Get the free Form 433-B - justice

Show details

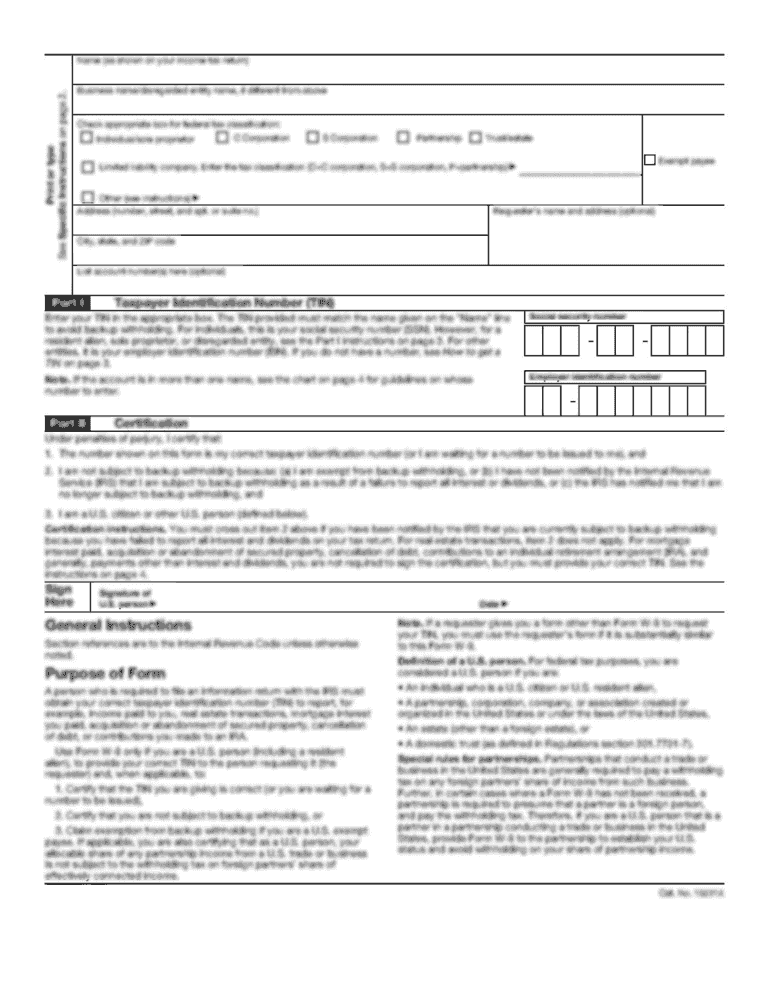

This form is used by businesses to provide the IRS with detailed financial information, assisting in the assessment of their ability to pay tax liabilities.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 433-b - justice

Edit your form 433-b - justice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 433-b - justice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 433-b - justice online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 433-b - justice. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 433-b - justice

How to fill out Form 433-B

01

Download Form 433-B from the IRS website.

02

Provide your personal information, including your name, address, and Social Security number.

03

List your assets, including bank accounts, investments, and real estate.

04

Document your income, including wages, self-employment income, and any other sources.

05

Detail your expenses, such as housing costs, utilities, and transportation.

06

Sign and date the form to certify that the information is accurate.

07

Submit the completed form to the IRS via mail or online as instructed.

Who needs Form 433-B?

01

Business owners or self-employed individuals who owe taxes and need to demonstrate financial circumstances to the IRS.

Fill

form

: Try Risk Free

People Also Ask about

What is IRS form 433 used for?

Form 433-A, or the Collection Information Statement for Wage Earners and Self-Employed Individuals, is used by the Internal Revenue Service (“IRS”) to evaluate a taxpayer's financial standing.

Why do I need form 8453?

Form 8453 is literally titled ``US. Individual Income Tax Transmittal for an IRS e-file Return'' and is used to submit forms that the IRS requires you to mail in even if you e-file. The IRS will never release coding for this form and other attachments that should be mailed in for TurboTax to add to the software.

What is the IRS form W-8BEN used for?

The W-8BEN establishes that you are a non-US taxpayer who has received US-sourced income. It allows you to claim exemption from the mandatory withholding, which can be up to 30% of interest earned.

What is form 433 A used for?

Form 433-A provides information necessary for determining how a wage earner or self-employed individual can satisfy an outstanding tax liability.

What is the IRS form 1099B used for?

Key Takeaways. Form 1099-B is used to report gains or losses from selling stocks, bonds, derivatives, or other securities through a broker, and for barter exchange transactions.

What is the purpose of form 433-B?

Form 433-B is an IRS Collection Information Statement for businesses used when a business owes taxes but cannot pay them. IRS Form 433A is for self-employed and wage earners, while IRS Form 433B is for businesses like c-corporations, s-corporations, and partnerships.

What is the IRS form 433-B used for?

Form 433-B is used to obtain current financial information necessary for determining how a business can satisfy an outstanding tax liability. Complete items 1 through 6. For items 4 and 5, include information for mobile commerce and mobile accounts such as PayPal Mobile or Paymate.

What are the monthly necessary living expenses for IRS form 433 F?

Monthly Necessary Living Expenses In the living expenses section of the 433-F form, you will list your expenses, including food, clothing, gas, insurance, utilities, medical bills, child care, and housekeeping supplies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 433-B?

Form 433-B is a form used by the Internal Revenue Service (IRS) to collect financial information from businesses to determine their ability to pay tax debts.

Who is required to file Form 433-B?

Form 433-B must be filed by businesses or self-employed individuals who owe taxes and are seeking to establish an installment agreement or offer in compromise with the IRS.

How to fill out Form 433-B?

To fill out Form 433-B, you need to provide detailed information about your business's finances, including income, expenses, assets, liabilities, and employee information.

What is the purpose of Form 433-B?

The purpose of Form 433-B is to provide the IRS with a clear picture of a business's financial situation to assess their tax liability and payment options.

What information must be reported on Form 433-B?

Form 433-B requires reporting of information such as business name, address, structure, financial accounts, monthly income and expenses, and assets owned by the business.

Fill out your form 433-b - justice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 433-B - Justice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.