Get the free Application for Federal Housing Administration (FHA) Lender Approval - portal hud

Show details

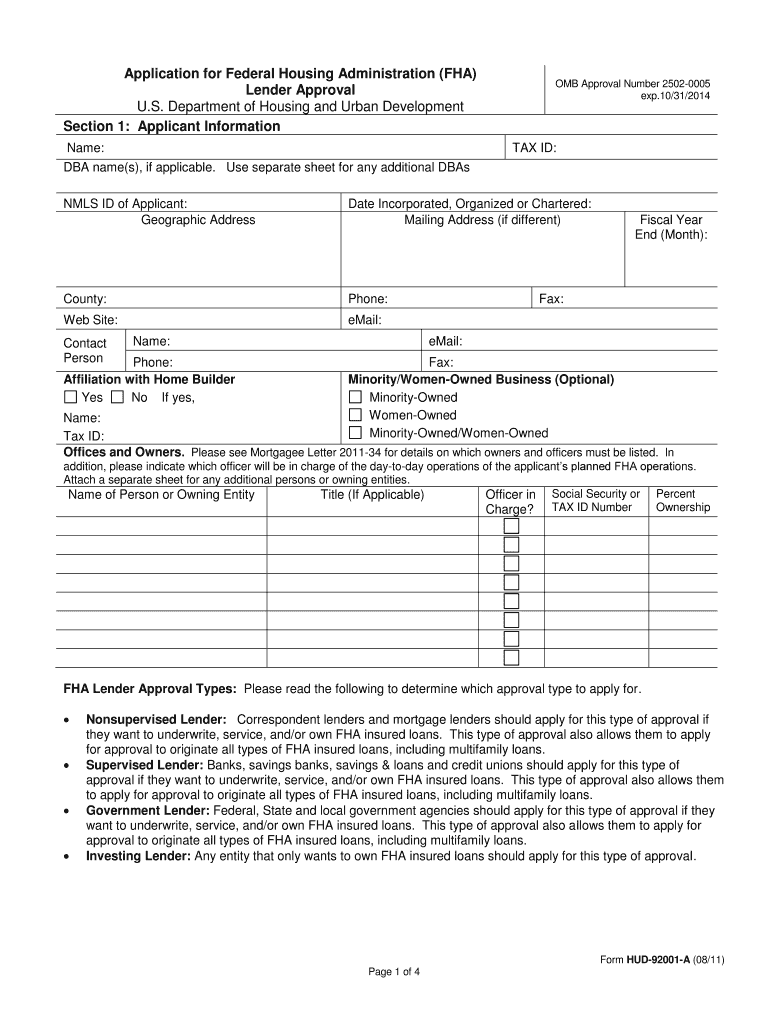

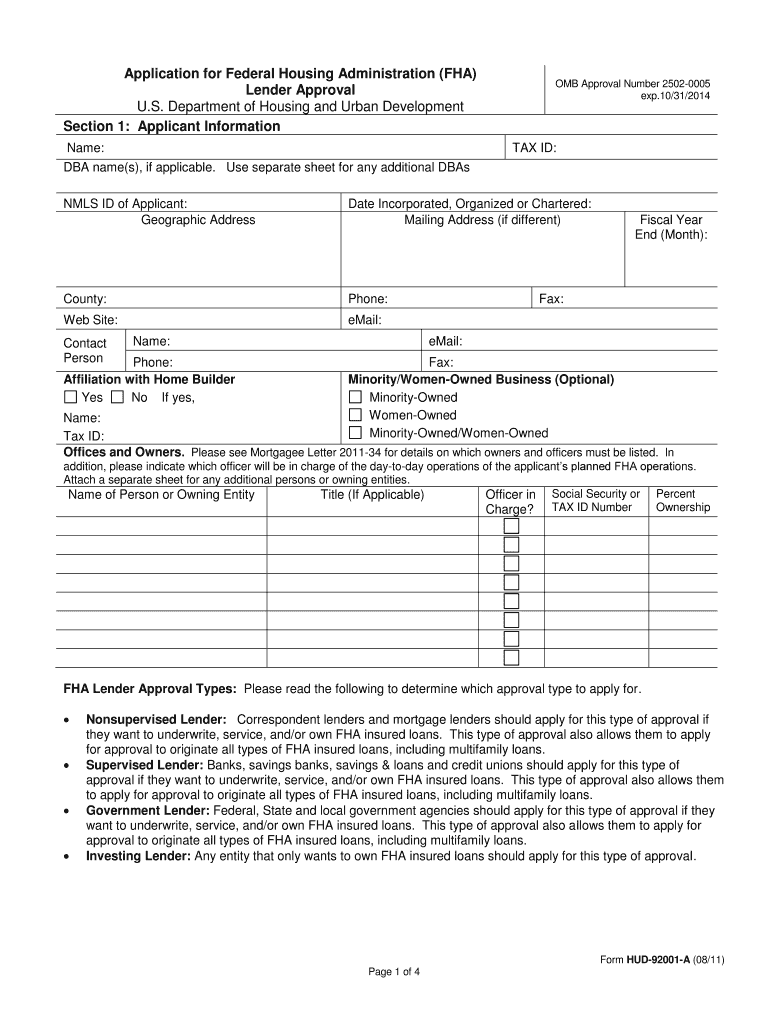

This document is used for lenders to apply for approval to underwrite, service, and/or own FHA insured loans.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for federal housing

Edit your application for federal housing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for federal housing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for federal housing online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application for federal housing. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for federal housing

How to fill out Application for Federal Housing Administration (FHA) Lender Approval

01

Obtain the Application for FHA Lender Approval form, which can be found on the HUD website.

