Get the free Crop Insurance Application - gpo

Show details

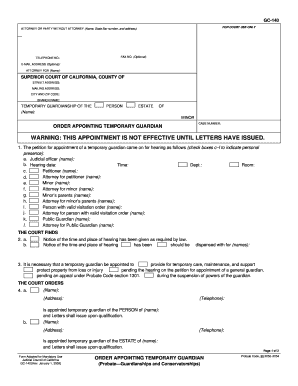

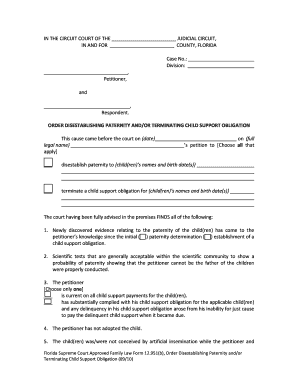

This document serves as an application for crop insurance policies issued by the Federal Crop Insurance Corporation, ensuring coverage for farmers against losses due to various risks.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign crop insurance application

Edit your crop insurance application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your crop insurance application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit crop insurance application online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit crop insurance application. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out crop insurance application

How to fill out Crop Insurance Application

01

Gather necessary documents: Collect information about your farm, including production history, land ownership, and crop types.

02

Complete personal information: Fill out your name, address, and contact details on the application.

03

Provide farm details: Specify the location of your farm and the crops you intend to insure.

04

Choose insurance options: Select the type of coverage you need, such as revenue protection or yield protection.

05

Estimate coverage levels: Decide on the amount of coverage based on your expected yield and market prices.

06

Review the application: Double-check all information to ensure accuracy and completeness.

07

Submit application: Send your completed application to your local insurance agent or crop insurance provider by the deadline.

Who needs Crop Insurance Application?

01

Farmers who grow crops and wish to protect themselves against potential losses due to natural disasters.

02

Agricultural producers looking to secure their income against price fluctuations in the market.

03

Those who want to manage risk associated with crop production and ensure financial stability.

Fill

form

: Try Risk Free

People Also Ask about

Who writes crop insurance?

Federal Crop Insurance Program (FCIP) participation The USDA, Risk Management Agency (RMA) oversees FCIP and offers agricultural producers financial protection against losses due to adverse events including drought, excess moisture, damaging freezes, hail, wind, disease, and price fluctuations.

How do I get crop insurance?

To purchase a policy, you need to go through a crop insurance agent who sells policies for one of the approved insurance providers. The federal government subsidizes the insurance premium. Insurance providers sell and administer the insurance policies, making payments to farmers when there are eligible losses.

How much does farm insurance cost?

What Does Farm Insurance Cost. This will depend on the type of policy needed, and the size of the risk. A Small Farm package could cost about $1500 a year, while a large Dairy Operation could cost $30,000 a year. The cost will be based on the type of farm exposure.

How much can you make selling crop insurance?

What are Top 10 Highest Paying Cities for Crop Insurance Sales Jobs CityAnnual SalaryMonthly Pay Livermore, CA $76,244 $6,353 San Francisco, CA $76,051 $6,337 Daly City, CA $75,315 $6,276 Santa Cruz, CA $75,053 $6,2546 more rows

What is the most common type of crop insurance?

Yield-Based Crop Insurance This is the most common form of crop insurance, covering losses due to shortfall in crop yield. Farmers receive compensation when their crop production falls below the guaranteed yield benchmark. An example of this is the Pradhan Mantri Fasal Bima Yojana (PMFBY).

Do farmers pay for crop insurance?

Most farmers are going to buy up their coverage. Depending on the insurance plan, your crop, farm practice, coverage, acres insured, and extra endorsements, prices for premiums will vary.

What is an SBI in crop insurance?

Substantial Beneficial Interest (SBI) To apply for a Crop Insurance policy, the applicant, also known as the named insured, must own, or have an insurable share in the crop on which insurance is requested. Anyone with a 10% or greater interest in the named insured is called a substantial beneficial interest (SBI).

How much do farmers pay for crop insurance?

Overly generous share of premiums covered by taxpayers: On average, for every $1 of crop insurance protection, taxpayers cover 60 cents while farmers pay 40 cents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Crop Insurance Application?

A Crop Insurance Application is a formal request submitted by farmers or landowners to obtain insurance coverage for their crops against unforeseen events such as natural disasters, pests, or diseases.

Who is required to file Crop Insurance Application?

Farmers or landowners who wish to protect their crops through insurance are required to file a Crop Insurance Application.

How to fill out Crop Insurance Application?

To fill out a Crop Insurance Application, one must provide personal details, farm information, the specific crops insured, and any previous insurance history, along with supporting documents as required by the insurance provider.

What is the purpose of Crop Insurance Application?

The purpose of a Crop Insurance Application is to provide a documented request for financial protection against potential crop losses, thereby ensuring economic stability for farmers.

What information must be reported on Crop Insurance Application?

The information that must be reported on a Crop Insurance Application includes the applicant's personal information, details about the farm and crops, the acreage planted, and historical yield data, as well as any previous claims.

Fill out your crop insurance application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Crop Insurance Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.