Get the free Proposal: Regulation AA - Unfair or Deceptive Acts or Practices - federalreserve

Show details

A proposal commenting on unfair overdraft fees and interest rates charged by banks and credit card companies, advocating for reinstating usury laws to limit financial institutions' power.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign proposal regulation aa

Edit your proposal regulation aa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your proposal regulation aa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing proposal regulation aa online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit proposal regulation aa. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

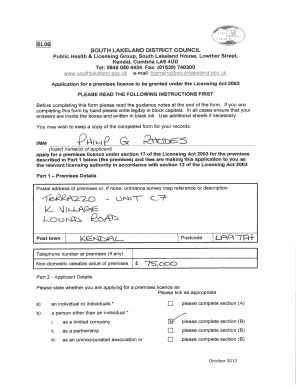

How to fill out proposal regulation aa

How to fill out Proposal: Regulation AA - Unfair or Deceptive Acts or Practices

01

Begin by gathering all relevant information regarding your business practices.

02

Review the guidelines set forth in Regulation AA to understand the scope and objectives.

03

Identify any potentially unfair or deceptive practices within your operations.

04

Outline your proposal by highlighting the specific practices that are in violation.

05

Provide a detailed plan on how you intend to address and rectify these practices.

06

Include any supporting documentation or evidence to back your claims.

07

Ensure your proposal is clear, concise, and adheres to the required format.

08

Submit the completed proposal to the appropriate regulatory body.

Who needs Proposal: Regulation AA - Unfair or Deceptive Acts or Practices?

01

Businesses that offer consumer credit services.

02

Financial institutions that may engage in unfair practices.

03

Consumers who are affected by deceptive acts in the marketplace.

04

Regulatory agencies monitoring compliance with consumer protection laws.

Fill

form

: Try Risk Free

People Also Ask about

What is Section 5 of the Clayton Act?

In many of these cases, the FTC has charged the defendants with violating Section 5 of the FTC Act, which bars unfair and deceptive acts and practices in or affecting commerce. In addition to the FTC Act, the agency also enforces other federal laws relating to consumers' privacy and security.

What is Section 5 unfair or deceptive acts or practices?

Section 5 of the Federal Trade Commission Act (FTC Act) (15 USC 45) prohibits ''unfair or deceptive acts or practices in or affecting commerce. '' The prohibition applies to all persons engaged in commerce, including banks.

What is considered a deceptive act or practice?

Section 5 of the Clayton Act' is designed to relieve private claimants of some of the difficulty and expense of proving a violation and resultant dam- age under the antitrust laws.

What is Section 5 of the Federal Trade Commission Act unfair or deceptive acts or practices?

An act or practice may be found to be deceptive if there is a representation, omission, or practice that misleads or is likely to mislead a consumer. Deception is not limited to situations in which a consumer has already been misled.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Proposal: Regulation AA - Unfair or Deceptive Acts or Practices?

Proposal: Regulation AA addresses unfair or deceptive acts or practices in consumer financial products and services, establishing standards for transparency and fairness.

Who is required to file Proposal: Regulation AA - Unfair or Deceptive Acts or Practices?

Entities and individuals engaged in providing consumer financial products and services are required to file under Regulation AA.

How to fill out Proposal: Regulation AA - Unfair or Deceptive Acts or Practices?

To fill out the proposal, entities must complete the required forms provided by the regulatory authority, ensuring all relevant information regarding practices is disclosed accurately.

What is the purpose of Proposal: Regulation AA - Unfair or Deceptive Acts or Practices?

The purpose is to protect consumers from unfair, deceptive, or abusive practices in the financial services industry and to promote transparency.

What information must be reported on Proposal: Regulation AA - Unfair or Deceptive Acts or Practices?

Information that must be reported includes descriptions of practices, any consumer complaints received, and measures taken to address those complaints.

Fill out your proposal regulation aa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Proposal Regulation Aa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.