Get the free Report of Assets and Liabilities of U.S. Branches and Agencies of Foreign Banks - ffiec

Show details

This document is a regulatory report required from U.S. branches and agencies of foreign banks, detailing their assets and liabilities as of the close of business on a specific date, in accordance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign report of assets and

Edit your report of assets and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your report of assets and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit report of assets and online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit report of assets and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

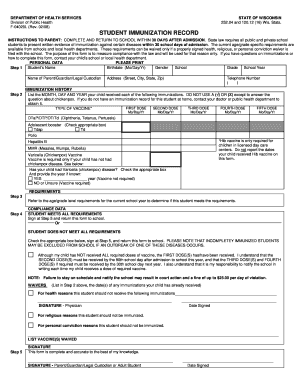

How to fill out report of assets and

How to fill out Report of Assets and Liabilities of U.S. Branches and Agencies of Foreign Banks

01

Gather relevant financial data for the branch or agency, including balance sheets and income statements.

02

Download the Report of Assets and Liabilities form from the appropriate regulatory website.

03

Start with Section I, entering the total assets amount accurately.

04

Fill out Section II by listing all liabilities, ensuring each entry is correct and up-to-date.

05

Complete Section III, which includes any additional notes or disclosures required by the reporting guidelines.

06

Verify that all entries match the supporting documents to avoid discrepancies.

07

Review the entire report for accuracy and completeness before submission.

08

Submit the report electronically through the designated platform by the deadline.

Who needs Report of Assets and Liabilities of U.S. Branches and Agencies of Foreign Banks?

01

Foreign banks operating branches or agencies in the U.S.

02

Regulatory authorities that monitor the financial health of foreign institutions in the U.S.

03

Financial analysts and researchers studying the impact of foreign banks on the U.S. economy.

04

Investors interested in understanding the financial position of foreign branches and agencies.

Fill

form

: Try Risk Free

People Also Ask about

Does the IRS have access to my foreign bank account?

The Foreign Account Tax Compliance Act (FATCA) requires foreign banks to report account numbers, balances, names, addresses, and identification numbers of account holders to the IRS.

Who regulates U.S. branches of foreign banks?

The Office of the Comptroller of the Currency (OCC) is an independent bureau of the U.S. Department of the Treasury. The OCC charters, regulates, and supervises all national banks, federal savings associations, and federal branches and agencies of foreign banks.

Who is exempt from FATCA reporting IRS?

An interest in the social security, social insurance, or another similar program of a foreign government. If you have an investment interest in the social security, social insurance, or a foreign government program of a similar nature, you'll not have to report such investments under FATCA's regulations.

What are the assets and liabilities of the banking system?

A bank's asset may be cash reserves or consumer loans, such as automobile loans. Current liabilities need to be paid out within the current period, such as utility bills or rent for the building.

Does Reg W apply to U.S. branches of foreign banks?

Regulation W also applies Sections 23A and 23B to transactions between a U.S. branch or agency of a foreign bank and any portfolio company controlled by the foreign bank under GLBA's merchant banking or insurance company investment authorities.

Do U.S. banks report to foreign countries?

With a “reciprocal” IGA, the US is generally required to exchange information about accounts held in US financial institutions by citizens or residents of the IGA partner countries.

Do US banks share information with other countries?

With a “reciprocal” IGA, the US is generally required to exchange information about accounts held in US financial institutions by citizens or residents of the IGA partner countries.

What happens if I have more than $10,000 in a foreign bank account?

A United States person that has a financial interest in or signature authority over foreign financial accounts must file an FBAR if the aggregate value of the foreign financial accounts exceeds $10,000 at any time during the calendar year. The full line item instructions are located at FBAR Line Item Instructions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Report of Assets and Liabilities of U.S. Branches and Agencies of Foreign Banks?

The Report of Assets and Liabilities of U.S. Branches and Agencies of Foreign Banks, also known as the F.R. 2052a, is a regulatory report that provides a comprehensive snapshot of the financial position of U.S. branches and agencies of foreign banks, detailing their assets, liabilities, and capital structure.

Who is required to file Report of Assets and Liabilities of U.S. Branches and Agencies of Foreign Banks?

All U.S. branches and agencies of foreign banks that operate in the United States are required to file the Report of Assets and Liabilities on a quarterly basis, as mandated by the Federal Reserve.

How to fill out Report of Assets and Liabilities of U.S. Branches and Agencies of Foreign Banks?

To fill out the Report of Assets and Liabilities, institutions must provide detailed information on their assets, liabilities, and capital. This includes categorizing financial data according to standardized formats and ensuring accurate reporting of figures in compliance with regulatory guidelines.

What is the purpose of Report of Assets and Liabilities of U.S. Branches and Agencies of Foreign Banks?

The primary purpose of the Report of Assets and Liabilities is to ensure regulatory oversight and promote the safety and soundness of U.S. branches and agencies of foreign banks. It aids regulatory authorities in monitoring financial health, assessing risks, and maintaining the stability of the financial system.

What information must be reported on Report of Assets and Liabilities of U.S. Branches and Agencies of Foreign Banks?

The report must include information on total assets, total liabilities, capital, various types of loans, deposits, and other financial instruments that reflect the branch's or agency's financial standing, as well as information on off-balance sheet activities.

Fill out your report of assets and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Report Of Assets And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.