Get the free Consolidated Reports of Condition and Income for A Bank With Domestic Offices Only-F...

Show details

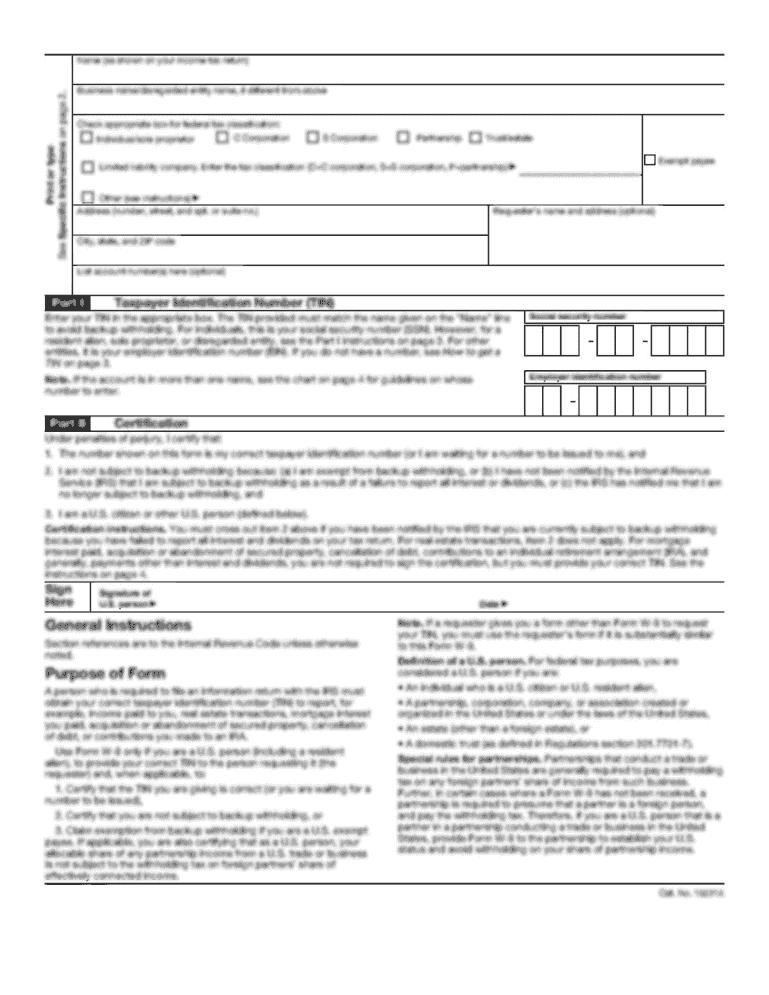

This document is a mandatory report for banks with domestic offices, capturing their financial condition and income to comply with federal regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consolidated reports of condition

Edit your consolidated reports of condition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consolidated reports of condition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit consolidated reports of condition online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit consolidated reports of condition. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consolidated reports of condition

How to fill out Consolidated Reports of Condition and Income for A Bank With Domestic Offices Only-FFIEC 041

01

Gather necessary financial data such as assets, liabilities, and equity.

02

Download the FFIEC 041 reporting form from the official website.

03

Fill out the 'Balance Sheet' section with accurate figures from the bank's financial statements.

04

Complete the 'Income Statement' section, detailing revenues and expenses.

05

Ensure all figures are in compliance with GAAP standards.

06

Review each section for accuracy and completeness.

07

Submit the report electronically via the FFIEC Central Data Repository.

Who needs Consolidated Reports of Condition and Income for A Bank With Domestic Offices Only-FFIEC 041?

01

All banks with domestic offices in the United States.

02

Regulatory agencies such as the FDIC and Federal Reserve.

03

Investors and stakeholders interested in the bank's financial health.

Fill

form

: Try Risk Free

People Also Ask about

What is the Ffiec 002 Report of assets and liabilities of US branches and agencies of foreign banks?

