Get the free Crop Revenue Coverage Insurance Policy - gpo

Show details

This document provides detailed provisions for Crop Revenue Coverage (CRC) insurance for wheat, including eligibility, terms, conditions, and coverage changes for the 1999 crop year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign crop revenue coverage insurance

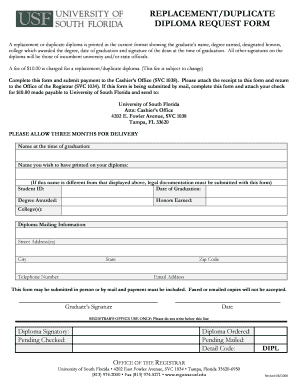

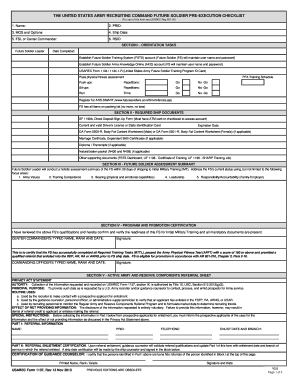

Edit your crop revenue coverage insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your crop revenue coverage insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit crop revenue coverage insurance online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit crop revenue coverage insurance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out crop revenue coverage insurance

How to fill out Crop Revenue Coverage Insurance Policy

01

Gather required information: Prepare farm details, including location, crop types, and production history.

02

Choose coverage level: Decide on the percentage of revenue to be covered, typically ranging from 70% to 90%.

03

Complete the application: Fill out the Crop Revenue Coverage Insurance application form with accurate information.

04

Provide financial records: Attach relevant financial documents, such as tax records and previous crop yields.

05

Review policy options: Look through available insurers and their policy options to select the best fit.

06

Submit the application: Send the completed application to the chosen insurance provider before the deadline.

07

Confirm coverage details: Once approved, verify the coverage limits and terms specified in the policy.

Who needs Crop Revenue Coverage Insurance Policy?

01

Farmers who are concerned about potential crop losses due to market fluctuations.

02

Agricultural producers looking to stabilize income and manage risks associated with crop production.

03

Farmers cultivating high-value crops that are more susceptible to price volatility.

04

Producers who want to protect their investment in crop production and ensure financial security.

Fill

form

: Try Risk Free

People Also Ask about

How much is crop insurance premium?

Historical Crop Insurance Prices CornWinter Wheat 2021 $4.58 $6.21 2022 $5.90 $10.88 2023 $5.91 $8.20 2024 $4.66 $6.2724 more rows

What is the average cost of insurance premium?

The Average Cost of Car Insurance in Your State StateAverage Annual Car Insurance Rate California $1,782 Colorado $1,663 Connecticut $1,567 Delaware $2,23121 more rows

What is the average cost of farm insurance?

What Does Farm Insurance Cost. This will depend on the type of policy needed, and the size of the risk. A Small Farm package could cost about $1500 a year, while a large Dairy Operation could cost $30,000 a year. The cost will be based on the type of farm exposure.

What is the 20 20 rule for crop insurance?

20/20 rule: Acreage must be at least 20 acres or 20 percent of the insured crop acreage for the unit to be paid on a per-unit basis. The ground was planted in at least one of the four most recent crop years.

What is crop revenue insurance?

Revenue Protection insurance guarantees a certain level of revenue rather than just production. It protects you from declines in both crop prices and yields. The guarantee is based on market prices and the actual yield on your farm.

What is covered by crop insurance?

Federal Crop Insurance Program (FCIP) participation The USDA, Risk Management Agency (RMA) oversees FCIP and offers agricultural producers financial protection against losses due to adverse events including drought, excess moisture, damaging freezes, hail, wind, disease, and price fluctuations.

What is the average premium for crop insurance?

Historical Crop Insurance Prices CornWinter Wheat 2021 $4.58 $6.21 2022 $5.90 $10.88 2023 $5.91 $8.20 2024 $4.66 $6.2724 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Crop Revenue Coverage Insurance Policy?

Crop Revenue Coverage Insurance Policy is a type of crop insurance that provides financial protection to farmers by covering a portion of the revenue lost due to reduced crop yields or lower market prices.

Who is required to file Crop Revenue Coverage Insurance Policy?

Farmers who wish to protect their crop revenues against potential losses are required to file for the Crop Revenue Coverage Insurance Policy. It is typically recommended for those who grow insurable crops.

How to fill out Crop Revenue Coverage Insurance Policy?

To fill out the Crop Revenue Coverage Insurance Policy, farmers need to complete an application form provided by their insurance provider, detailing information about their crops, expected yields, and their revenue history.

What is the purpose of Crop Revenue Coverage Insurance Policy?

The purpose of the Crop Revenue Coverage Insurance Policy is to help farmers safeguard their income from low yields and falling market prices, ensuring financial stability even in adverse conditions.

What information must be reported on Crop Revenue Coverage Insurance Policy?

Information that must be reported on the Crop Revenue Coverage Insurance Policy includes details about the crops being insured, planted acreage, production history, and any other relevant financial data related to crop revenues.

Fill out your crop revenue coverage insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Crop Revenue Coverage Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.