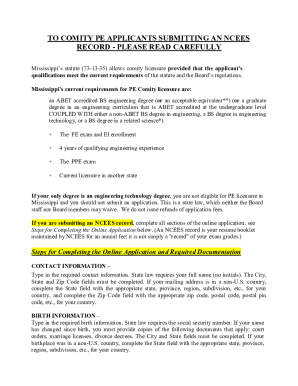

Get the free Final Rule Amending the Bank Secrecy Act Regulations - gpo

Show details

This document outlines the final rule by the Financial Crimes Enforcement Network (FinCEN) to amend the Bank Secrecy Act regulations regarding the reporting of foreign financial accounts, detailing

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign final rule amending form

Edit your final rule amending form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your final rule amending form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing final rule amending form online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit final rule amending form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out final rule amending form

How to fill out Final Rule Amending the Bank Secrecy Act Regulations

01

Gather necessary documentation, including identification and financial records.

02

Review the Final Rule Amending the Bank Secrecy Act Regulations thoroughly to understand requirements.

03

Complete the necessary forms as outlined in the regulations.

04

Ensure all information provided is accurate and complete to avoid delays.

05

Submit the completed forms to the appropriate regulatory agency as specified in the guidelines.

06

Keep copies of all submitted documents for your records.

07

Monitor for any feedback or requests for additional information from the regulatory agency.

Who needs Final Rule Amending the Bank Secrecy Act Regulations?

01

Financial institutions including banks, credit unions, and money services businesses.

02

Entities involved in certain types of financial transactions that trigger reporting requirements.

03

Compliance officers and legal advisors within the financial industry.

04

Businesses that handle large sums of cash or are at high risk for money laundering.

Fill

form

: Try Risk Free

People Also Ask about

How long must you keep a copy of a money order transaction report after selling $3,000 in money orders?

Federal law requires every person selling money orders, bill payment or prepaid transactions totaling between $3,000 and $10,000 (including fees) to make a record of the sale. The Money Order Transaction Report must be completed for recordkeeping requirements and a copy kept with your records for 5 years.

What is the BSA $3 000 rule?

for cash of $3,000-$10,000, inclusive, to the same customer in a day, it must keep a record. more to the same customer in a day, regardless of the method of payment, it must keep a record. a record. The Bank Secrecy Act (BSA) was enacted by Congress in 1970 to fight money laundering and other financial crimes.

What amended the Bank Secrecy Act?

BSA & Related Regulations The BSA was amended to incorporate the provisions of the USA PATRIOT Act which requires every bank to adopt a customer identification program as part of its BSA compliance program.

What is the final rule of FinCEN RIA?

The Financial Crimes Enforcement Network (FinCEN) recently introduced the “Final Rule,” adding new compliance requirements for RIAs. Now classified as “financial institutions” under the Bank Secrecy Act (BSA), RIAs must implement Anti-Money Laundering (AML) programs.

What is the $3000 rule for BSA?

for cash of $3,000-$10,000, inclusive, to the same customer in a day, it must keep a record. more to the same customer in a day, regardless of the method of payment, it must keep a record. a record. The Bank Secrecy Act (BSA) was enacted by Congress in 1970 to fight money laundering and other financial crimes.

What is the CDD final rule?

CDD Final Rule requires financial institutions to identify and verify the identity of the beneficial owners of their clients. Beneficial owners are individuals who ultimately own or control a legal entity or arrangement, such as a company or trust.

What regulations and rules did the Bank Secrecy Act implement?

Specifically, the regulations implementing the BSA require financial institutions to, among other things, keep records of cash purchases of negotiable instruments, file reports of cash transactions exceeding $10,000 (daily aggregate amount), and to report suspicious activity that might signify money laundering, tax

What is the final rule of AML?

Specifically, the Final Rule does the following: Requires certain registered investment advisers (RIAs) and exempt reporting advisers (ERAs) to establish AML/CFT programs and prescribes minimum standards for such programs. Requires those RIAs and ERAs to report suspicious activity to FinCEN.

What is required before processing any monetary transaction for $3,000 or more?

The requirement that financial institutions verify and record the identity of each cash purchaser of money orders and bank, cashier's, and traveler's checks in excess of $3,000.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Final Rule Amending the Bank Secrecy Act Regulations?

The Final Rule Amending the Bank Secrecy Act Regulations refers to amendments made to the existing regulations under the Bank Secrecy Act (BSA) that enhance the framework for financial institutions to detect and report suspicious activity, facilitating compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) efforts.

Who is required to file Final Rule Amending the Bank Secrecy Act Regulations?

Financial institutions including banks, credit unions, broker-dealers, mutual funds, and other entities defined as financial institutions under the BSA are required to file reports as mandated by the Final Rule.

How to fill out Final Rule Amending the Bank Secrecy Act Regulations?

To fill out the required forms under the Final Rule, institutions must follow the detailed instructions provided by the Financial Crimes Enforcement Network (FinCEN), ensuring that all necessary information is accurately reported, and incorporating any amendments or specific guidance associated with the final rule.

What is the purpose of Final Rule Amending the Bank Secrecy Act Regulations?

The purpose of the Final Rule is to improve the effectiveness of the BSA regulatory framework by imposing additional reporting requirements on certain transactions that pose a higher risk for money laundering and terrorism financing, thereby strengthening national security and financial system integrity.

What information must be reported on Final Rule Amending the Bank Secrecy Act Regulations?

The information that must be reported includes details about transactions that meet specific thresholds for suspicious activity, including the amounts, dates, parties involved, and the nature of the activity that triggered the filing requirement.

Fill out your final rule amending form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Final Rule Amending Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.