Get the free Preferred Risk Policy - fema

Show details

A comprehensive guide detailing the terms, eligibility, and coverage limits of the Preferred Risk Policy (PRP) under the Standard Flood Insurance Policy (SFIP), specifically designed for properties

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign preferred risk policy

Edit your preferred risk policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your preferred risk policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing preferred risk policy online

Follow the steps down below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit preferred risk policy. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out preferred risk policy

How to fill out Preferred Risk Policy

01

Gather the necessary personal and property information.

02

Review the eligibility criteria for the Preferred Risk Policy.

03

Fill out the application form with accurate details.

04

Provide any required documentation, such as proof of property ownership.

05

Indicate the types of coverage you wish to include.

06

Review the completed application for any errors.

07

Submit the application to the insurance provider.

08

Await confirmation of policy acceptance from the insurer.

Who needs Preferred Risk Policy?

01

Homeowners in low to moderate flood risk areas.

02

Individuals looking for more affordable flood insurance options.

03

Property owners with homes built after the Flood Insurance Rate Map was issued.

Fill

form

: Try Risk Free

People Also Ask about

What is a preferred risk in an insurance policy?

: an insured that an insurer deems has a lower than average chance of loss and that usually may pay a lower premium.

What is the deductible under a Nfip preferred risk policy?

The standard deductible for PRPs is $1,000 each for building and contents, applied separately. Optional deductibles are not available for PRPs.

What is a preferred risk life insurance policy?

Preferred Risk These are individuals who offer a lower risk for the insurer than a standard risk and are rewarded with generally lower premium rates. High personal characteristics contribute to a preferred risk rating such as nonsmoking and overall good health.

What is an example of a preferred risk?

Definition of preferred risk insured, or an applicant for insurance, with lower expectation of incurring a loss than the standard applicant. For example, an applicant for life insurance who does not smoke can usually obtain a reduced premium rate to reflect greater life expectancy.

What is a preferred policy?

Preferred Risk Policies provide you with flood insurance protection that is the same as a standard policy, but at significant savings. Preferred Risk Policies are only available in areas of low or moderate flood risk.

What is a preferred risk policy for flood insurance?

