Get the free IRS Announces Enhancements to Online Payment Agreement Application

Show details

The document outlines recent improvements to the IRS's interactive Online Payment Agreement application, which enables eligible taxpayers to set up installment agreements for unpaid taxes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs announces enhancements to

Edit your irs announces enhancements to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs announces enhancements to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs announces enhancements to online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit irs announces enhancements to. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

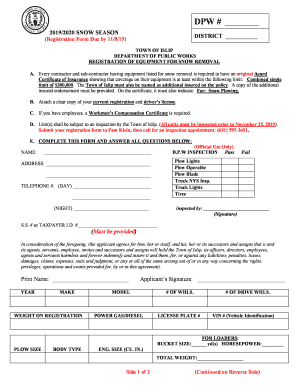

How to fill out irs announces enhancements to

How to fill out IRS Announces Enhancements to Online Payment Agreement Application

01

Visit the IRS website and navigate to the Online Payment Agreement application page.

02

Select the type of agreement you wish to apply for.

03

Fill in your personal and financial information as prompted.

04

Provide details about your tax liability, including the amount you owe and any past payments.

05

Review your application for accuracy before submitting.

06

Submit your application electronically.

Who needs IRS Announces Enhancements to Online Payment Agreement Application?

01

Individuals or businesses who owe taxes to the IRS and need a payment plan.

02

Taxpayers seeking a convenient method to manage their tax liabilities online.

03

Those who have been granted special consideration or prior payment arrangements and need to update them.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take for the IRS to approve an installment agreement?

When you request an IA using the form, generally, you'll receive a response from the IRS within 30 days notifying you of whether the IA request was approved or rejected. An assigned IRS employee may also contact you and request financial records to verify the amount you've requested to pay.

Can I reduce my IRS installment agreement online?

You can use the Online Payment Agreement tool to make the following changes: Change your monthly payment amount. Change your monthly payment due date. Convert an existing agreement to a Direct Debit agreement.

Is an IRS installment agreement worth it?

An installment plan allows you to pay your taxes over time while avoiding garnishments, levies or other collection actions. You'll still owe penalties and interest for paying your taxes late, but it can help make the payments more affordable.

How much is the 9465 installment agreement fee?

Don't stress the IRS. The user fee for requesting an installment agreement using Form 9465 is $225 with payment by check and $107 with payment by direct debit from your checking account.

How much is the 9465 installment agreement fee?

The user fee for requesting an installment agreement using Form 9465 is $225 with payment by check and $107 with payment by direct debit from your checking account.

What is the IRS payment plan agreement form?

Use Form 9465 to request a monthly installment agreement (payment plan) if you can't pay the full amount you owe shown on your tax return (or on a notice we sent you). Most installment agreements meet our streamlined installment agreement criteria. See Streamlined installment agreement, later, for more information.

How much will the IRS accept for payment plans?

If you are an individual, you may qualify to apply online if: Long-term payment plan (installment agreement): You owe $50,000 or less in combined tax, penalties and interest, and filed all required returns. Short-term payment plan: You owe less than $100,000 in combined tax, penalties and interest.

Will the IRS keep my refund if I have an installment agreement?

Can I receive a tax refund if I am currently making payments under an installment agreement or payment plan for another federal tax period? No, one of the conditions of your installment agreement is that the IRS will automatically apply any refund (or overpayment) due to you against taxes you owe.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRS Announces Enhancements to Online Payment Agreement Application?

The IRS has made improvements to its Online Payment Agreement Application, allowing taxpayers to set up installment agreements more easily and efficiently for paying their taxes.

Who is required to file IRS Announces Enhancements to Online Payment Agreement Application?

Taxpayers who owe taxes and need to establish a payment plan for their tax liabilities are required to file this application.

How to fill out IRS Announces Enhancements to Online Payment Agreement Application?

To fill out the application, taxpayers should visit the IRS website, follow the prompts to provide personal and financial information, and select the option for an installment agreement.

What is the purpose of IRS Announces Enhancements to Online Payment Agreement Application?

The purpose is to simplify the process for taxpayers to establish payment plans for outstanding tax debts, making it more accessible and user-friendly.

What information must be reported on IRS Announces Enhancements to Online Payment Agreement Application?

Taxpayers must provide personal identification information, details about the tax owed, financial information including income and expenses, and their proposed payment plan.

Fill out your irs announces enhancements to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Announces Enhancements To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.