Get the free Proposed Rules on Tax Return Preparer Penalties and Wine Labeling Regulations - gpo

Show details

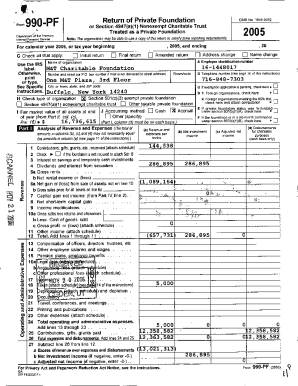

This document cancels a public hearing previously scheduled regarding proposed rulemaking on tax return preparer penalties and discusses amendments to wine labeling regulations, specifically vintage

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign proposed rules on tax

Edit your proposed rules on tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your proposed rules on tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit proposed rules on tax online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit proposed rules on tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out proposed rules on tax

How to fill out Proposed Rules on Tax Return Preparer Penalties and Wine Labeling Regulations

01

Obtain the Proposed Rules document from the IRS or relevant regulatory authority.

02

Read the introduction and purpose section to understand the intent behind the rules.

03

Identify the specific sections applicable to tax return preparer penalties and wine labeling regulations.

04

Follow the instructions on each section carefully, filling in required details as specified.

05

Provide accurate information about your tax preparation business or wine product as required.

06

Review all entries to ensure compliance with the outlined guidelines.

07

Submit the completed form through the designated submission channel, whether electronically or via mail.

Who needs Proposed Rules on Tax Return Preparer Penalties and Wine Labeling Regulations?

01

Tax return preparers who are subject to penalties under the new regulations.

02

Wine producers and distributors who need to comply with wine labeling standards.

03

Businesses involved in tax preparation services.

04

Legal or compliance professionals seeking to understand the implications of the regulations.

05

Consumers wanting transparency about wine labeling and tax preparation practices.

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum penalty a tax preparer may be subject to?

Failure to file correct information returns – IRC § 6695(e): Penalty is $50 for each failure of a tax preparer to include correct information on tax returns (maximum penalty cannot be greater than $27,000 in calendar year 2022).

What are the penalties for taxes?

If you don't pay the amount shown as tax you owe on your return, we calculate the failure to pay penalty in this way: The failure to pay penalty is 0.5% of the unpaid taxes for each month or part of a month the tax remains unpaid. The penalty won't exceed 25% of your unpaid taxes.

Which situations would likely create an IRC 6694 penalty for a tax return preparer?

IRC section 6694 imposes a penalty on a paid preparer who takes an unreasonable position, or who engages in willful or reckless conduct, resulting in an understatement of a taxpayer's liability.

Which if any of the following could result in penalties against an income tax return preparer?

Tax preparer will be liable for penalties arising from an understatement due to willful or reckless conduct.

In which of the following situations will a tax preparer likely incur a penalty?

If you prepare a return that understates the taxpayer's liability, you may face a penalty if the following apply: Unreasonable position – The greater of $1,000 or 50% of the income you received to prepare the return. Willful or reckless conduct – The greater of $5,000 or 75%.

What is the due diligence penalty for tax preparers?

IRC 6695 – Due Diligence Penalties The due diligence penalty is $545 (in 2022) for each failure on a tax return. These penalties are imposed for failure to comply with the due diligence requirements. The due diligence requirements are documented on Form 8867, Paid Preparer's Due Diligence Checklist.

What is the maximum penalty a tax preparer may be subject to?

Failure to file correct information returns – IRC § 6695(e): Penalty is $50 for each failure of a tax preparer to include correct information on tax returns (maximum penalty cannot be greater than $27,000 in calendar year 2022).

What are the penalties for violating Circular 230?

What sanctions are authorized by Circular 230 and to whom do they apply? (updated March 5, 2025) Circular 230 sanctions are a censure (essentially a public reprimand), suspension from practice before the IRS, disbarment from practice before the IRS, monetary penalties, and “disqualification” as an appraiser.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Proposed Rules on Tax Return Preparer Penalties and Wine Labeling Regulations?

The Proposed Rules on Tax Return Preparer Penalties outline potential penalties for tax preparers who fail to comply with certain tax regulations. The Wine Labeling Regulations pertain to the labeling requirements for wine products to ensure consumers receive accurate information about the contents.

Who is required to file Proposed Rules on Tax Return Preparer Penalties and Wine Labeling Regulations?

Tax return preparers who provide services for compensation are required to comply with the proposed rules regarding penalties. Additionally, producers and distributors of wine are required to adhere to the labeling regulations.

How to fill out Proposed Rules on Tax Return Preparer Penalties and Wine Labeling Regulations?

Filing out the proposed rules involves completing specific forms related to tax preparation or wine labeling, which typically require detailed information about the preparer's qualifications or the wine product's details. Guidelines provided in the proposal should be followed strictly.

What is the purpose of Proposed Rules on Tax Return Preparer Penalties and Wine Labeling Regulations?

The purpose of these proposed rules is to enhance compliance among tax preparers and provide clear labeling requirements for wine products, thereby protecting consumers and ensuring fairness in regulatory practices.

What information must be reported on Proposed Rules on Tax Return Preparer Penalties and Wine Labeling Regulations?

The report must include information such as the preparer's registration details, compliance history, specific labeling components such as alcohol content, origin, and any health warnings required by law.

Fill out your proposed rules on tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Proposed Rules On Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.