Get the free Manufacturers' Investment Credit FAQs

Show details

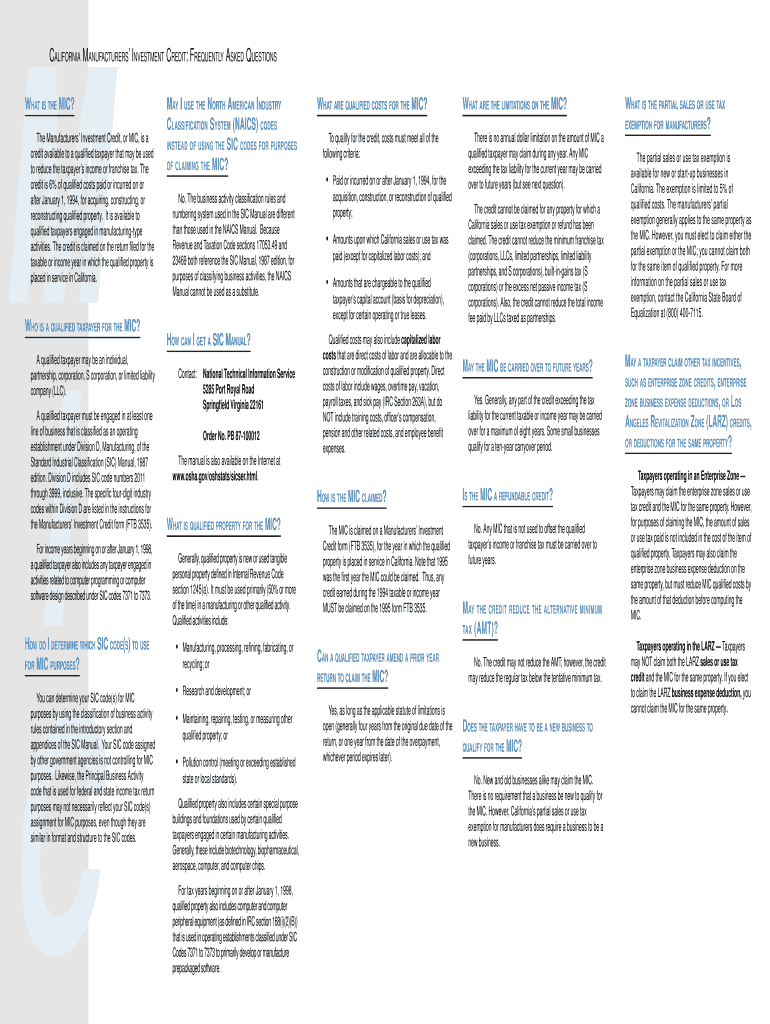

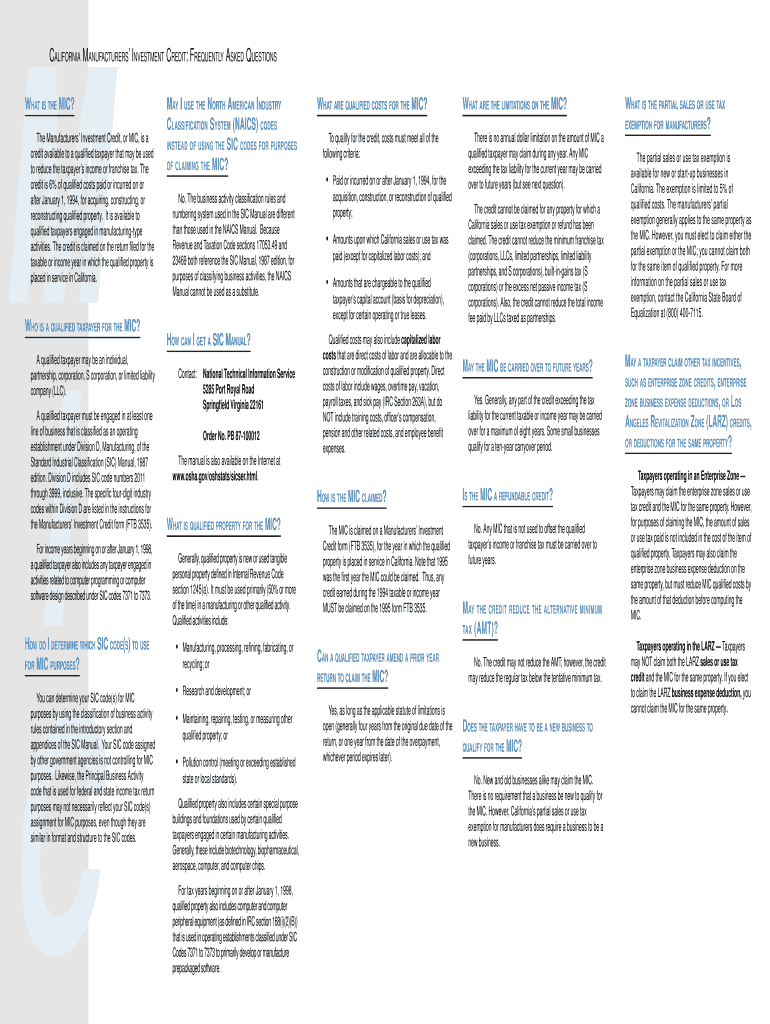

Este documento proporciona información sobre el Crédito de Inversión para Fabricantes (MIC) de California, destinado a contribuyentes calificados que realizan actividades de fabricación. Incluye

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign manufacturers investment credit faqs

Edit your manufacturers investment credit faqs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your manufacturers investment credit faqs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit manufacturers investment credit faqs online

Follow the steps down below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit manufacturers investment credit faqs. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out manufacturers investment credit faqs

How to fill out Manufacturers' Investment Credit FAQs

01

Gather necessary documentation: Collect all relevant information regarding your manufacturing investments.

02

Review the eligibility criteria: Ensure that your investments meet the requirements for the Manufacturers' Investment Credit.

03

Outline your investments: Clearly state the types of investments made, such as machinery, equipment, or property.

04

Complete the required forms: Fill out the necessary forms accurately, providing detailed descriptions and values of the investments.

05

Provide supporting evidence: Attach any needed documentation that substantiates your claims for the credit.

06

Check submission guidelines: Follow any specific instructions regarding how to submit the FAQs, including any deadlines.

07

Keep copies: Retain copies of all submitted documents for your records.

Who needs Manufacturers' Investment Credit FAQs?

01

Manufacturers who have made eligible investments and are looking to benefit from tax credits.

02

Investors in manufacturing sectors who want to understand the potential tax implications of their investments.

03

Financial officers and accountants working within manufacturing companies who need to advise on investment credits.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between production tax credit and investment tax credit?

The ITC is a one-time credit, and a project is typically eligible in the year that project is placed into service. Clean energy projects claiming the production tax credit typically have an eligibility period of 10 years after the equipment is placed into service.

What is the difference between investment tax credit and production tax credit?

The ITC is a one-time credit, and a project is typically eligible in the year that project is placed into service. Clean energy projects claiming the production tax credit typically have an eligibility period of 10 years after the equipment is placed into service.

