Get the free Miscellaneous Tariff Bill Preliminary Disclosure Form - waysandmeans house

Show details

This document is a disclosure form accompanying a Miscellaneous Tariff Bill, detailing the availability of tariff relief and identifying entities affected by the bill.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign miscellaneous tariff bill preliminary

Edit your miscellaneous tariff bill preliminary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your miscellaneous tariff bill preliminary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing miscellaneous tariff bill preliminary online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit miscellaneous tariff bill preliminary. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

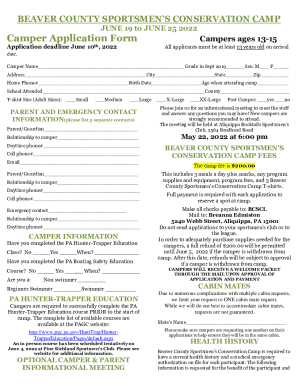

How to fill out miscellaneous tariff bill preliminary

How to fill out Miscellaneous Tariff Bill Preliminary Disclosure Form

01

Gather all required documentation related to the product.

02

Ensure you have the correct classification for the product under tariff codes.

03

Fill out the applicant's information section, including name, address, and contact details.

04

Provide details of the product for which the tariff bill is being sought, including description and intended use.

05

Include any relevant supporting documentation that justifies the request for a tariff reduction or waiver.

06

Review the form for completeness and accuracy to avoid delays in processing.

07

Sign and date the form to certify that all information provided is true and accurate.

Who needs Miscellaneous Tariff Bill Preliminary Disclosure Form?

01

Importers seeking tariff reductions on specific products.

02

Manufacturers requesting exemptions for raw materials or components.

03

Businesses looking to promote competitiveness by reducing import costs.

04

Companies involved in trade who are affected by current tariff rates.

Fill

form

: Try Risk Free

People Also Ask about

What is the MTB Reform Act?

The MTB Reform Act would: Approve duty-free treatment of products recommended under the 2019 application process created by the American Manufacturing Competitiveness Act through December 31, 2025, in order to support domestic manufacturers who participated in that process in a good faith manner.

What is the Trade Reform Act 1974?

The act provided the authority to reduce or eliminate trade barriers and to improve relationships with non-market Communist countries and countries with developing economies. Further, the act hoped to bring change to injurious and unfair competition laws.

What is the MTB tariff?

Miscellaneous Tariff Bills (MTBs) enact the temporary reduction or suspension of duties on certain U.S. imports or other technical corrections to the U.S. Harmonized Tariff System.

What is the miscellaneous tariff bill?

Miscellaneous Tariff Bills (MTBs) enact the temporary reduction or suspension of duties on certain U.S. imports or other technical corrections to the U.S. Harmonized Tariff System.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Miscellaneous Tariff Bill Preliminary Disclosure Form?

The Miscellaneous Tariff Bill Preliminary Disclosure Form is a document that must be submitted to provide information regarding tariff reductions for certain imported goods that do not have a domestic production equivalent.

Who is required to file Miscellaneous Tariff Bill Preliminary Disclosure Form?

Any individual or entity seeking to benefit from the tariff reductions under the Miscellaneous Tariff Bill must file the Preliminary Disclosure Form.

How to fill out Miscellaneous Tariff Bill Preliminary Disclosure Form?

To fill out the form, you need to provide accurate details about the imported goods, including descriptions, classification numbers, and the reasoning for requesting the tariff reduction.

What is the purpose of Miscellaneous Tariff Bill Preliminary Disclosure Form?

The purpose of the form is to ensure transparency and gather necessary information required for evaluating requests for tariff reductions under the Miscellaneous Tariff Bill.

What information must be reported on Miscellaneous Tariff Bill Preliminary Disclosure Form?

The form must report information such as the name of the importer, detailed descriptions of the goods, tariff classification numbers, uses of the goods, and any supporting documentation for the tariff reduction request.

Fill out your miscellaneous tariff bill preliminary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Miscellaneous Tariff Bill Preliminary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.