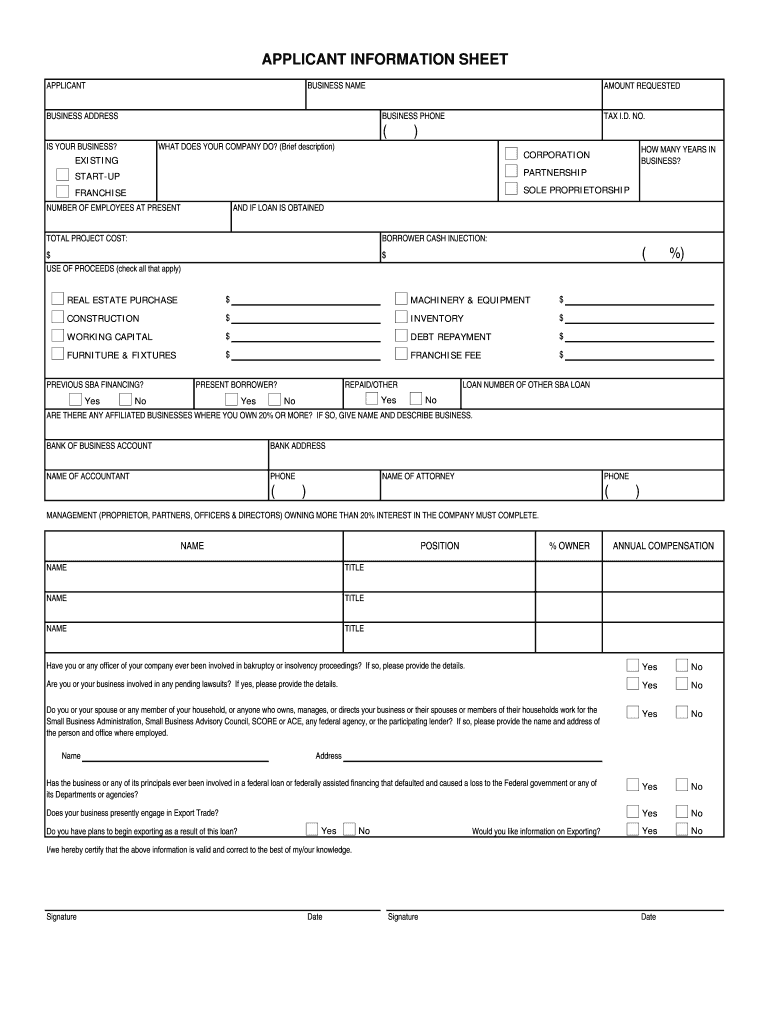

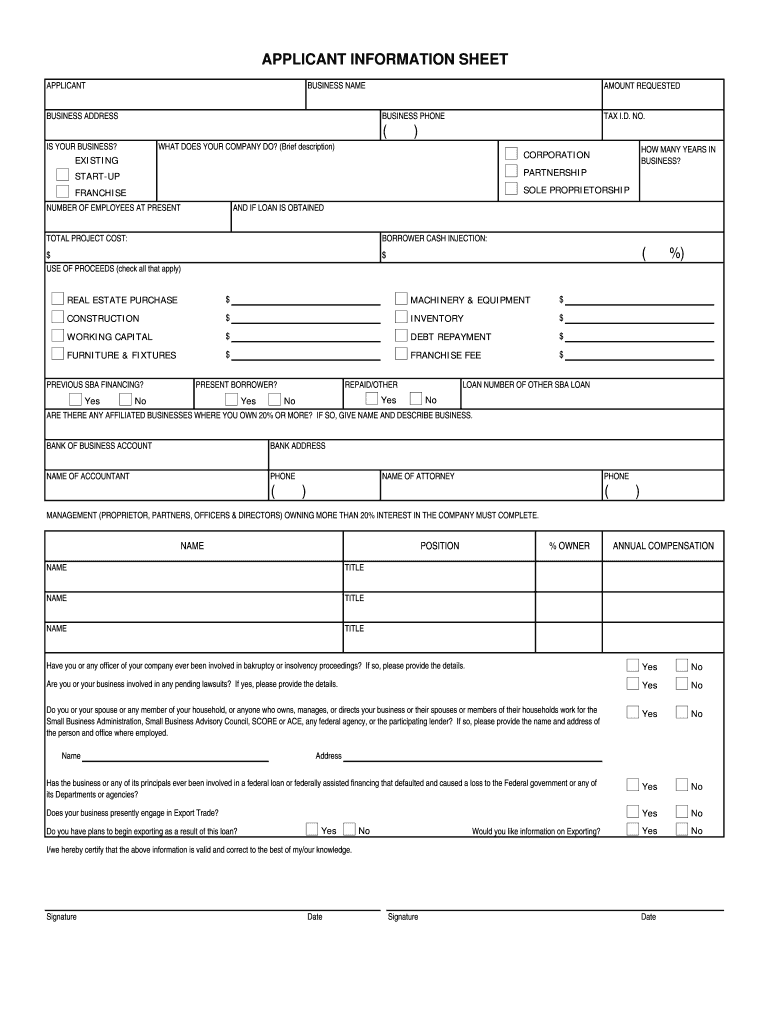

SBA LOAN APPLICATION This checklist has been provided to assist you through the process of gathering the necessary information for the initial evaluation of your loan request. Complete information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sba loan application

Edit your sba loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sba loan application online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sba loan application. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sba loan application

How to fill out Pacific Commerce Bank SBA Loan Application Pkg

01

Gather all required documentation, including personal financial statements and business plans.

