Get the free Study on Prescreened Solicitations or Firm Offers of Credit or Insurance - federalre...

Show details

This document discusses the implications of prescreened solicitations for credit and insurance, highlighting risks such as identity theft and increased credit burdens.

We are not affiliated with any brand or entity on this form

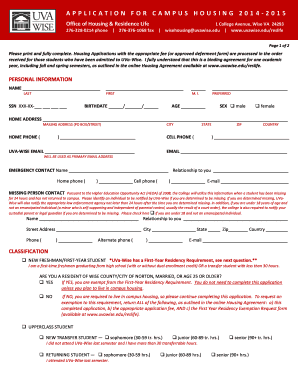

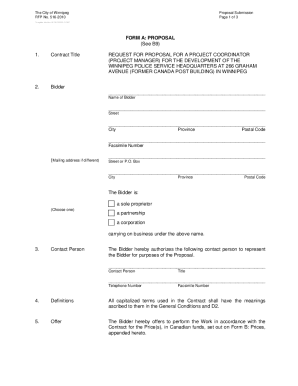

Get, Create, Make and Sign study on prescreened solicitations

Edit your study on prescreened solicitations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your study on prescreened solicitations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing study on prescreened solicitations online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit study on prescreened solicitations. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out study on prescreened solicitations

How to fill out Study on Prescreened Solicitations or Firm Offers of Credit or Insurance

01

Begin by obtaining the Study on Prescreened Solicitations or Firm Offers document.

02

Read the introductory section to understand the purpose of the study.

03

Review the eligibility criteria outlined for individuals or organizations.

04

Fill in your personal or business information accurately in the designated sections.

05

Provide any required supporting documents, such as income verification or credit history.

06

Follow any specific instructions provided for signature and date.

07

Submit the completed study through the designated method (online, by mail, etc.).

08

Keep a copy of the submitted document for your records.

Who needs Study on Prescreened Solicitations or Firm Offers of Credit or Insurance?

01

Individuals seeking to understand their eligibility for credit or insurance offers.

02

Businesses looking to evaluate potential credit or insurance solicitations.

03

Financial institutions and researchers analyzing prescreened solicitation trends.

04

Consumers who want to manage their credit score or financial health.

Fill

form

: Try Risk Free

People Also Ask about

Are prescreened credit offers legit?

Don't do it. They're legit but they're demographic is people desperate for credit. You'll end up owing more in fees (and paying interest on them) than anything else. Stat clear of them.

What is a prescreened firm offer of credit?

Prescreened credit offers are firm offers of credit. Credit card companies use information from credit reporting companies to make firm offers of credit to consumers whose credit histories meet the criteria selected by the card company (for example, a minimum credit score).

What does "firm offer" mean?

A firm offer is an offer that will remain open for a certain period or until a certain time or occurrence of a certain event, during which it is incapable of being revoked. As a general rule, all offers are revocable at any time prior to acceptance, even those offers that purport to be irrevocable on their face.

What is a firm credit?

A firm offer of credit is any offer of credit to a consumer that will be honored if the consumer is willing to meet a specific set of prescreening criteria. A specific set of prescreening criteria is used to select the consumer for the firm offer of credit, ing to the Consumer Financial Protection Bureau (CPFB).

What are firm offers of credit or insurance?

A "firm offer of credit" is defined as "any offer of credit or insurance to a consumer that will be honored if the consumer is determined, based on information in a consumer report on the consumer, to meet the specific criteria used to select the consumer for the offer." A financial institution must extend credit to

What is a firm offer of credit or insurance?

A firm offer of credit is an offer to apply for a loan or line of credit. Creditors must honor these offers and approve your application if you still meet the criteria they used to send the offer.

What are examples of firm offers?

Example 1: A car dealership promises in writing to keep an offer to sell a car to a customer open for two weeks. This is a firm offer, and the dealership cannot revoke or withdraw the offer during that two-week period.

What is a prescreened solicitation?

Pre-screened credit offers are generated based on your credit history and other financial information, allowing lenders to market their products to you before you express interest.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

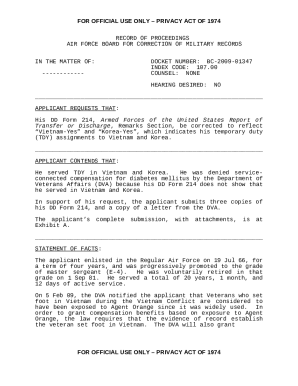

What is Study on Prescreened Solicitations or Firm Offers of Credit or Insurance?

The Study on Prescreened Solicitations or Firm Offers of Credit or Insurance is a regulatory analysis mandated by the Fair Credit Reporting Act (FCRA) that examines the use, scope, and impact of prescreened offers of credit and insurance on consumers.

Who is required to file Study on Prescreened Solicitations or Firm Offers of Credit or Insurance?

Financial institutions, including banks and credit unions, as well as companies that provide prescreened solicitations for credit or insurance, are required to file this study.

How to fill out Study on Prescreened Solicitations or Firm Offers of Credit or Insurance?

To fill out the Study on Prescreened Solicitations or Firm Offers of Credit or Insurance, filers must collect relevant data on prescreened offers made, including the number of solicitations sent, the response rate from consumers, and any other pertinent consumer data as outlined by the regulations.

What is the purpose of Study on Prescreened Solicitations or Firm Offers of Credit or Insurance?

The purpose of the study is to assess the effectiveness and fairness of prescreened offers in the credit and insurance markets, ensuring compliance with consumer protection laws and identifying potential risks to consumers.

What information must be reported on Study on Prescreened Solicitations or Firm Offers of Credit or Insurance?

Information that must be reported includes the volume of prescreened offers generated, the acceptance rates, consumer demographic data, and results of any consumer outreach efforts related to these solicitations.

Fill out your study on prescreened solicitations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Study On Prescreened Solicitations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.