Get the free National Flood Insurance Program Provisional Rating Questionnaire - fema

Show details

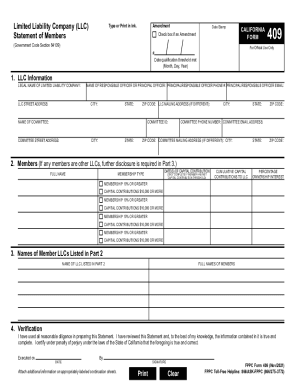

This document provides guidelines for completing the Provisional Rating Questionnaire, which is necessary for applying flood insurance coverage before obtaining an Elevation Certificate.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign national flood insurance program

Edit your national flood insurance program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your national flood insurance program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing national flood insurance program online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit national flood insurance program. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out national flood insurance program

How to fill out National Flood Insurance Program Provisional Rating Questionnaire

01

Obtain the National Flood Insurance Program Provisional Rating Questionnaire form.

02

Read the instructions carefully to understand the requirements.

03

Fill out the property information section, including the location and type of building.

04

Provide details about the flood zone designation, using available flood maps if necessary.

05

Indicate any elevation information relevant to the building.

06

Answer questions regarding flood protection measures and any previous flood claims.

07

Review your information for accuracy and completeness.

08

Submit the completed questionnaire to your insurance provider or FEMA.

Who needs National Flood Insurance Program Provisional Rating Questionnaire?

01

Homeowners in flood-prone areas who are applying for flood insurance.

02

Businesses seeking to obtain flood coverage in designated flood zones.

03

Property developers looking to assess flood risks before building.

04

Lenders requiring flood insurance for properties in high-risk flood areas.

Fill

form

: Try Risk Free

People Also Ask about

Which loss would not be covered by the National Flood Insurance?

In general, the policy excludes losses caused by earth movement, even if the earth movement is caused by flood. Examples of excluded earth movement include: Earthquake. Landslide.

How do you qualify for National Flood Insurance Program?

The NFIP works with communities required to adopt and enforce floodplain management regulations that help mitigate flooding effects. Flood insurance is available to anyone living in one of the almost 23,000 participating NFIP communities.

What is excluded by the standard flood insurance policy?

Flood Insurance Exclusions For example, excluded property may include exterior property like landscaping, decks, fences, and pools. In addition, automobiles are generally excluded from flood coverage, as are cash, collectibles, and heirlooms.

How much does the National Flood Insurance Program cover?

The NFIP's Dwelling Form offers coverage for: 1. Building Property, up to $250,000, and 2. Personal Property (Contents), up to $100,000. The NFIP encourages people to purchase both types of coverage.

Does the National Flood Insurance Program include loss of use coverage?

Loss of use coverage can be provided by the National Flood Insurance Program and Federal Emergency Management Agency (FEMA) through the disaster assistance or disaster relief program.

What is the maximum for National Flood Insurance Program?

The maximum for residential structures for a family of one-to-four is $250,000 in building coverage and $100,000 in contents coverage. For residential structures of five or more units, the maximum is $500,000 in building coverage and $100,000 in contents coverage.

What loss would not be covered by the National Flood Insurance Program?

In general, the policy excludes losses caused by earth movement, even if the earth movement is caused by flood. Examples of excluded earth movement include: Earthquake. Landslide.

What structures are not eligible for flood insurance under the National Flood Insurance Program?

Structures Not Eligible for Flood Insurance Under the NFIP Converted buses or vans. Buildings entirely in, on, or over water into which boats are floated. area designated as an undeveloped coastal barrier with the Coastal Barrier Resource System established by the Coastal Barrier Resources Act (Public Law 97-348).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is National Flood Insurance Program Provisional Rating Questionnaire?

The National Flood Insurance Program Provisional Rating Questionnaire is a form used to collect information necessary to establish the flood insurance risk rating for properties in flood-prone areas.

Who is required to file National Flood Insurance Program Provisional Rating Questionnaire?

Lenders, insurance agents, and property owners seeking flood insurance coverage must file the National Flood Insurance Program Provisional Rating Questionnaire to ensure accurate risk assessment.

How to fill out National Flood Insurance Program Provisional Rating Questionnaire?

To fill out the questionnaire, collect relevant property data including location, elevation, occupancy type, and any previous flood history, and accurately complete each section as instructed.

What is the purpose of National Flood Insurance Program Provisional Rating Questionnaire?

The purpose of the questionnaire is to facilitate the correct assessment of flood risk for properties, allowing for appropriate flood insurance rates and coverage determination.

What information must be reported on National Flood Insurance Program Provisional Rating Questionnaire?

The information required includes property address, flood zone, building characteristics, elevation data, and any prior flood claims or mitigation measures.

Fill out your national flood insurance program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

National Flood Insurance Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.