02

Complete the loan application form, ensuring all fields are filled out accurately.

03

Provide a detailed explanation of how the loan will be used.

04

Include information about your business's legal structure and ownership.

05

Disclose any existing debts and liabilities.

06

Prepare a copy of your business credit report.

07

Collect and submit two years of business tax returns.

08

Include any supplemental forms required by the bank.

09

Review the completed application for accuracy and completeness.

10

Submit the application package to Pacific Commerce Bank, and follow up to ensure receipt.

Who needs Pacific Commerce Bank SBA Loan Application Pkg?

01

Small business owners seeking funding for expansion, equipment, or working capital.

02

Entrepreneurs looking to start a new business and need financial support.

03

Business owners with insufficient liquidity or collateral to qualify for traditional loans.

Fill

form

: Try Risk Free

People Also Ask about

Who has to fill out SBA Form 1919?

When applying for an SBA 7(a) loan, you must complete SBA Form 1919. The form is required for each owner, partner, officer and director with a 20% stake or more in the business and/or managing member who handles day-to-day operations.

What forms are needed for SBA loan?

Borrower information form (required): Complete SBA Form 1919 and submit it to an SBA-participating lender. Financial statements (as applicable): The lender may require personal financial statements for the applicant(s) or owner(s) of the applicant.

What paperwork do you need for SBA loan?

Include the business' signed federal income tax returns for the previous three years. Include personal resumes for each principal. Provide a history of the business and its challenges. Include an explanation of why the SBA loan is needed and how it will help the business.

Can I get a SBA loan through a bank?

SBA loans are small-business loans offered by banks and online lenders and partly guaranteed by the government. Check SBA loan rates for 2023SBA loans offer some of the lowest rates on the market, but rates can change based on the Federal Reserve's actions.

What credit score is needed for SBA business loan?

For the SBA 7(a), this means a minimum score of approximately 640. But you'll increase your chances to be approved for an SBA loan with a minimum credit score of 680 or higher.

Can you get an SBA loan with a 580 credit score?

However, SBA loans are provided by lenders who may have minimum score requirements. Typically, this minimum is about 620. 15 However, the higher your score, the more likely you are to receive approval.

Is it hard to get an SBA loan for a business?

The short answer – No, it is not hard to get an SBA loan! Most businesses are eligible and qualifying is easier than you might think! The SBA 504 loan is specifically designed to help small businesses expand by purchasing fixed assets such as real estate and equipment.

How do I get my SBA loan approved?

Meet the SBA's size standards: Your business must qualify as a “small” business based on average annual receipts or average number of employees. Not be receiving funds from any other financial lenders. Be able to repay the loan based on your business's projected operating cash flow.

How do you get denied for the SBA loan?

Why Your SBA Loan Was Declined and What to Do About It You Botched the Application. Your Credit Score is Lacking. Your Business is Too Green. You Need More Collateral. Your Cash Flow is Lacking. You're in a Risky Library. You Went for the Wrong Loan. Your Business Plan is Underwhelming.

What disqualifies you from getting an SBA loan?

Ineligible businesses include those engaged in illegal activities, loan packaging, speculation, multi-sales distribution, gambling, investment or lending, or where the owner is on parole.

What is the easiest SBA loan to get?

SBA Express This term loan or line of credit offers fixed or variable SBA loan rates as well as the easiest SBA application process, quick approval times, flexible terms, and lower down payment requirements than conventional loans.

Why would SBA loan be denied?

You have a low overall personal or business credit score, or a poor credit history. You do not have sufficient collateral or assets to secure your loan. You do not have enough free capital or cash flow to meet loan repayments. You have too much already outstanding debt.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sba loan application for eSignature?

To distribute your sba loan application, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for the sba loan application in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your sba loan application in minutes.

Can I create an electronic signature for signing my sba loan application in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your sba loan application directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is Pacific Commerce Bank SBA Loan Application Pkg?

The Pacific Commerce Bank SBA Loan Application Package is a set of forms and documentation required by Pacific Commerce Bank to apply for a Small Business Administration (SBA) loan.

Who is required to file Pacific Commerce Bank SBA Loan Application Pkg?

Small business owners seeking financing through Pacific Commerce Bank's SBA loan program are required to file the Pacific Commerce Bank SBA Loan Application Package.

How to fill out Pacific Commerce Bank SBA Loan Application Pkg?

To fill out the Pacific Commerce Bank SBA Loan Application Package, applicants need to complete all required forms accurately, provide necessary documentation, and ensure all information is up-to-date before submission.

What is the purpose of Pacific Commerce Bank SBA Loan Application Pkg?

The purpose of the Pacific Commerce Bank SBA Loan Application Package is to collect essential information from borrowers to assess their eligibility for SBA loans and to facilitate the loan approval process.

What information must be reported on Pacific Commerce Bank SBA Loan Application Pkg?

The Pacific Commerce Bank SBA Loan Application Package typically requires information such as business financial statements, personal financial statements, business plans, and details about the owners and management of the business.

Fill out your sba loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.