What are the two classifications of tax credits?

Investment tax credits are basically a federal tax incentive for business investment. They let individuals or businesses deduct a certain percentage of investment costs from their taxes.

What is the section 48D advanced manufacturing investment credit?

Section 48D(a) provides that the section 48D credit is an amount equal to 25 percent of the qualified investment for any taxable year with respect to any advanced manufacturing facility of an eligible taxpayer.

Is the 48C credit refundable?

The § 48C credit can reduce your federal income tax liability to zero, but it is not refundable, and it is not a grant like the grants issued by Treasury Department under § 1603 of the American Recovery and Reinvestment Act. 4. What is the process for getting a section 48C tax credit?

How does the investment tax credit work?

Investment tax credits are basically a federal tax incentive for business investment. They let individuals or businesses deduct a certain percentage of investment costs from their taxes. These credits are in addition to normal allowances for depreciation.

What is a production tax credit?

Types of Tax Credits There are three categories of tax credits: nonrefundable, refundable, and partially refundable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Manufacturers' Investment Credit FAQs?

Manufacturers' Investment Credit FAQs provide answers to common questions regarding the Manufacturers' Investment Tax Credit, which incentivizes businesses to invest in manufacturing properties and equipment.

Who is required to file Manufacturers' Investment Credit FAQs?

Businesses and manufacturers who qualify for the investment tax credit and wish to claim it on their tax returns are required to file these FAQs to seek guidance on the process.

How to fill out Manufacturers' Investment Credit FAQs?

To fill out the Manufacturers' Investment Credit FAQs, individuals should review the eligibility criteria, gather necessary documentation, and follow the provided instructions on the form for accurate submissions.

What is the purpose of Manufacturers' Investment Credit FAQs?

The purpose of Manufacturers' Investment Credit FAQs is to provide clarity and assistance to manufacturers regarding the tax credit process, ensuring they understand how to properly claim the credit.

What information must be reported on Manufacturers' Investment Credit FAQs?

Information that must be reported includes the type of investment, the value of qualifying property, the business details, and any supporting documentation necessary to substantiate the claim for the credit.

Fill out your manufacturers investment credit faqs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Manufacturers Investment Credit Faqs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.