Get the free Quarterly Financial Statements of Nonbank Subsidiaries of Bank Holding Companies—FR ...

Show details

This document provides the quarterly financial statements required by the Bank Holding Company Act, detailing the financial position of nonbank subsidiaries within bank holding companies.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign quarterly financial statements of

Edit your quarterly financial statements of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your quarterly financial statements of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit quarterly financial statements of online

To use the professional PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit quarterly financial statements of. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out quarterly financial statements of

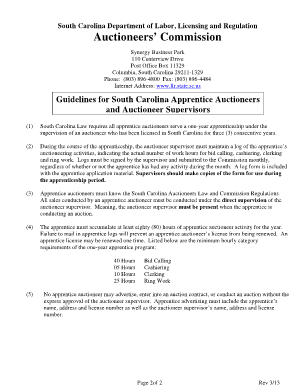

How to fill out Quarterly Financial Statements of Nonbank Subsidiaries of Bank Holding Companies—FR Y-11Q

01

Gather all relevant financial data for the quarter.

02

Organize the data into categories such as assets, liabilities, and equity.

03

Complete the balance sheet section by listing all assets and liabilities as of the quarter-end date.

04

Fill out the income statement section by reporting revenues, expenses, and net income for the quarter.

05

Complete the cash flow statement by detailing cash inflows and outflows during the quarter.

06

Ensure that all entries are accurate and reflect the company's financial position.

07

Review the completed statements for completeness and compliance with regulatory requirements.

08

Submit the final Quarterly Financial Statements by the designated deadline.

Who needs Quarterly Financial Statements of Nonbank Subsidiaries of Bank Holding Companies—FR Y-11Q?

01

Bank holding companies with nonbank subsidiaries are required to file Quarterly Financial Statements of Nonbank Subsidiaries.

02

Regulatory agencies, such as the Federal Reserve, use these statements for oversight and monitoring purposes.

03

Investors and stakeholders may require these statements to assess the financial health of the subsidiary.

Fill

form

: Try Risk Free

People Also Ask about

What are the regulatory capital requirements for bank holding companies?

Federal Reserve Board regulations require bank holding companies to maintain a minimum Tier 1 capital ratio of 4% and a minimum total capital ratio of 8%.

What is the BHC regulation?

Companies that control banks are required to be regulated and supervised by the Federal Reserve (Fed) as bank holding companies (BHCs). The BHC structure is widely used by both small community banks with simple structures and the largest, most complex financial institutions in the United States.

What does bank holding company mean?

Bank holding companies are corporations that own controlling interests in one or more banks and manage their operations. Advantages of a bank holding company can include reduced overall risk and increased access to funding. Examples of bank holding companies include JPMorgan Chase & Co., U.S. Bancorp and Citicorp.

What is Bank Holding Company Regulation Y?

What is Regulation Y? Regulation Y governs the corporate practices of bank holding companies and certain practices of state-member banks. Regulation Y also describes transactions for which bank holding companies must seek and receive the Federal Reserve's approval.

What act of Congress required bank holding companies to divest themselves of nonbank subsidiary holdings?

AN ACT To define bank holding companies, control their future expansion, and require divestment of their nonbanking interests. Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled, That this Act may be cited as the ''Bank Holding Company Act of 1956''.

What does the Bank Holding Company Act do?

The 1956 act redefined a bank holding company as any company that held a stake in 25 percent or more of the shares of two or more banks. Stake holding included outright ownership as well as control of or the ability to vote on shares.

What is the difference between balance sheet of banking and non banking companies?

A company's balance sheet typically includes assets such as inventory, property, plant, and equipment, and liabilities such as accounts payable and loans. In contrast, a bank's balance sheet typically includes assets such as loans and investments, and liabilities such as deposits and borrowing.

Which is a non banking subsidiary of ?

A prominent example is the bank holding company Corporation, whose bank subsidiary, , N.A., offers bank services and products, while such non-bank subsidiaries as Banc of America Investment Services, Inc.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Quarterly Financial Statements of Nonbank Subsidiaries of Bank Holding Companies—FR Y-11Q?

The Quarterly Financial Statements of Nonbank Subsidiaries of Bank Holding Companies—FR Y-11Q is a report that bank holding companies are required to file to provide a snapshot of the financial condition and performance of their nonbank subsidiaries.

Who is required to file Quarterly Financial Statements of Nonbank Subsidiaries of Bank Holding Companies—FR Y-11Q?

Bank holding companies that have nonbank subsidiaries must file the FR Y-11Q report.

How to fill out Quarterly Financial Statements of Nonbank Subsidiaries of Bank Holding Companies—FR Y-11Q?

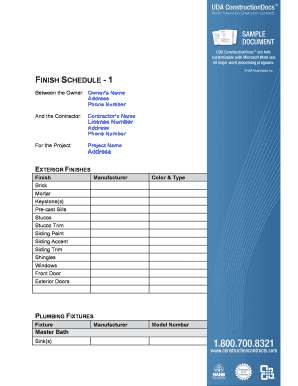

To fill out the FR Y-11Q, the reporting entity must compile financial data from its nonbank subsidiaries, complete the report forms as per the provided guidelines, including information on assets, liabilities, income, and expenses, and submit the report electronically in accordance with the Federal Reserve requirements.

What is the purpose of Quarterly Financial Statements of Nonbank Subsidiaries of Bank Holding Companies—FR Y-11Q?

The purpose of the FR Y-11Q is to ensure regulatory oversight of the financial condition of nonbank subsidiaries of bank holding companies and to assess their contributions to the overall financial stability of the banking organization.

What information must be reported on Quarterly Financial Statements of Nonbank Subsidiaries of Bank Holding Companies—FR Y-11Q?

The FR Y-11Q requires reporting of financial information including, but not limited to, balance sheet data, income statement data, and details about assets, liabilities, equity, and any significant transactions or changes in the financial status of the nonbank subsidiaries.

Fill out your quarterly financial statements of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Quarterly Financial Statements Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.