Get the free Proposal: Study on Prescreened Solicitations or Firm Offers of Credit or Insurance -...

Show details

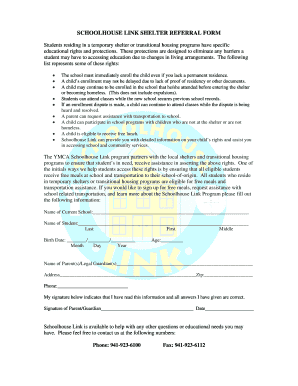

This document presents a proposal addressing the issue of unsolicited credit solicitations and suggests regulatory changes to secure and improve the process.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign proposal study on prescreened

Edit your proposal study on prescreened form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your proposal study on prescreened form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing proposal study on prescreened online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit proposal study on prescreened. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out proposal study on prescreened

How to fill out Proposal: Study on Prescreened Solicitations or Firm Offers of Credit or Insurance

01

Start with the title: clearly state 'Proposal: Study on Prescreened Solicitations or Firm Offers of Credit or Insurance'.

02

Provide a brief introduction outlining the purpose of the study.

03

Include a background section with relevant information on prescreened solicitations and firm offers.

04

Define the objectives of the study: what you aim to achieve.

05

Describe the methodology: outline how data will be collected and analyzed.

06

Include a timeline: provide an estimated schedule for the completion of various phases of the study.

07

Detail the expected outcomes and potential impacts of the study.

08

Outline the budget: specify the financial resources required to conduct the study.

09

Add a conclusion summarizing the importance of the study and how it will contribute to the field.

10

Include your contact information for further inquiries.

Who needs Proposal: Study on Prescreened Solicitations or Firm Offers of Credit or Insurance?

01

Financial institutions looking to understand market trends in credit offers.

02

Insurance companies assessing the effectiveness of prescreened solicitations.

03

Regulatory bodies requiring insights on consumer protection in credit and insurance fields.

04

Researchers and academics studying consumer behavior related to credit and insurance.

05

Policy makers aiming to develop regulations concerning prescreened solicitation practices.

Fill

form

: Try Risk Free

People Also Ask about

What is the prescreened offer for credit?

Pre-screened credit offers are generated based on your credit history and other financial information, allowing lenders to market their products to you before you express interest.

What are examples of firm offers?

Example 1: A car dealership promises in writing to keep an offer to sell a car to a customer open for two weeks. This is a firm offer, and the dealership cannot revoke or withdraw the offer during that two-week period.

What is a prescreened firm offer of credit?

Prescreened credit offers are firm offers of credit. Credit card companies use information from credit reporting companies to make firm offers of credit to consumers whose credit histories meet the criteria selected by the card company (for example, a minimum credit score).

What is a firm offer of credit or insurance?

A firm offer of credit is an offer to apply for a loan or line of credit. Creditors must honor these offers and approve your application if you still meet the criteria they used to send the offer.

What does "firm offer" mean?

A firm offer is an offer that will remain open for a certain period or until a certain time or occurrence of a certain event, during which it is incapable of being revoked. As a general rule, all offers are revocable at any time prior to acceptance, even those offers that purport to be irrevocable on their face.

What are firm offers of credit or insurance?

A "firm offer of credit" is defined as "any offer of credit or insurance to a consumer that will be honored if the consumer is determined, based on information in a consumer report on the consumer, to meet the specific criteria used to select the consumer for the offer." A financial institution must extend credit to

What is a firm credit?

A firm offer of credit is any offer of credit to a consumer that will be honored if the consumer is willing to meet a specific set of prescreening criteria. A specific set of prescreening criteria is used to select the consumer for the firm offer of credit, ing to the Consumer Financial Protection Bureau (CPFB).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Proposal: Study on Prescreened Solicitations or Firm Offers of Credit or Insurance?

The Proposal: Study on Prescreened Solicitations or Firm Offers of Credit or Insurance is a regulatory framework aimed at assessing the practices and implications of prescreened offers of credit or insurance made to consumers based on data they have not requested.

Who is required to file Proposal: Study on Prescreened Solicitations or Firm Offers of Credit or Insurance?

Financial institutions, credit card companies, and insurance companies that engage in prescreening processes to make firm offers to consumers are required to file the proposal.

How to fill out Proposal: Study on Prescreened Solicitations or Firm Offers of Credit or Insurance?

To fill out the proposal, entities must provide specific data concerning the prescreened offers made, including consumer demographics, frequency of offers, and their acceptance rates, following the guidelines provided by regulatory authorities.

What is the purpose of Proposal: Study on Prescreened Solicitations or Firm Offers of Credit or Insurance?

The purpose is to analyze the impact of prescreened solicitations on consumers, ensuring transparency, consumer protection, and understanding the ramifications of these offers in the financial marketplace.

What information must be reported on Proposal: Study on Prescreened Solicitations or Firm Offers of Credit or Insurance?

The information required includes the number of prescreened offers sent, demographics of the recipients, acceptance rates, types of products offered, and any resulting consumer complaints or issues encountered.

Fill out your proposal study on prescreened online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Proposal Study On Prescreened is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.