Description: This report is mandated by the International Banking Act (IBA) of 1978. It collects balance sheet and off-balance-sheet information, including detailed supporting schedule items, from all U.S. branches and agencies of foreign banks.

Which organizations are included in the FFIEC?

The Council is an interagency body comprised of the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, the National Credit Union Administration, the Office of the Comptroller of the Currency, and the Consumer Financial Protection Bureau.

Who files FFIEC 031?

The bank must begin filing the FFIEC 031 report form (Consolidated Reports of Condition and Income for a Bank with Domestic and Foreign Offices) for the first quarterly report date following the commencement of operations by the "foreign" office.

Who does FFIEC apply to?

One of the member agencies of the FFIEC is the National Credit Union Administration, which supervises the charters and regulations for federal credit unions. Therefore, all credit unions fall under FFIEC regulations.

What is the FFIEC-002 Report?

Reporting Forms FormDescription FFIEC 002 Report of Assets and Liabilities of U.S. Branches and Agencies of Foreign Banks FFIEC 002S Report of Assets and Liabilities of a Non-U.S. Branch that is Managed or Controlled by a U.S. Branch or Agency of a Foreign (Non-U.S.) Bank FFIEC 009 Country Exposure Report6 more rows

Who needs to comply with FFIEC?

Federally supervised financial institutions need to comply with the FFIEC's stipulated guidelines. These include: State-chartered banks that are members of the Federal Reserve System. Bank holding companies.

Who is required to file FFIEC 031?

(1) BANKS WITH FOREIGN OFFICES: Banks of any size that have any "foreign" offices (as defined below) must file quarterly the Consolidated Reports of Condition and Income for a Bank with Domestic and Foreign Offices (FFIEC 031).

How often do institutions file the FFIEC-002?

The FFIEC 002 is required and must be submitted quarterly by U.S. branches and agencies of foreign banks.

Which Report also known as a consolidated Report of condition and Income?

The Consolidated Reports of Condition and Income are commonly referred to as the Call Report. For purposes of these General Instructions, the Financial Accounting Standards Board (FASB) Accounting Standards Codification is referred to as “ASC.”

Who is required to file a call report?

Who Is Required to File a Call Report? All national banks, state member banks, and non-member insured banks in the United States are required to file call reports.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Consolidated Reports of Condition and Income for A Bank With Domestic Offices Only-FFIEC 041?

The Consolidated Reports of Condition and Income for a Bank With Domestic Offices Only-FFIEC 041 is a regulatory reporting form used by certain banks in the United States to provide a comprehensive overview of their financial condition and performance. It includes detailed information about a bank's assets, liabilities, equity, income, and expenses.

Who is required to file Consolidated Reports of Condition and Income for A Bank With Domestic Offices Only-FFIEC 041?

Banks that are considered to be small, typically with total assets under $1 billion, are required to file the FFIEC 041 report. This includes state-chartered banks and national banks that operate solely within the United States.

How to fill out Consolidated Reports of Condition and Income for A Bank With Domestic Offices Only-FFIEC 041?

To fill out the FFIEC 041 report, banks must gather financial data from their records, including information on loans, deposits, and other financial obligations. The report must be completed in accordance with FFIEC guidelines, ensuring that all sections are filled accurately based on the bank's financial status as of the report date.

What is the purpose of Consolidated Reports of Condition and Income for A Bank With Domestic Offices Only-FFIEC 041?

The primary purpose of the FFIEC 041 reporting requirement is to provide regulatory authorities with necessary information to assess the financial health and stability of smaller banks. It enables regulators to monitor trends and potential risks within the banking sector.

What information must be reported on Consolidated Reports of Condition and Income for A Bank With Domestic Offices Only-FFIEC 041?

The report must include, but is not limited to, data on the bank's balance sheet (assets, liabilities, and equity), income statement (revenues, expenses, and net income), as well as details on loans, investments, deposits, and risk management practices.

Fill out your consolidated reports of condition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consolidated Reports Of Condition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.