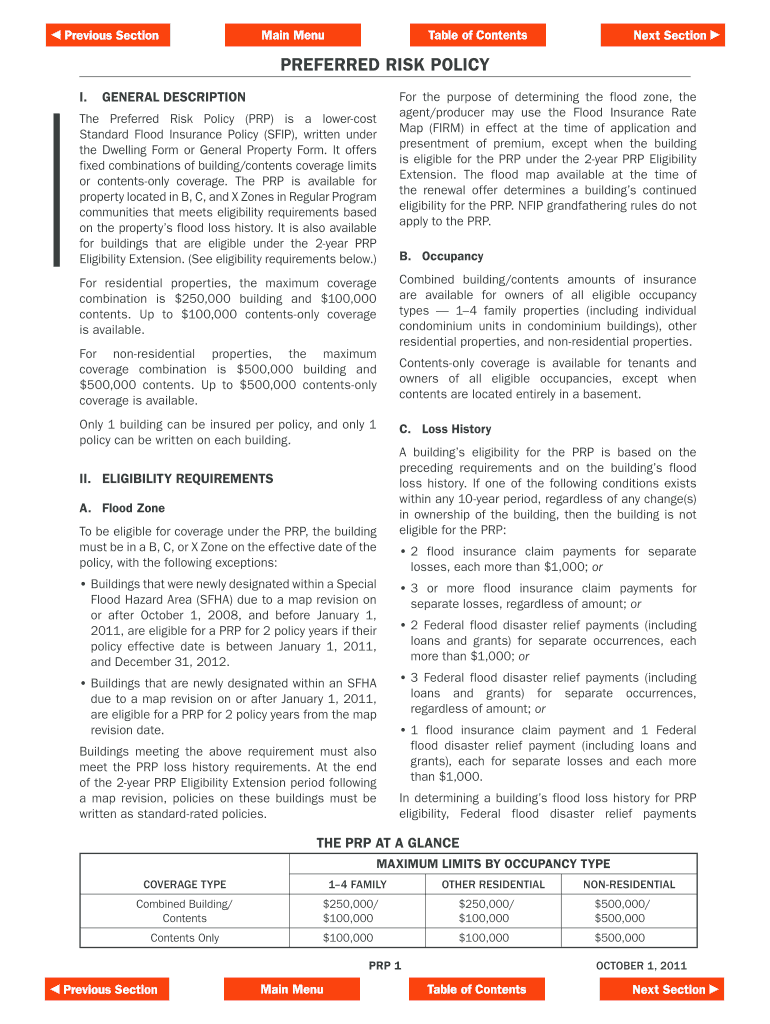

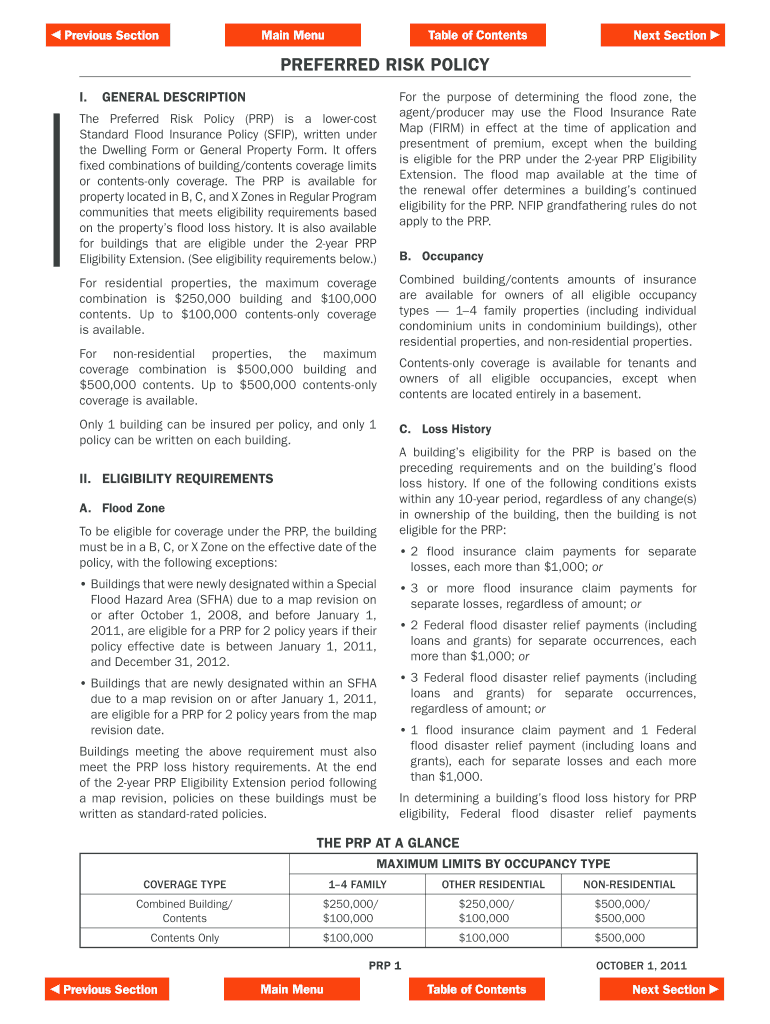

The Preferred Risk Policy (PRP) is a lower-cost Standard Flood Insurance Policy (SFIP), written under the Dwelling Form or General Property Form. It offers fixed combinations of building/contents coverage limits or contents-only coverage.

What is a preferred policy?

Preferred Risk Policies provide you with flood insurance protection that is the same as a standard policy, but at significant savings. Preferred Risk Policies are only available in areas of low or moderate flood risk.

What is the deductible for NFIP insurance?

NFIP flood insurance deductibles can range from $1,000 to $10,000 for both the building and contents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Preferred Risk Policy?

A Preferred Risk Policy is a type of insurance policy that offers coverage to individuals or entities that meet specific criteria indicating they are lower risk. These criteria often involve favorable factors related to the insured property or the insured's history.

Who is required to file Preferred Risk Policy?

Individuals or businesses that qualify as low-risk based on insurance underwriting guidelines are required to file a Preferred Risk Policy. This typically includes those with good claims history and risk factors that align with the insurer's preferred standards.

How to fill out Preferred Risk Policy?

To fill out a Preferred Risk Policy, applicants should carefully complete the application form, providing accurate personal and property information, and specifying the desired coverage limits. It may also be necessary to provide supporting documentation or additional information about the insured risk.

What is the purpose of Preferred Risk Policy?

The purpose of a Preferred Risk Policy is to provide insurance coverage at a lower premium rate for individuals or entities classified as lower risk. This incentivizes good risk management practices and allows insurers to attract and retain preferable clients.

What information must be reported on Preferred Risk Policy?

Information that must be reported on a Preferred Risk Policy typically includes the insured's name, address, and contact details, property information such as location and type, coverage options sought, and any prior insurance history or claims.

Fill out your preferred risk policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Preferred Risk Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.