Get the free Proposed Collection; Comment Request for Form 8900 - gpo

Show details

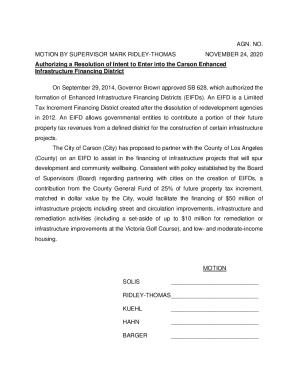

This document is a notice from the IRS inviting comments on the proposed Form 8900, which is used for calculating the Qualified Railroad Track Maintenance Credit under section 45G. It details the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign proposed collection comment request

Edit your proposed collection comment request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your proposed collection comment request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit proposed collection comment request online

In order to make advantage of the professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit proposed collection comment request. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

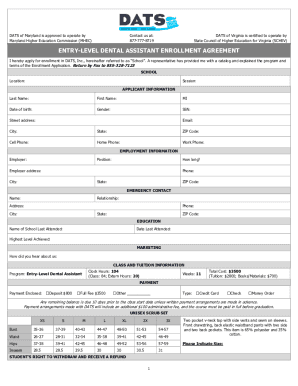

How to fill out proposed collection comment request

How to fill out Proposed Collection; Comment Request for Form 8900

01

Start by downloading the Proposed Collection; Comment Request for Form 8900 from the IRS website.

02

Read the general instructions provided at the beginning of the document carefully.

03

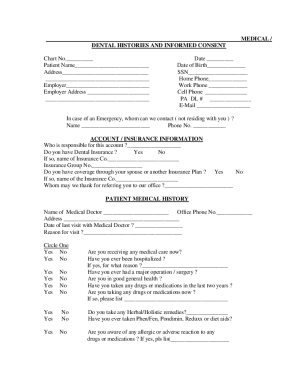

Fill out the basic identification information, including your name, address, and contact information.

04

Specify the purpose of the collection, detailing how the information will be used.

05

Include relevant statutory or regulatory citations that authorize the data collection.

06

Provide an estimation of the burden hours for respondents, including a breakdown of how this estimation was reached.

07

Ensure all applicable sections are completed, including any necessary attachments or supporting documents.

08

Review the form for accuracy and completeness before submission.

09

Submit the completed form using the specified submission guidelines provided in the instructions.

Who needs Proposed Collection; Comment Request for Form 8900?

01

Businesses or organizations that are required to provide information to the IRS.

02

Tax professionals who may assist clients in filling out related forms.

03

Entities involved in affairs covered under Form 8900 regulations, specifically concerning information collection.

04

Researchers or analysts needing the data outlined in Form 8900 for analysis or reporting purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS form for HSA distributions?

Distributions from a health savings account (HSA), Archer medical savings account (MSA), or Medicare Advantage (MA) MSA are reported to you on Form 1099-SA. File Form 8853 or Form 8889 with your Form 1040 or 1040-SR to report a distribution from these accounts even if the distribution isn't taxable.

Who files form 8828?

Form 8828 should be filed only if ALL the following apply: The taxpayer has a mortgage loan that was originally provided after December 1, 1990. The taxpayer sold or disposed of their home (resulting in a gain or not) The taxpayer received a federal mortgage subsidy.

What is the difference between a W2 and i9 tax form?

The difference between the W2 form and Form I-9 is that one is a tax form and the other is an eligibility verification form. There is no such thing as an I-9 tax form. Form I-9 is a form that verifies an employee's eligibility to work in the country legally.

What is form 5498?

The information on Form 5498 is submitted to the IRS by the trustee or issuer of your individual retirement arrangement (IRA) to report contributions, including any catch-up contributions, rollovers, repayments, required minimum distributions (RMDs), and the fair market value (FMV) of the account.

What is form 8900?

Eligible taxpayers file this form to claim the railroad track maintenance credit (RTMC) for qualified railroad track maintenance expenditures (QRTME) paid or incurred during the tax year. If you are an assignor with respect to miles of eligible railroad track, you must file Form 8900 even if you do not claim any RTMC.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Proposed Collection; Comment Request for Form 8900?

The Proposed Collection; Comment Request for Form 8900 is a request from the IRS for public comments regarding the information collections associated with Form 8900, which relates to the Renewable Electricity Production Credit.

Who is required to file Proposed Collection; Comment Request for Form 8900?

Taxpayers claiming the Renewable Electricity Production Credit are required to file Form 8900 and may need to address the comments put forth in the Proposed Collection.

How to fill out Proposed Collection; Comment Request for Form 8900?

To fill out the Proposed Collection; Comment Request for Form 8900, individuals or entities should provide their comments or suggestions regarding the form's purpose and the clarity of its instructions, as outlined in the IRS notice.

What is the purpose of Proposed Collection; Comment Request for Form 8900?

The purpose is to gather public feedback on the form's requirements and effectiveness in collecting necessary information to ensure compliance and proper tax administration regarding renewable energy production credits.

What information must be reported on Proposed Collection; Comment Request for Form 8900?

Information that must be reported includes the respondent's views on the necessity of the form, the clarity of the instructions, the potential burden of compliance, and any suggestions for improving the form.

Fill out your proposed collection comment request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Proposed Collection Comment Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.