Get the free Form 587 - dor mo

Show details

Este formulario proporciona detalles en apoyo a los montos mostrados como desembolsos en el Formulario 4757, Informe Mensual de Impuestos del Distribuidor. Cada desembolso de producto debe ser listado

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 587 - dor

Edit your form 587 - dor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 587 - dor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 587 - dor online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 587 - dor. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 587 - dor

How to fill out Form 587

01

Begin by downloading Form 587 from the official website.

02

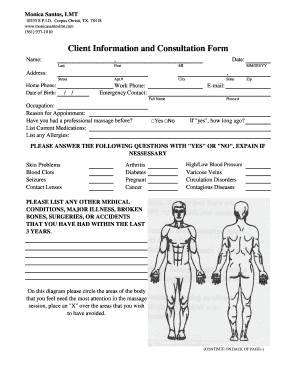

Fill in your personal information at the top of the form, including your name, address, and contact information.

03

Provide the necessary identification details such as your Social Security Number and other relevant identifiers.

04

Follow the instructions on the form to accurately describe the purpose of the request.

05

Review the form for accuracy, ensuring all necessary fields are completed.

06

Sign and date the form in the appropriate sections.

07

Submit the form as per the instructions provided, whether electronically or via mail.

Who needs Form 587?

01

Form 587 is typically needed by individuals or businesses requesting tax-related information or specific tax benefits from the IRS.

Fill

form

: Try Risk Free

People Also Ask about

How do I request a non resident withholding waiver in California?

Use Form 588, Nonresident Withholding Waiver Request, to request a waiver from withholding on payments of California source income to nonresident payees. Do not use Form 588 to request a waiver if you are a foreign (non-U.S.) partner or member.

How do I claim exemption from California withholding?

In order to claim exemption from state income tax withholding, employees must submit a W-4 or DE-4 certifying that they did not have any federal tax liability for the preceding year and that they do not anticipate any tax liability for the current taxable year.

Who needs to fill out a California Form 590?

Who Certifies this Form. Form 590 is certified (completed and signed) by the payee. California residents or entities exempt from the withholding requirement should complete Form 590 and submit it to the withholding agent before payment is made.

What is a 587 tax form?

Use Form 587, Nonresident Withholding Allocation Worksheet, to determine if withholding is required and the amount of California source income subject to withholding. Withholding is not required if payees are residents or have a permanent place of business in California.

How to claim California nonwage withholding credit?

Claim your nonwage withholding credit on one of the following: Form 540, California Resident Income Tax Return. Form 540NR, California Nonresident or Part-Year Resident Income Tax Return. Form 541, California Fiduciary Income Tax Return.

How to claim nonwage withholding credit in California?

Claim your nonwage withholding credit on one of the following: Form 540, California Resident Income Tax Return. Form 540NR, California Nonresident or Part-Year Resident Income Tax Return. Form 541, California Fiduciary Income Tax Return.

How do I certify that I am not subject to California withholding?

EXEMPTION FROM WITHHOLDING: If you wish to claim exempt, complete the federal Form W-4. You may claim exempt from withholding California income tax if you did not owe any federal income tax last year and you do not expect to owe any federal income tax this year.

Will you use a SOS, SSN, FEIN, or Corporation number on your 587?

You must provide a valid TIN as requested on this form. The following are acceptable TINs: social security number (SSN); individual taxpayer identification number (ITIN); federal employer identification number (FEIN); California corporation number (CA Corp no.); or California Secretary of State (CA SOS) file number.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 587?

Form 587 is a California form used for reporting the change of address, change of ownership, or change of business type for certain tax purposes.

Who is required to file Form 587?

Businesses that experience a change in address, ownership, or business type in California are required to file Form 587.

How to fill out Form 587?

To fill out Form 587, you should provide your business information, the nature of the change you are reporting, and any other pertinent details as specified on the form.

What is the purpose of Form 587?

The purpose of Form 587 is to ensure that the California tax authorities have updated information regarding your business for accurate tax reporting and compliance.

What information must be reported on Form 587?

On Form 587, you must report your current business name, address, the nature of the change, and any relevant identification numbers.

Fill out your form 587 - dor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 587 - Dor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.