Get the free Automated Export System Mandatory Filing for Items on the Commerce Control List and ...

Show details

This document details amendments to the Foreign Trade Statistics Regulations to mandate the electronic filing of export information via the Automated Export System for specific items on the Commerce

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automated export system mandatory

Edit your automated export system mandatory form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automated export system mandatory form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit automated export system mandatory online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit automated export system mandatory. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

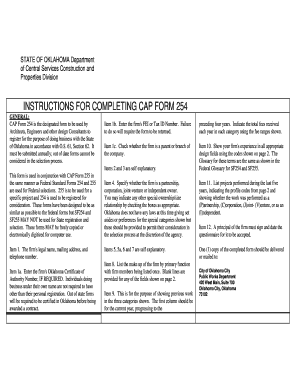

How to fill out automated export system mandatory

How to fill out Automated Export System Mandatory Filing for Items on the Commerce Control List and the United States Munitions List

01

Determine if your item is on the Commerce Control List or the United States Munitions List.

02

Gather all necessary documentation related to the export, including invoices, licenses, and shipping details.

03

Create a profile in the Automated Export System (AES) if you do not already have one.

04

Access the AES and select the appropriate option for filing your export shipment.

05

Fill out the required data fields, including exporter information, consignee details, and item description.

06

Enter export control classification number (ECCN) for items on the Commerce Control List.

07

For items on the United States Munitions List, ensure that you provide the proper license information.

08

Review the completed AES submission for accuracy and completeness.

09

Submit the filing to AES and receive the confirmation number.

10

Retain the confirmation number and any related documents for your records.

Who needs Automated Export System Mandatory Filing for Items on the Commerce Control List and the United States Munitions List?

01

All exporters who are shipping items categorized under the Commerce Control List and United States Munitions List must file through the Automated Export System.

Fill

form

: Try Risk Free

People Also Ask about

What items are on the commerce control list?

Commerce Control List (CCL) Category 0 - Nuclear Materials Facilities & Equipment [and Miscellaneous Items] Category 1 - Special Materials and Related Equipment, Chemicals, “Microorganisms,” and “Toxins” Category 2 - Materials Processing. Category 3 - Electronics. Category 4 - Computers.

Are EAR99 items on the Commerce Control List?

They fall under U.S. Department of Commerce jurisdiction and are not listed on the Commerce Control List (CCL). EAR99 items generally consist of low-technology consumer goods and do not require a license in most situations.

What is the commerce control list (CCL) and why does it exist?

The Commerce Control List (CCL) is a list of categories and product groups used to help you determine whether an export license is needed from the U.S. Department of Commerce for U.S. exports.

How many categories are in the Commerce Control List (CCL) structure?

The CCL is divided into ten categories, represented by the first digit of the ECCN. Each of the ten categories is divided into five product groups, represented by the second digit of the ECCN.

What can be found on the Commerce Control List?

Commerce Control List (CCL) Category 0 - Nuclear Materials Facilities & Equipment [and Miscellaneous Items] Category 1 - Special Materials and Related Equipment, Chemicals, “Microorganisms,” and “Toxins” Category 2 - Materials Processing. Category 3 - Electronics. Category 4 - Computers.

What is an AES filing for exporters?

The Automated Export System (AES) is the export component of the Automated Commercial Environment (ACE). It is the system for collecting, processing, and storing Electronic Export Information (EEI) from persons or entities exporting goods from the United States, Puerto Rico, or the U.S. Islands.

What is ECCN ing to the US Commerce Control List?

ECCNs are five character alpha-numeric designations used on the Commerce Control List (CCL) to identify dual-use items for export control purposes. An ECCN categorizes items based on the nature of the product, i.e. type of commodity, software, or technology and its respective technical parameters.

Which type of items are assigned an ECCN?

ECCNs are five character alpha-numeric designations used on the Commerce Control List (CCL) to identify dual-use items for export control purposes. An ECCN categorizes items based on the nature of the product, i.e. type of commodity, software, or technology and its respective technical parameters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Automated Export System Mandatory Filing for Items on the Commerce Control List and the United States Munitions List?

The Automated Export System (AES) Mandatory Filing for Items on the Commerce Control List (CCL) and the United States Munitions List (USML) is a requirement for exporters to electronically file export information related to certain controlled items. This process is essential for compliance with U.S. export regulations, ensuring that the export of sensitive materials is monitored and regulated.

Who is required to file Automated Export System Mandatory Filing for Items on the Commerce Control List and the United States Munitions List?

Exporters of items classified under the Commerce Control List (CCL) and the United States Munitions List (USML) are required to file the AES. This includes manufacturers, suppliers, and other entities involved in the export process of these controlled items.

How to fill out Automated Export System Mandatory Filing for Items on the Commerce Control List and the United States Munitions List?

To fill out the AES, exporters must gather required information, including the exporter’s and consignee’s details, descriptions of the items, shipping information, and any applicable licensing numbers. They must access the AESDirect system or a certified AES software to submit the electronic filing, ensuring all information is accurate and complete.

What is the purpose of Automated Export System Mandatory Filing for Items on the Commerce Control List and the United States Munitions List?

The primary purpose of the AES Mandatory Filing is to facilitate the tracking of exports of controlled items, ensure compliance with U.S. export laws, and provide data for statistical purposes. This helps prevent illegal exportation of sensitive technologies and military items, thereby enhancing national security.

What information must be reported on Automated Export System Mandatory Filing for Items on the Commerce Control List and the United States Munitions List?

Exporters must report details such as the exporter's name and address, consignee information, item description, quantity, value, and shipping details, including the mode of transport and export control classification number (ECCN) if applicable. This information helps authorities track and manage controlled exports effectively.

Fill out your automated export system mandatory online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automated Export System Mandatory is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.