CT OP-236 Schedule A 2008 free printable template

Show details

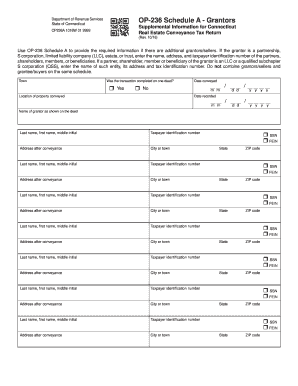

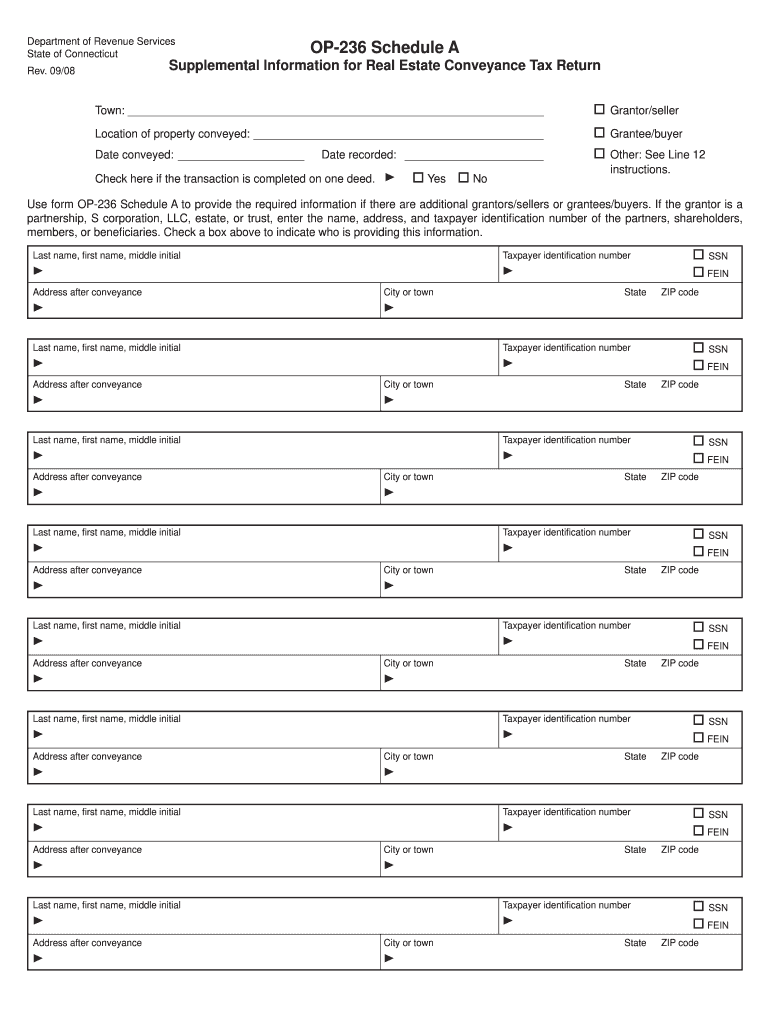

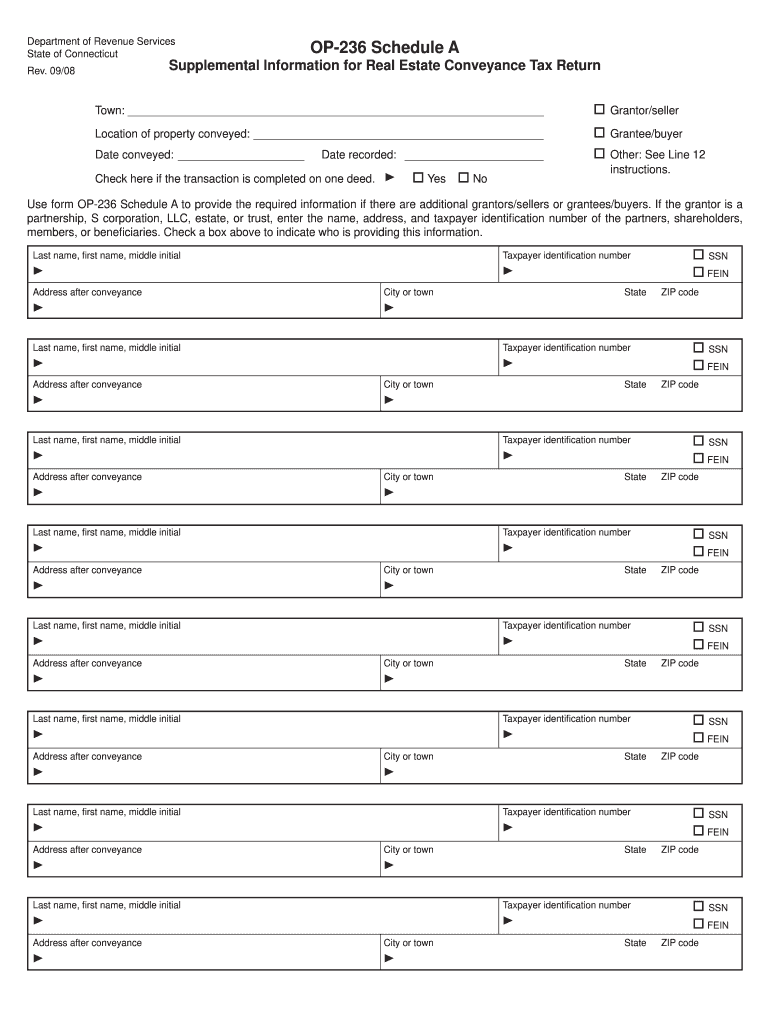

Date recorded Check here if the transaction is completed on one deed. Yes No Use form OP-236 Schedule A to provide the required information if there are additional grantors/sellers or grantees/buyers. Department of Revenue Services State of Connecticut OP-236 Schedule A Supplemental Information for Real Estate Conveyance Tax Return Rev. 09/08 Town Grantor/seller Location of property conveyed Grantee/buyer Date conveyed Other See Line 12 instructions. If the grantor is a partnership S...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign op 236 form 2008

Edit your op 236 form 2008 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your op 236 form 2008 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing op 236 form 2008 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit op 236 form 2008. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT OP-236 Schedule A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out op 236 form 2008

How to fill out CT OP-236 Schedule A

01

Begin by obtaining a copy of the CT OP-236 Schedule A form from the Connecticut Department of Revenue Services website.

02

Fill out your personal information at the top of the form, including your name, address, and Social Security number.

03

Provide information regarding the type of income you are reporting, such as wages, dividends, or interest.

04

Input the amount of each type of income in the designated fields, ensuring accuracy to avoid future issues.

05

Detail any adjustments to your income, such as deductions or credits you are eligible for, in the appropriate sections.

06

