Get the free FORM 8437 (9-2013)

Show details

This form is used to apply for financing options such as purchase, lease, or refinance of agricultural equipment. It requires detailed information about the applicant(s), their farming business, income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 8437 9-2013

Edit your form 8437 9-2013 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 8437 9-2013 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 8437 9-2013 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 8437 9-2013. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 8437 9-2013

How to fill out FORM 8437 (9-2013)

01

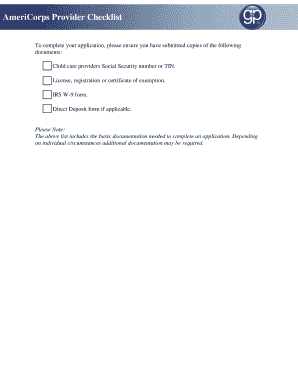

Obtain FORM 8437 (9-2013) from the official website or a designated office.

02

Carefully read the instructions provided with the form to understand its purpose and requirements.

03

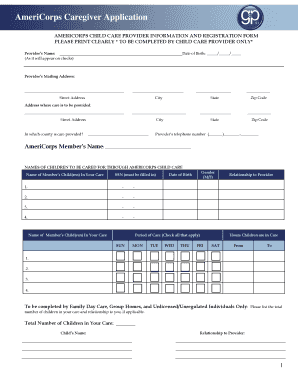

Fill in your personal information in the designated fields, including your name, address, and contact details.

04

Provide any necessary identification numbers, such as a Social Security Number or taxpayer identification number.

05

Complete the relevant sections of the form based on the specific situation you are addressing.

06

Review all the information you have entered to ensure accuracy and completeness.

07

Sign and date the form at the appropriate section.

08

Make a copy of the completed form for your records.

09

Submit the form according to the instructions provided, either by mail or electronically if applicable.

Who needs FORM 8437 (9-2013)?

01

Individuals who need to request a waiver from certain penalties associated with tax obligations.

02

Taxpayers who are involved in situations that require the documentation provided in FORM 8437.

03

Businesses or individuals facing unique circumstances that could lead to penalties and need to justify their request.

Fill

form

: Try Risk Free

People Also Ask about

Where to paper file form 1310?

If you are filing Form 1310 separately, send it to the same Internal Revenue Service Center where the original return was filed.

Does form 1310 need to be paper filed?

A return containing Form 1310 can only be e-filed in certain circumstances. EF messages are shown if there is an issue that prevents e-file. If either option A or B is marked for an original return, EF messages 1016 and 5420 prevent e-file. The return must be paper-filed with Form 1310 attached instead.

Where do I mail my M 1310 form?

If you are filing Form 1310 separately, send it to the same Internal Revenue Service Center where the original return was filed.

What is a K 9 form?

The K9 form addresses specific financial transactions requiring detailed reporting. It is primarily used by entities engaged in activities that demand comprehensive disclosure of financial data to ensure transparency and adherence to regulatory standards.

How long does form 1310 need to be mailed?

There is no specific deadline for filing Form 1310, but it should be filed as soon as possible after the taxpayer's death to expedite the refund process.

What is form 9990?

Form 990 (officially, the "Return of Organization Exempt From Income Tax") is a United States Internal Revenue Service (IRS) form that provides the public with information about a nonprofit organization. It is also used by government agencies to prevent organizations from abusing their tax-exempt status.

Where do I mail the IRS form 1310 to?

Send the completed form to the IRS center where you filed the original tax return, or. Follow the instructions for the form to which you are attaching Form 1310.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM 8437 (9-2013)?

FORM 8437 (9-2013) is a document used for reporting certain tax-related information to the IRS, often pertaining to claims for refund or credit.

Who is required to file FORM 8437 (9-2013)?

Individuals and businesses who wish to claim a refund or credit on specific tax liabilities are required to file FORM 8437 (9-2013).

How to fill out FORM 8437 (9-2013)?

To fill out FORM 8437 (9-2013), provide accurate information in the required fields including your personal details, the tax year, and the nature of the claim being made. Follow the instructions carefully to ensure compliance.

What is the purpose of FORM 8437 (9-2013)?

The purpose of FORM 8437 (9-2013) is to facilitate the process of claiming refunds or credits for specific overpayments made in certain tax categories.

What information must be reported on FORM 8437 (9-2013)?

The information that must be reported on FORM 8437 (9-2013) includes your identifying information, the tax period for the claim, and the reason for requesting a refund or credit, along with any supporting documentation.

Fill out your form 8437 9-2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8437 9-2013 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.