CO DoR 104 2011 free printable template

Show details

File this form now through Revenue Online. Visit www.Colorado.gov/RevenueOnline today! Through Revenue Online you can: File your Return Amend your Return Make a Payment Access Your Tax Account (Sign

pdfFiller is not affiliated with any government organization

Instructions and Help about CO DoR 104

How to edit CO DoR 104

How to fill out CO DoR 104

Instructions and Help about CO DoR 104

How to edit CO DoR 104

To edit the CO DoR 104 form, you may use tools that allow electronic form editing, such as pdfFiller. Begin by uploading the form to the platform, where you can make necessary modifications. Ensure to save your changes before downloading or printing the edited version for submission.

How to fill out CO DoR 104

Filling out the CO DoR 104 form involves providing accurate information regarding payments made for services. Follow these steps:

01

Start by entering your legal name and address in the designated fields.

02

Specify the payment amount and describe the nature of the services provided.

03

Complete any additional sections as required based on the type of payment being reported.

04

Check the form for accuracy before submission.

About CO DoR previous version

What is CO DoR 104?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CO DoR previous version

What is CO DoR 104?

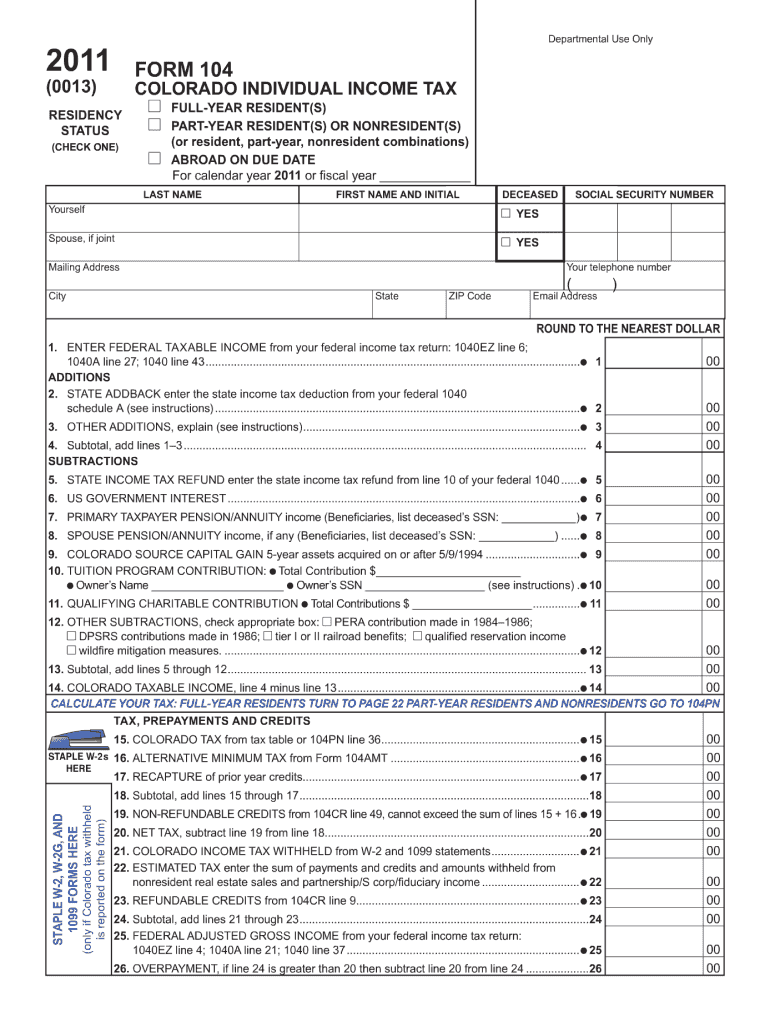

The CO DoR 104, also known as the Colorado Department of Revenue Tax Form 104, is used for reporting certain payments made by entities or individuals to service providers. The form primarily pertains to payments made for services performed within Colorado.

What is the purpose of this form?

The purpose of the CO DoR 104 form is to report payments to independent contractors and various service providers to ensure proper taxation of these payments. It helps the Colorado Department of Revenue track income and enforce compliance with state tax laws.

Who needs the form?

Any individual or business that has made payments of $600 or more to a non-employee, such as an independent contractor, must file the CO DoR 104. This includes payments for services rendered in trade or business activities.

When am I exempt from filling out this form?

Exemptions from filling out the CO DoR 104 form include situations where the payment is made to corporations, payments under $600, or payments made for goods rather than services. It's essential to review these criteria to determine if an exemption applies.

Components of the form

The CO DoR 104 form includes several key components such as the payer's details, recipient's information, and the amount paid for services. Additionally, there are sections to report payment dates and descriptions of the services rendered.

What are the penalties for not issuing the form?

Failure to issue the CO DoR 104 form when required can result in penalties. These penalties may include fines imposed by the Colorado Department of Revenue and could also lead to challenges during audits or reviews of financial transactions.

What information do you need when you file the form?

When filing the CO DoR 104 form, you need the payer's and payee's full legal names, addresses, tax identification numbers, and the total amount paid. Ensure that the information is complete and accurate to avoid delays or issues with the submission.

Is the form accompanied by other forms?

The CO DoR 104 form does not require any accompanying forms when submitted. However, it is essential to maintain thorough records of the payments reported in case of future inquiries by the tax authority.

Where do I send the form?

The completed CO DoR 104 form should be sent to the Colorado Department of Revenue. It is advisable to check the latest mailing address on the official Colorado Department of Revenue website to ensure you are sending it to the correct location.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

pdf filler has allowed me to easily upload and edit pdf documents...as the technology improves it will be a standard use software for most users.

Where has PDFfiller been my whole life?!?! LOVE IT!

See what our users say