Get the free Incentive-Based Compensation Arrangements Proposed Rule - gpo

Show details

This document proposes rules to implement section 956 of the Dodd-Frank Act, focusing on incentive-based compensation arrangements in covered financial institutions to prevent excessive compensation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign incentive-based compensation arrangements proposed

Edit your incentive-based compensation arrangements proposed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your incentive-based compensation arrangements proposed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit incentive-based compensation arrangements proposed online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit incentive-based compensation arrangements proposed. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out incentive-based compensation arrangements proposed

How to fill out Incentive-Based Compensation Arrangements Proposed Rule

01

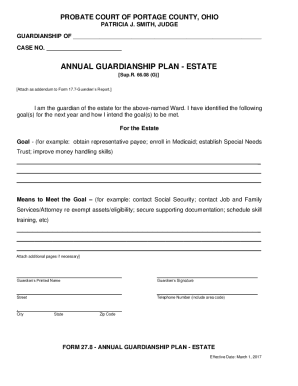

Review the full text of the Incentive-Based Compensation Arrangements Proposed Rule.

02

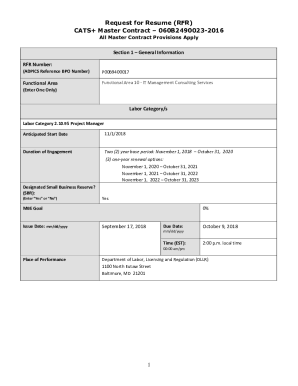

Identify the specific information required for disclosure in each section of the proposed rule.

03

Gather relevant data concerning the incentive-based compensation arrangements within your organization.

04

Complete the required forms with accurate and up-to-date information as per the rule’s guidelines.

05

Ensure that all necessary signatures and approvals are obtained prior to submission.

06

Submit the completed forms by the designated deadline to the appropriate regulatory body.

Who needs Incentive-Based Compensation Arrangements Proposed Rule?

01

Financial institutions that offer incentive-based compensation to their employees.

02

Regulatory bodies monitoring compliance with compensation structures.

03

Stakeholders interested in understanding the compensation practices of financial entities.

Fill

form

: Try Risk Free

People Also Ask about

What are the Dodd Frank compensation rules?

Under Dodd-Frank, the SEC is required to promulgate a rule requiring public companies to disclose the relationship between executive compensation actually paid versus the financial performance of the company, as measured by share price appreciation, dividends and distributions.

What is the Section 956 rule?

Specifically, section 956 of Dodd–Frank requires that the agencies prohibit any type of incentive-based compensation arrangements, or any feature of any such arrangements, that the agencies determine encourage inappropriate risks by a covered financial institution (1) by providing an executive officer, employee,

What is the rule 956?

Specifically, section 956 of Dodd–Frank requires that the agencies prohibit any type of incentive-based compensation arrangements, or any feature of any such arrangements, that the agencies determine encourage inappropriate risks by a covered financial institution (1) by providing an executive officer, employee,

What is an incentive compensation arrangement?

Incentive compensation is a form of payment that rewards employees – often sales employees specifically – for achieving certain goals or objectives. It is often tied to individual or company performance and serves the purpose of motivating employees to work as effectively as possible and achieve better results.

What is the IRC 956 regulation?

IRC section 956 prevents taxpayer workarounds on earnings repatriations from controlled foreign corporations (CFCs) that are similar to dividends and would have been subject to tax except that they were done through an investment of earnings in U.S. property.

What is the proposed incentive-based compensation rule?

The proposed rule includes prohibitions intended to make incentive-based compensation arrangements more sensitive to risk. These include a prohibition on incentive-based compensation arrangements that do not include risk adjustment of awards, deferral of payments, and forfeiture and clawback provisions.

What is an example of incentive-based compensation?

A good example of a monetary incentive is a sales-based incentive. Sales-based incentive compensation is ideal for employees who are responsible for talking to customers and closing sales. Employers often structure these incentive plans as a percentage, like 5% of all the deals each sales rep closes.

What is the proposed incentive-based compensation rule?

The proposed rule includes prohibitions intended to make incentive-based compensation arrangements more sensitive to risk. These include a prohibition on incentive-based compensation arrangements that do not include risk adjustment of awards, deferral of payments, and forfeiture and clawback provisions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Incentive-Based Compensation Arrangements Proposed Rule?

The Incentive-Based Compensation Arrangements Proposed Rule is a regulation aimed at establishing standards for the design and implementation of incentive-based compensation practices in financial institutions, focusing on risk management and promoting sound decision-making.

Who is required to file Incentive-Based Compensation Arrangements Proposed Rule?

The filing requirement typically applies to financial institutions with assets exceeding a specified threshold, including banks, credit unions, and other lending entities that have significant incentive-based compensation arrangements for their employees.

How to fill out Incentive-Based Compensation Arrangements Proposed Rule?

Filling out the Incentive-Based Compensation Arrangements Proposed Rule generally involves completing specific forms that require detailed information about the institution's compensation practices, structures, and policies, ensuring compliance with the proposed standards and regulations.

What is the purpose of Incentive-Based Compensation Arrangements Proposed Rule?

The purpose of the rule is to mitigate risks associated with excessive risk-taking behavior by aligning compensation structures with the long-term interests of the institution and its stakeholders, thereby promoting financial stability.

What information must be reported on Incentive-Based Compensation Arrangements Proposed Rule?

Key information that must be reported includes the criteria used for determining compensation, performance metrics, risk adjustments, and any potential conflicts of interest related to incentive-based compensation arrangements.

Fill out your incentive-based compensation arrangements proposed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Incentive-Based Compensation Arrangements Proposed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.