Get the free Regulation V - Fair Credit Reporting - federalreserve

Show details

This document contains a proposal concerning Regulation V related to fair credit reporting, expressing concerns about consumer confusion and unnecessary regulatory burdens in the banking sector.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign regulation v - fair

Edit your regulation v - fair form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your regulation v - fair form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing regulation v - fair online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit regulation v - fair. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

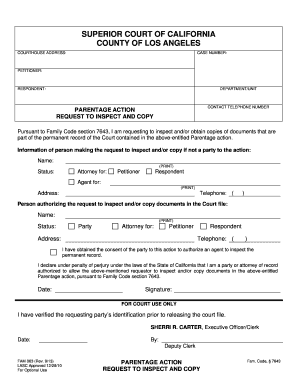

How to fill out regulation v - fair

How to fill out Regulation V - Fair Credit Reporting

01

Gather the necessary personal information including your name, address, and Social Security number.

02

Obtain a copy of your credit report from a consumer reporting agency.

03

Review the report for accuracy and highlight any errors or discrepancies.

04

Identify the specific creditors or entities that have reported information to the consumer reporting agency.

05

Prepare a written statement to clarify any inaccuracies and request corrections.

06

Submit your statement along with any supporting documents to the consumer reporting agency and the creditors involved.

07

Keep records of all communications and submissions related to the dispute.

08

Follow up to ensure your dispute is processed and corrected information is reported.

Who needs Regulation V - Fair Credit Reporting?

01

Consumers who want to ensure their credit reports are accurate and free from errors.

02

Lenders and financial institutions that must comply with regulations governing fair credit reporting.

03

Employers who perform background checks that involve reviewing a candidate's credit report.

04

Any business that uses consumer reports for decision-making processes related to credit, employment, or renting.

Fill

form

: Try Risk Free

People Also Ask about

What is the Fair Credit Reporting Act?

The Fair and Accurate Credit Transactions Act (FACTA) of 2003, an amendment to the Fair Credit Reporting Act (FCRA), was created for the purpose of implementing requirements for financial institutions and creditors to develop and implement written identity theft prevention programs.

What is the Fair Credit Billing Act?

The purpose of the Fair Credit Reporting Act is to: Provide fair and accurate consumer credit reporting. The Federal Fair Credit Reporting Act requires the Insurer to warn the Insured in advance that: An inspection report will be obtained.

What is the difference between the Fair credit Billing Act and the Fair Credit Reporting Act?

The Consumer Financial Protection Bureau (CFPB) is issuing a final rule amending Regulation V, which implements the Fair Credit Reporting Act (FCRA), concerning medical information. The FCRA prohibits creditors from considering medical information in credit eligibility determinations.

What is the regulation for credit reporting?

The Fair Credit Reporting Act (FCRA) regulates the consumer credit reporting industry. In general, the FCRA requires that industry to report your consumer credit information in a fair, timely, and accurate manner. Banks and other lenders use this information to make lending decisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Regulation V - Fair Credit Reporting?

Regulation V is a federal regulation that implements the Fair Credit Reporting Act (FCRA), which aims to promote the accuracy, fairness, and privacy of information in the files of consumer reporting agencies.

Who is required to file Regulation V - Fair Credit Reporting?

Entities that furnish information to consumer reporting agencies, such as creditors, banks, and other financial institutions, are required to comply with Regulation V.

How to fill out Regulation V - Fair Credit Reporting?

Filling out Regulation V typically involves entering accurate consumer information, ensuring compliance with guidelines for data accuracy, and submitting it to the appropriate consumer reporting agencies as required.

What is the purpose of Regulation V - Fair Credit Reporting?

The purpose of Regulation V is to enhance the accuracy of consumer credit information, protect consumer privacy, and provide consumers with the means to dispute inaccurate information.

What information must be reported on Regulation V - Fair Credit Reporting?

Furnishers must report accurate and complete information, including the consumer's name, address, Social Security number, account status, and payment history, among other relevant details.

Fill out your regulation v - fair online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Regulation V - Fair is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.