Get the free Farm Credit Lender Mortgagee Certificate - marad dot

Show details

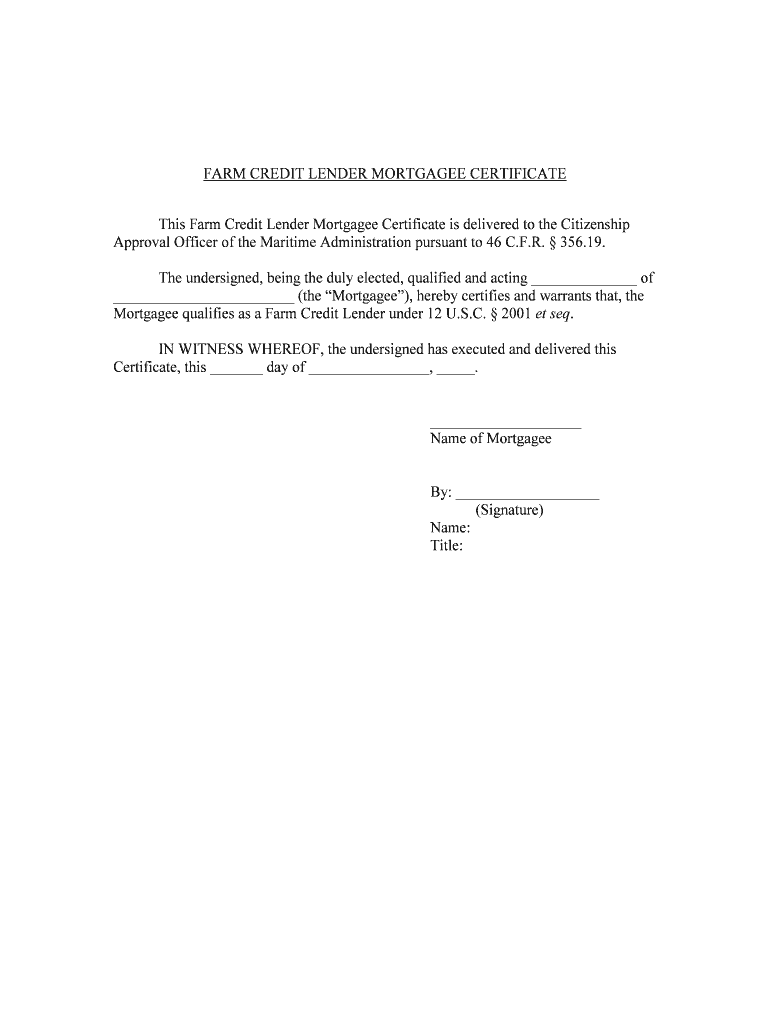

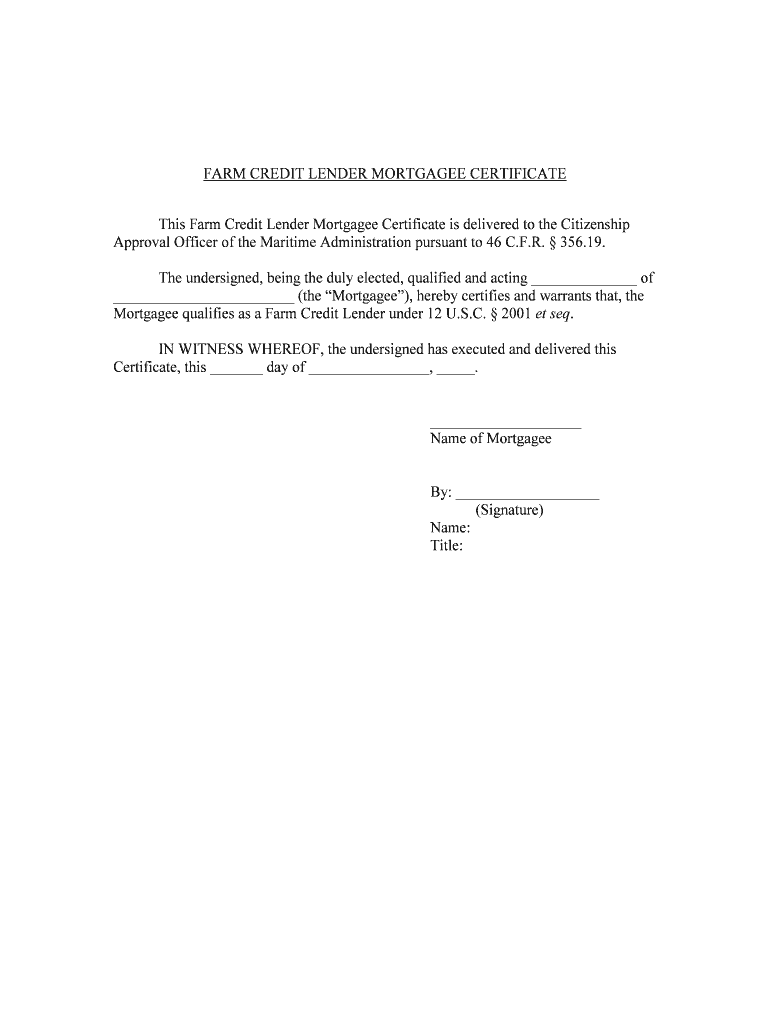

This certificate certifies that the undersigned mortgagee qualifies as a Farm Credit Lender under U.S. law and is submitted to the Citizenship Approval Officer of the Maritime Administration.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign farm credit lender mortgagee

