Get the free Regulation Z - Truth in Lending R-1305 - federalreserve

Show details

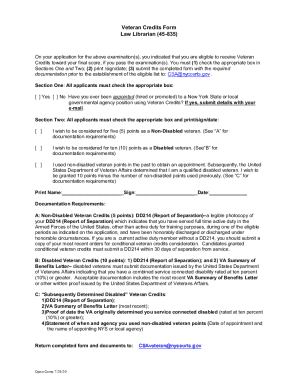

This document is a proposal addressing concerns and opinions regarding Regulation Z related to Truth in Lending, specifically discussing the implications of requiring brokers to disclose yield spread

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign regulation z - truth

Edit your regulation z - truth form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your regulation z - truth form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit regulation z - truth online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit regulation z - truth. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out regulation z - truth

How to fill out Regulation Z - Truth in Lending R-1305

01

Gather all necessary financial information related to the loan, including amounts, terms, and interest rates.

02

Review the required disclosures under Regulation Z, which include the Annual Percentage Rate (APR), finance charges, and total payments.

03

Complete the Loan Estimate form, ensuring all information is accurate and clearly presented to the borrower.

04

Provide the borrower with a copy of the Loan Estimate within three business days of receiving the application.

05

Upon loan closing, ensure the borrower receives the Closing Disclosure, highlighting loan terms and fees.

06

Maintain records of the disclosures provided and any correspondence related to the Truth in Lending Act.

Who needs Regulation Z - Truth in Lending R-1305?

01

Lenders offering consumer credit, including banks, credit unions, and mortgage companies.

02

Borrowers looking for clear and transparent information regarding loan terms and costs.

03

Financial institutions required to comply with federal disclosure laws to ensure fair lending practices.

04

Consumer advocacy groups and regulators monitoring compliance with lending regulations.

Fill

form

: Try Risk Free

People Also Ask about

What are the requirements for regulation Z?

Regulation Z requires lenders to disclose a variety of information related to consumer borrowing, such as providing written information about interest rates and all fees and finance charges that are to be paid in association with a loan or credit card.

What is regulation Z in the truth in the lending Act?

Regulation Z provides finance charge tolerances for legal accuracy that should not be confused with those provided in the TILA for reimbursement under regulatory agency orders.

What disclosures are required by Regulation Z?

Lenders have to provide borrowers a Truth in Lending disclosure statement. It has handy information like the loan amount, the annual percentage rate (APR), finance charges, late fees, prepayment penalties, payment schedule and the total amount you'll pay.

What is covered under Regulation Z?

Regulation Z requires mortgage issuers, credit card companies and other lenders to provide written disclosure of important credit terms, such as interest rate and other financing charges, abstain from certain unfair practices and to respond to borrower complaints about errors in periodic billings.

What are the 6 things they must disclose under the truth in the Lending Act?

The regulation covers topics such as: Credit card disclosures. Periodic statements. Mortgage loan disclosures. Mortgage loan servicing requirements.

What are common regulation Z violations?

Those violations of Regulation Z involved understating the finance charge for discounted, adjustable rate mortgages (ARMs) and incorrectly listing the names of the settlement service providers.

What must be disclosed under regulation Z?

Finance Charge Regulation Z restricts how rates can be included in advertisements for closed-end credit. The APR must always be listed (and must state that the APR is subject to increase after consummation, if applicable). The interest rate may also be listed but not more conspicuously than the APR.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Regulation Z - Truth in Lending R-1305?

Regulation Z is a federal regulation that implements the Truth in Lending Act (TILA). It requires lenders to provide clear and standardized information about the terms and costs of credit to consumers, ensuring they can make informed financial decisions.

Who is required to file Regulation Z - Truth in Lending R-1305?

Any lender or creditor that extends credit to consumers, including banks, credit unions, and other financial institutions, must comply with Regulation Z and may be required to file reports as per its guidelines.

How to fill out Regulation Z - Truth in Lending R-1305?

To fill out Regulation Z - Truth in Lending R-1305, a lender must gather all relevant information concerning the loan terms, costs, and fees associated with the credit, and present it in the required format specified by the regulation to ensure transparency and compliance.

What is the purpose of Regulation Z - Truth in Lending R-1305?

The purpose of Regulation Z is to protect consumers by requiring lenders to disclose important information about the cost of loans in a clear, accurate, and timely manner, thereby promoting informed borrowing decisions and fostering fair lending practices.

What information must be reported on Regulation Z - Truth in Lending R-1305?

The information reported under Regulation Z includes the annual percentage rate (APR), finance charges, total payments, terms of the loan, and any other pertinent details regarding the costs and features of the credit being offered.

Fill out your regulation z - truth online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Regulation Z - Truth is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.