Get the free Part 553 - Application of the Fair Labor Standards Act to Employees of State and Loc...

Show details

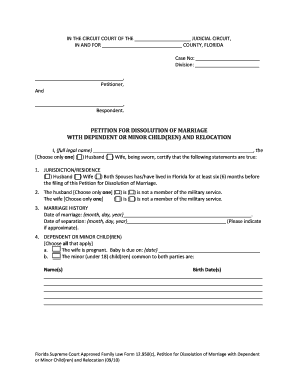

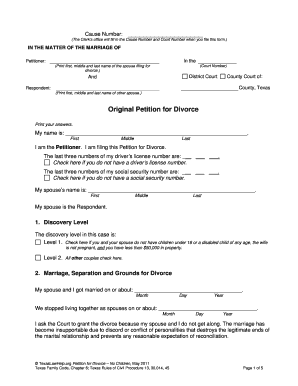

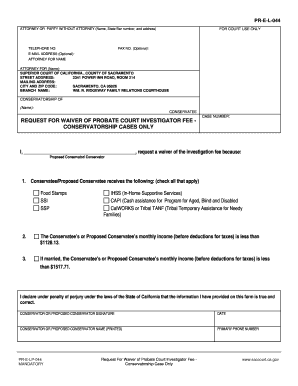

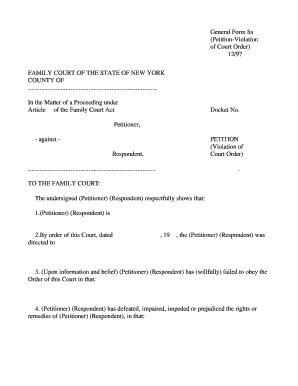

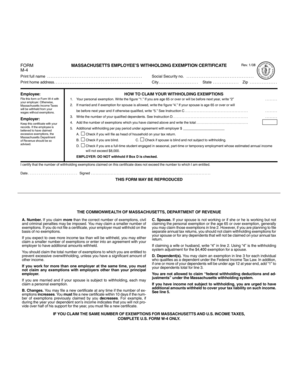

This document outlines the application of the Fair Labor Standards Act (FLSA) to employees of state and local governments, including recordkeeping requirements, compensatory time rules, and exemptions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign part 553 - application

Edit your part 553 - application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your part 553 - application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing part 553 - application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit part 553 - application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out part 553 - application

How to fill out Part 553 - Application of the Fair Labor Standards Act to Employees of State and Local Governments

01

Begin by obtaining the application form for Part 553.

02

Read the instructions carefully to ensure you understand the requirements.

03

Fill in the identification information, including the name and address of the government entity.

04

Provide details about the type of employment and the nature of the work performed by the employees.

05

Include information about the hours of work, including regular and overtime hours.

06

Specify the payment methods used (hourly wages, salary, etc.) and any benefits provided.

07

Ensure that all the information is accurate and complete before submitting the form.

08

Review the form for any possible omissions or errors.

09

Submit the completed application form to the appropriate governing body or agency for review.

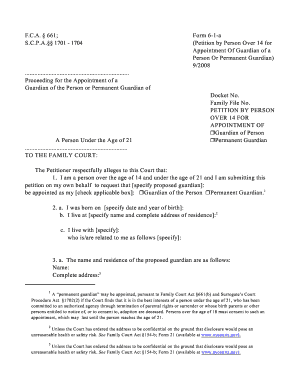

Who needs Part 553 - Application of the Fair Labor Standards Act to Employees of State and Local Governments?

01

State and local government employers who need to comply with the Fair Labor Standards Act.

02

Human resources personnel responsible for employee compensation and hours tracking.

03

Legal teams within government entities that ensure compliance with labor laws.

04

Employees of state and local governments who want to understand their rights under the FLSA.

Fill

form

: Try Risk Free

People Also Ask about

What is 7 Fair Labor Standards Act?

Under Section 7, employers must pay covered workers at least one-and-a-half times their regular hourly wage for hours worked over 40 hours a week at a given job. Employers may choose to pay more than time-and-a-half for overtime or to pay overtime to employees who are exempt from overtime under the FLSA.

What is Title 5 of the Fair Labor Standards Act?

Fact Sheet: Overtime Pay, Title 5 Overtime pay provided under title 5, United States Code, is pay for hours of work officially ordered or approved in excess of 8 hours in a day or 40 hours in an administrative workweek.

What does the Fair Labor Standards Act apply to?

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and child labor standards affecting full-time and part-time workers in the private sector and in Federal, State, and local governments.

What are the major provisions of the Fair Labor Standards Act?

(For best printout, see the PDF version (Spanish).) The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay, recordkeeping, and child labor standards affecting full-time and part-time workers in the private sector and in Federal, State, and local governments.

What 3 things did the Fair Labor Standards Act accomplish?

Generally, the bill provided for a 40-cent-an-hour minimum wage, a 40-hour maximum workweek, and a minimum working age of 16 except in certain industries outside of mining and manufacturing.

What are 5 of the major provisions of the Fair labor Standard Act?

FLSA rules specify when workers are considered on the clock, when they should be paid overtime, and a minimum wage. Employees are deemed either exempt or nonexempt with regard to the FLSA. The FLSA applies to employers whose annual sales total $500,000 or more or are engaged in interstate commerce.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Part 553 - Application of the Fair Labor Standards Act to Employees of State and Local Governments?

Part 553 outlines the regulations and guidelines under the Fair Labor Standards Act (FLSA) as they apply to employees of state and local government entities, specifying how these employees are treated in terms of wages, hours worked, and overtime.

Who is required to file Part 553 - Application of the Fair Labor Standards Act to Employees of State and Local Governments?

State and local government employers that have employees covered by the Fair Labor Standards Act must file under Part 553.

How to fill out Part 553 - Application of the Fair Labor Standards Act to Employees of State and Local Governments?

To fill out Part 553, government employers must gather required wage and work hour information, indicate compliance with FLSA provisions, and complete the necessary forms as specified by the Department of Labor.

What is the purpose of Part 553 - Application of the Fair Labor Standards Act to Employees of State and Local Governments?

The purpose of Part 553 is to provide a framework for ensuring that state and local government employees are paid in accordance with federal labor standards, including minimum wage and overtime pay.

What information must be reported on Part 553 - Application of the Fair Labor Standards Act to Employees of State and Local Governments?

Employers must report employee hours worked, wage rates, overtime calculations, and any exemptions applied under the FLSA, along with other relevant employment details.

Fill out your part 553 - application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Part 553 - Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.