Get the free Home Affordable Modification Program Records - gpo

Show details

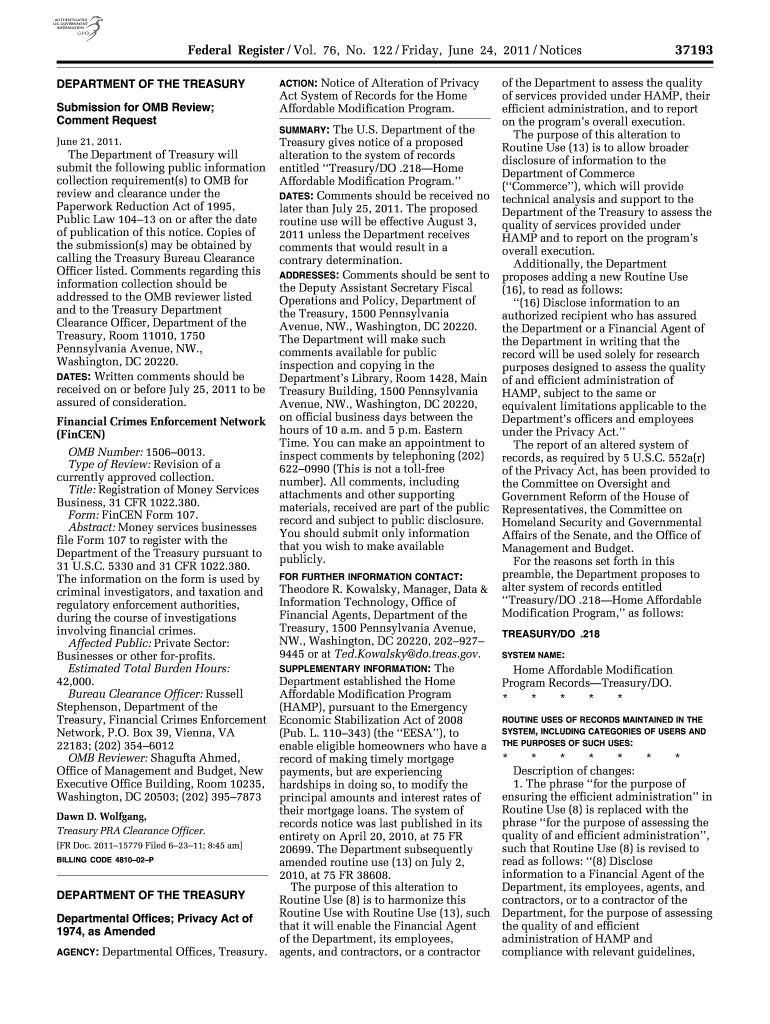

This document provides notice about the alteration of a system of records related to the Home Affordable Modification Program (HAMP) by the Department of the Treasury, including details about the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home affordable modification program

Edit your home affordable modification program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home affordable modification program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit home affordable modification program online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit home affordable modification program. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home affordable modification program

How to fill out Home Affordable Modification Program Records

01

Gather your financial documents including income statements, tax returns, and monthly expenses.

02

Obtain the Home Affordable Modification Program (HAMP) application form.

03

Fill out the form with your personal information, including loan details and property address.

04

Provide information about your financial situation, including income sources and total monthly debts.

05

Attach supporting documentation such as pay stubs, bank statements, and any other required forms.

06

Review the completed application for accuracy and completeness.

07

Submit the application to your loan servicer via the method they specify (online, mail, etc.).

08

Keep a copy of the submitted application and all related documents for your records.

Who needs Home Affordable Modification Program Records?

01

Homeowners who are struggling to make their mortgage payments due to financial hardships.

02

Individuals seeking to lower their monthly mortgage payments or stabilize their financial situation.

03

Borrowers whose loans are eligible for HAMP, especially those facing foreclosure.

Fill

form

: Try Risk Free

People Also Ask about

What is the Home Affordable Modification Program?

HAMP works by encouraging participating mortgage servicers to modify mortgages so struggling homeowners can have lower monthly payments and avoid foreclosure. It has specific eligibility requirements for homeowners and includes strict guidelines for servicers.

What are the disadvantages of a loan modification?

Cons of Loan Modification Greater total cost: Adding months or years to a loan repayment term can increase the amount of interest you'll pay over the life of the loan.

What happens after a loan modification is approved?

For many struggling homeowners, a mortgage loan modification can be a smart financial decision. By changing the monthly payments you make, along with other terms, a modification can help you keep from defaulting on your mortgage.

How much can a loan modification save me?

Conventional loan modification: If you have a conventional mortgage backed by Fannie Mae or Freddie Mac, you might be eligible for the Flex Modification program, which can reduce your monthly payments by up to 20 percent, extend the loan term up to 40 years and potentially lower the interest rate.

Does Hamp still exist?

The Home Affordable Modification Program (HAMP), created in 2009 by the federal government, helped struggling homeowners stay afloat by modifying their original mortgage loan terms. The HAMP program ended in 2016, but other loss mitigation and mortgage modification options have cropped up.

How much will a loan modification reduce my payment?

Conventional loan modification: If you have a conventional mortgage backed by Fannie Mae or Freddie Mac, you might be eligible for the Flex Modification program, which can reduce your monthly payments by up to 20 percent, extend the loan term up to 40 years and potentially lower the interest rate.

What is the history of the home affordable modification program?

The Home Affordable Modification Program (HAMP) was a federal program introduced in 2009 to help struggling homeowners avoid foreclosure. The HAMP allowed homeowners to reduce their mortgage principal and/or interest rates, temporarily postpone payments, or get loan extensions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Home Affordable Modification Program Records?

The Home Affordable Modification Program (HAMP) Records refer to documentation related to the federal program aimed at helping homeowners avoid foreclosure by modifying their mortgage loans to make them more affordable.

Who is required to file Home Affordable Modification Program Records?

Lenders and servicers who participate in the HAMP program are required to file Home Affordable Modification Program Records.

How to fill out Home Affordable Modification Program Records?

To fill out HAMP Records, lenders must provide detailed information about the mortgage modifications, including borrower information, loan details, and the terms of the modifications made.

What is the purpose of Home Affordable Modification Program Records?

The purpose of HAMP Records is to track the effectiveness of the program, ensure compliance with federal guidelines, and provide transparency about the mortgage modifications being provided.

What information must be reported on Home Affordable Modification Program Records?

Information that must be reported includes borrower identification, property information, loan amounts, modification terms, and payment history.

Fill out your home affordable modification program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Affordable Modification Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.