Get the free Regulation AA Feedback - federalreserve

Show details

This document captures a consumer's complaint about unfair credit card interest rate increases following a late payment, conveying the need for regulatory oversight.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign regulation aa feedback

Edit your regulation aa feedback form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your regulation aa feedback form via URL. You can also download, print, or export forms to your preferred cloud storage service.

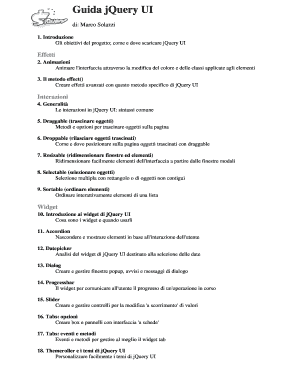

How to edit regulation aa feedback online

Follow the steps below to use a professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit regulation aa feedback. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out regulation aa feedback

How to fill out Regulation AA Feedback

01

Read the Regulation AA guidelines thoroughly to understand the requirements.

02

Gather necessary information related to the feedback, including consumer complaints and business practices.

03

Fill out the feedback form by providing detailed information about each section as required.

04

Be specific and clear in your responses to ensure effective communication.

05

Review your entries for accuracy before submission.

06

Submit the completed feedback form through the designated channels.

Who needs Regulation AA Feedback?

01

Financial institutions that provide credit to consumers.

02

Consumers who have experienced unfair or deceptive practices in credit transactions.

03

Regulatory bodies monitoring compliance with consumer protection laws.

Fill

form

: Try Risk Free

People Also Ask about

Is UDAP a regulation?

UDAAP compliance is important for consumer finance companies to: Protect consumers: By ensuring compliance with UDAAP, consumers are protected from financial harm. Avoid enforcement actions: Failure to comply with UDAAP regulations can result in enforcement actions, costly penalties, and reputational damage.

Was Reg AA repealed?

The Federal Reserve published a final rule to repeal it's Regulation AA – Unfair or Deceptive Acts or Practices effective March 21, 2016.

What replaced regulation AA?

The Dodd-Frank Wall Street Reform and Consumer Protection Act ended the Federal Reserve Board's power to make rules regarding deceptive or unfair banking practices, and thus Regulation AA was repealed with the passage of the Dodd-Frank Act.

What is the history of UDAAP?

In response to the Great Recession, Congress enacted the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) in 2010. Under the Dodd- Frank Act, it is unlawful for a provider of consumer financial products or services to engage in any unfair, deceptive, or abusive acts or practices (UDAAP).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Regulation AA Feedback?

Regulation AA Feedback refers to the reporting and evaluation process established under the Fair Credit Reporting Act that aims to enhance the quality and accuracy of consumer credit information.

Who is required to file Regulation AA Feedback?

Entities that furnish information to consumer reporting agencies, such as banks, credit unions, and other financial institutions, are required to file Regulation AA Feedback.

How to fill out Regulation AA Feedback?

To fill out Regulation AA Feedback, organizations must complete the required reporting forms accurately, providing detailed information on the accuracy of the data submitted to credit reporting agencies.

What is the purpose of Regulation AA Feedback?

The purpose of Regulation AA Feedback is to ensure consumer reporting accuracy and to provide consumers with more reliable credit information, enhancing their financial opportunities.

What information must be reported on Regulation AA Feedback?

Organizations must report information such as the nature of the data reported, inaccuracies identified, and steps taken to correct those inaccuracies as part of Regulation AA Feedback.

Fill out your regulation aa feedback online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Regulation Aa Feedback is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.