Get the free Request for Prompt Assessment Under Internal Revenue Code Section 6501(d) - gpo

Show details

This document serves as a request form for fiduciaries representing a dissolving corporation or a decedent's estate to expedite the assessment of tax under IRS regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for prompt assessment

Edit your request for prompt assessment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for prompt assessment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing request for prompt assessment online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit request for prompt assessment. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out request for prompt assessment

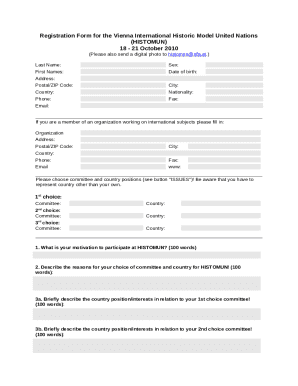

How to fill out Request for Prompt Assessment Under Internal Revenue Code Section 6501(d)

01

Obtain the Request for Prompt Assessment Under Internal Revenue Code Section 6501(d) form from the IRS website.

02

Fill out the taxpayer's name, address, and identification number at the top of the form.

03

Indicate the tax year(s) for which the request is being made.

04

Provide details regarding the specific issues prompting the request and why there is a need for prompt assessment.

05

Review any instructions provided by the IRS related to the form to ensure all requirements are met.

06

Sign and date the form to certify that the information is correct.

07

Submit the completed form to the relevant IRS address, ensuring to keep a copy for your records.

Who needs Request for Prompt Assessment Under Internal Revenue Code Section 6501(d)?

01

Individuals or businesses seeking a faster assessment of tax liability due to unique circumstances such as ongoing audits or pending tax issues.

02

Taxpayers who believe that waiting for the standard assessment process could adversely affect their financial situation.

Fill

form

: Try Risk Free

People Also Ask about

How long does IRS have to respond to form 4810 online?

Wait for IRS Response: The IRS will review the form, conduct any necessary audits or assessments, and notify you if additional taxes are owed. If no additional tax is assessed within 18 months, the matter is effectively closed.

How do I request a tax transcript for a deceased person?

Tax transcript If you request a transcript online, it will be mailed to the deceased person's address of record. To have the transcript mailed to you, submit Form 4506-T, Request for Transcript of Tax Return. See Form 4506-T for instructions on where to send your request.

What is form 211 Internal Revenue Service?

Submit a whistleblower claim Individuals must use IRS Form 211, Application for Award for Original Information PDF, and ensure that it contains the following: A description of the alleged tax noncompliance, including a written narrative explaining the issue(s).

What is the examination of your tax returns by the Internal Revenue Service?

An IRS audit is a review/examination of an organization's or individual's books, accounts and financial records to ensure information reported on their tax return is reported correctly ing to the tax laws and to verify the reported amount of tax is correct. Why am I being selected for an audit? How am I notified?

What is form 4810 request for prompt assessment under Internal Revenue Code 6501 D?

By filing Form 4810, the taxpayer is formally requesting the IRS to expedite the assessment of their tax liability. The IRS will review the request and, if approved, will assess the taxpayer's taxes promptly.

What is a request for prompt assessment?

What Is A Request For Prompt Assessment? A request for prompt assessment shortens the time frame within which the IRS can audit and assess taxes related to a particular tax return, particularly for decedents' final returns, estate income tax returns, or fiduciary returns.

What is the IRS audit adjustment form?

Each reviewed year should have a separate Form 8986. This form must be completed for reviewed years that have adjustments related to an audit or an AAR.

What is code section 6501 D?

(D) “Professional fiduciary” also includes a person acting as a professional fiduciary practice administrator, appointed pursuant to Section 2469 or 9765 of the Probate Code. (3) For purposes of this subdivision, “related” means related by blood, adoption, marriage, or registered domestic partnership.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Request for Prompt Assessment Under Internal Revenue Code Section 6501(d)?

A Request for Prompt Assessment Under Internal Revenue Code Section 6501(d) is a formal request made by a taxpayer to the IRS to expedite the assessment of their tax return. This request allows the IRS to assess additional taxes or refunds more quickly, typically in situations where a taxpayer anticipates a substantial change in their tax liability.

Who is required to file Request for Prompt Assessment Under Internal Revenue Code Section 6501(d)?

Any taxpayer who wishes to expedite the assessment process for additional taxes or refunds under specific conditions can file a Request for Prompt Assessment under Section 6501(d). This is often utilized by individuals or businesses with complex tax situations or pending claims.

How to fill out Request for Prompt Assessment Under Internal Revenue Code Section 6501(d)?

To fill out a Request for Prompt Assessment, taxpayers must complete the appropriate IRS form, typically Form 1040 or other relevant forms, ensuring that they indicate the request for prompt assessment clearly. It is important to provide all necessary documentation and details related to the tax period in question.

What is the purpose of Request for Prompt Assessment Under Internal Revenue Code Section 6501(d)?

The purpose of the Request for Prompt Assessment is to allow taxpayers to receive a faster resolution of their tax liabilities, avoiding delays in processing. This can be beneficial for taxpayers facing substantial changes in their tax situations, allowing for quicker certainty on their tax obligations.

What information must be reported on Request for Prompt Assessment Under Internal Revenue Code Section 6501(d)?

The information required on a Request for Prompt Assessment includes details about the taxpayer, the tax period in question, the reasons for the request, and any relevant financial information that may impact the assessment. Accurate and comprehensive information will help facilitate a faster review.

Fill out your request for prompt assessment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Prompt Assessment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.