02

Fill out the general information section, including the lender's legal name, address, and contact details.

03

Complete the organizational structure section, detailing the type of lender (e.g., bank, credit union) and ownership structure.

04

Provide financial statements and other supporting documents, including income statements and balance sheets for the last two years.

05

Fill out the management and key personnel information, including resumes or qualifications of senior management and board members.

06

Complete training and experience sections, detailing knowledge of FHA programs and compliance regulations.

07

Submit the application with the appropriate fees as outlined in the application instructions.

08

Check the application for completeness and accuracy before submitting it to the HUD for review.

09

Await approval or any requests for additional information from HUD.

Who needs Application for Federal Housing Administration (FHA) Lender Approval?

01

Mortgage lenders and financial institutions seeking to offer FHA-backed loans to borrowers.

02

Organizations looking to participate in the FHA insurance program to provide more accessible housing options.

Fill

form

: Try Risk Free

People Also Ask about

Does the Federal Housing Administration FHA still exist?

Since its establishment in 1934, the FHA and HUD have collectively provided insurance for nearly 50 million home mortgages. Presently, the FHA holds a portfolio that includes approximately 8.5 million insured single-family mortgages, as well as more than 11,000 insured multifamily mortgages.

What are red flags for an FHA loan?

A red flag is going to be any major defect or safety concern, such as a leaky roof, mold, or structural damage. Remember, FHA appraisers are looking for obvious hazards and structural issues that could impact the home's habitability or long-term value.

What makes a home ineligible for FHA?

Homes that may not pass an FHA inspection Certain characteristics of a property can cause it to be ineligible for an FHA loan, such as: Structural issues: FHA loans require that the property be structurally sound, so homes with significant structural problems may not pass inspection.

Why would you be denied an FHA loan?

Despite the lenient FHA loan requirements, being denied is possible. The three primary factors that can disqualify you from getting an FHA loan are a high debt-to-income ratio, poor credit, or lack of funds to cover the required down payment, monthly mortgage payments, or closing costs.

What disqualifies you for an FHA loan?

The three primary factors that can disqualify you from getting an FHA loan are a high debt-to-income ratio, poor credit, or lack of funds to cover the required down payment, monthly mortgage payments, or closing costs.

Where to fill out FHA loan application?

FHA lenders: Where can I apply for an FHA loan? The FHA doesn't offer loans directly, so in order to apply for an FHA loan you'll need to contact a private lender. Most lenders are FHA-approved, giving you a wide range of options: Local banks and credit unions.

What would cause a house to fail an FHA inspection?

Health and safety issues that can halt FHA approval FHA-approved appraisers are focused on ensuring that a home is safely habitable. They look for hazardous building materials and finishes that are known to cause health problems in humans. This can include lead paint and asbestos in older homes.

How to become an FHA-approved lender?

Lenders seeking FHA approval must submit an online application containing all information and documentation required to demonstrate eligibility for approval as provided in the Single Family Housing Policy Handbook 4000.1 (Handbook 4000.1).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Federal Housing Administration (FHA) Lender Approval?

The Application for Federal Housing Administration (FHA) Lender Approval is a formal request submitted by lenders seeking to become approved to offer FHA-insured loans. This process ensures that lenders meet the FHA's standards for financial stability, lending practices, and compliance with regulations.

Who is required to file Application for Federal Housing Administration (FHA) Lender Approval?

Any lender or financial institution that wishes to offer FHA-insured mortgage loans is required to file the Application for Federal Housing Administration (FHA) Lender Approval. This includes banks, savings and loans, credit unions, and mortgage companies.

How to fill out Application for Federal Housing Administration (FHA) Lender Approval?

To fill out the Application for Federal Housing Administration (FHA) Lender Approval, lenders must complete the required forms provided by HUD, including detailed information about the company's business structure, financial status, lending policies, and compliance history. It's essential to follow the guidelines specified in the FHA Lender Handbook.

What is the purpose of Application for Federal Housing Administration (FHA) Lender Approval?

The purpose of the Application for Federal Housing Administration (FHA) Lender Approval is to ensure that lenders are qualified to handle FHA-insured loans, maintain compliance with FHA regulations, and provide fair and responsible lending practices to borrowers seeking home financing.

What information must be reported on Application for Federal Housing Administration (FHA) Lender Approval?

The information required on the Application for Federal Housing Administration (FHA) Lender Approval includes the lender's business information, organizational structure, financial statements, loan origination capabilities, underwriting guidelines, compliance history, and any relevant licensing or regulatory approvals.

Fill out your application for federal housing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Federal Housing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.