Edit your farm credit lender mortgagee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your farm credit lender mortgagee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit farm credit lender mortgagee online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit farm credit lender mortgagee. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out farm credit lender mortgagee

How to fill out Farm Credit Lender Mortgagee Certificate

01

Obtain the Farm Credit Lender Mortgagee Certificate form from your lender.

02

Fill in the loan number associated with your mortgage.

03

Provide the names and addresses of all parties involved in the mortgage agreement.

04

Specify the loan amount and the property address.

05

Indicate the type of mortgage (e.g., conventional, FHA, etc.).

06

Sign and date the form where required.

07

Submit the completed form to your lender for processing.

Who needs Farm Credit Lender Mortgagee Certificate?

01

Farmers and ranchers seeking financing through Farm Credit services.

02

Lenders who require verification for mortgage-related transactions.

03

Persons or entities involved in agricultural property transactions.

Fill

form

: Try Risk Free

People Also Ask about

What is the minimum down payment for Farm Credit?

Direct Farm Ownership Down Payment Loan Down Payment loans require loan applicants to provide a minimum cash down payment of 5 percent of the purchase price of the farm.

What credit score do you need for a Farm Credit loan?

The credit score you need for a farm loan depends on your lenders, your personal finance history, and other factors relating to your loan request. As a baseline, you should maintain a credit score of at least 660, though most ag lenders will question a credit score below 700. However, there are exceptions.

What banks are part of the Farm Credit System?

Once the Funding Corporation issues debt securities on behalf of all Farm Credit institutions, the four regional wholesale banks, AgFirst, AgriBank, CoBank and Farm Credit Bank of Texas, fund the individual Farm Credit associations who support farmers, ranchers and rural homebuyers.

What is a farm credit lender?

Congress established the Farm Credit System in 1916 to support rural communities with reliable credit and financially related services. Today, it consists of a nationwide network of customer-owned financial institutions with customers in every state, Puerto Rico and, under certain conditions, U.S. territories.

Is Farm Credit a good lender?

FCS institutions are leaders in agricultural lending, holding roughly 40 percent of all farm business debt in the country. In contrast, the U.S. Department of Agriculture's (USDA) loan programs support less than 5 percent of all farm loans; commercial banks and other lenders make up the difference.

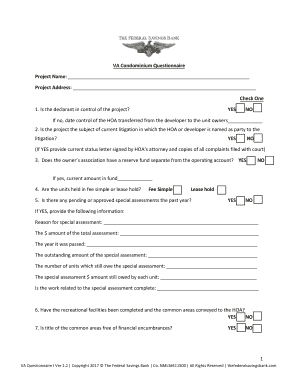

What is a lender's certificate?

A Lender Certification from the Homeowner's Association (HOA) is a form required by the new lender that provides information regarding the number of units that are owner and/or non‑owner occupied in the community, notices regarding pending litigation, and notices of pending and current assessments and reserves.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Farm Credit Lender Mortgagee Certificate?

The Farm Credit Lender Mortgagee Certificate is a document issued by Farm Credit lenders that verifies the mortgage status of a borrower. It serves as official proof of a mortgage loan held by a Farm Credit lender.

Who is required to file Farm Credit Lender Mortgagee Certificate?

The borrower who has received a mortgage loan from a Farm Credit lender is required to file the Farm Credit Lender Mortgagee Certificate as part of the mortgage process.

How to fill out Farm Credit Lender Mortgagee Certificate?

To fill out the Farm Credit Lender Mortgagee Certificate, the borrower must provide specific details such as the name of the lender, loan number, property address, and any other relevant information requested on the form.

What is the purpose of Farm Credit Lender Mortgagee Certificate?

The purpose of the Farm Credit Lender Mortgagee Certificate is to provide proof of mortgage, facilitate the transfer of property, and clarify the rights and responsibilities associated with the mortgage loan.

What information must be reported on Farm Credit Lender Mortgagee Certificate?

The information that must be reported on the Farm Credit Lender Mortgagee Certificate includes the lender's name, loan number, property description, borrower's information, and the terms of the mortgage.

Fill out your farm credit lender mortgagee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Farm Credit Lender Mortgagee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.