Get the free Survey of Terms of Business Lending—FR 2028A - federalreserve

Show details

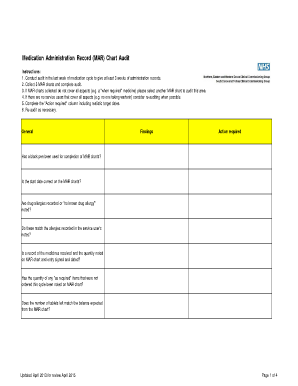

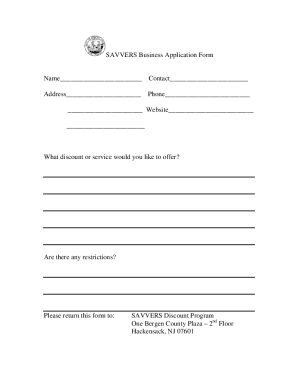

This document is a survey form used by the Board of Governors of the Federal Reserve System to collect data on business lending including loans made during specific weeks, interest rates, loan amounts,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign survey of terms of

Edit your survey of terms of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your survey of terms of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit survey of terms of online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit survey of terms of. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out survey of terms of

How to fill out Survey of Terms of Business Lending—FR 2028A

01

Gather the necessary financial documents related to business lending.

02

Access the Survey of Terms of Business Lending—FR 2028A form.

03

Carefully read the instructions provided with the survey.

04

Fill out sections detailing the type of loans being surveyed, including amounts and terms.

05

Provide information on interest rates, fees, and other loan details.

06

Review the filled-out form for accuracy and completeness.

07

Submit the completed survey to the relevant authority as specified in the instructions.

Who needs Survey of Terms of Business Lending—FR 2028A?

01

Financial institutions that offer business loans.

02

Regulatory agencies requiring data on lending practices.

03

Researchers analyzing trends in business lending.

04

Policy makers interested in understanding business financing.

Fill

form

: Try Risk Free

People Also Ask about

What are the 5 C's of lending?

Lending Discrimination Statutes and Regulations The Equal Credit Opportunity Act (ECOA) prohibits discrimination in any aspect of a credit transaction. It applies to any extension of credit, including extensions of credit to small businesses, corporations, partnerships, and trusts.

What are the 3 C's of lending?

Term loans come in several varieties, usually reflecting the lifespan of the loan. These include: Short-term loans: These types of term loans are usually offered to firms that don't qualify for a line of credit. They generally run less than a year, though they can also refer to a loan of up to 18 months. 2.

What are the three C's in lending?

Character, capital (or collateral), and capacity make up the three C's of credit. Credit history, sufficient finances for repayment, and collateral are all factors in establishing credit.

What do the three C's refer to?

The 3 C's of credit—character, capacity, and collateral—are a widely-used framework for evaluating potential borrowers' creditworthiness.

What do the three C's stand for?

This is a recovery toolkit you can use to help lead your loved one to a more fulfilling and rational lifestyle towards the help they need for recovery from the active substance or alcohol abuse. The Three C's of Dealing with an addict are: I didn't cause it. I can't cure it. I can't control it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Survey of Terms of Business Lending—FR 2028A?

The Survey of Terms of Business Lending—FR 2028A is a report conducted by the Federal Reserve that collects information on the terms and conditions of business loans from financial institutions to facilitate the analysis of commercial lending standards.

Who is required to file Survey of Terms of Business Lending—FR 2028A?

Financial institutions that hold commercial loans are required to file the Survey of Terms of Business Lending—FR 2028A.

How to fill out Survey of Terms of Business Lending—FR 2028A?

To fill out the Survey of Terms of Business Lending—FR 2028A, institutions must provide information on various aspects of their business loans, including interest rates, terms, and borrower characteristics, following the guidelines provided in the survey instructions.

What is the purpose of Survey of Terms of Business Lending—FR 2028A?

The purpose of the Survey of Terms of Business Lending—FR 2028A is to gather data that helps the Federal Reserve understand lending practices and trends, which can influence monetary policy and financial regulations.

What information must be reported on Survey of Terms of Business Lending—FR 2028A?

Institutions must report information such as loan amounts, interest rates, terms, types of collateral, and borrower qualifications, among other relevant details regarding business loans.

Fill out your survey of terms of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Survey Of Terms Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.