Review all the information you have entered to ensure correctness and completeness.

07

Sign and date the form to certify that the information provided is true and accurate.

Who needs CT OP-236 Schedule A?

01

Individuals who are residents of Connecticut and need to report their income.

02

Anyone who has income that is subject to Connecticut state tax.

03

Taxpayers filing their state income tax returns for the year.

Fill

form

: Try Risk Free

People Also Ask about

What is the CT real estate conveyance tax?

State law generally requires a person who sells real property for at least $2,000 to pay a tax on the property's conveyance. The tax has a state and municipal component and ranges from 1% to 2.75% of the sales price, depending on the property type and the municipality in which the property is located.

What is the land transfer tax in CT?

1. The State Conveyance Tax is 0.75% of the sales price for properties with a sales price that is $800,000.00 or less. 2. For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00 is taxed at a rate of 1.25%.

What is exempt from CT conveyance tax?

Additionally, the following are exempt from the state transfer tax: (1) deeds of the principal residence of any person approved for elderly taxpayer assistance; (2) deeds of property located in an area designated as an enterprise zone; and (3) deeds of property located in an entertainment district.

Who pays real estate transfer tax in CT?

This tax, typically paid by the seller at closing, is based on a percentage of the total sales price of a home. Sellers in some states pay multiple conveyance taxes, one to the state and another to the town and/or county. In Connecticut, sellers pay a state conveyance tax along with a municipal tax.

What is the real estate conveyance tax in Connecticut?

1. The State Conveyance Tax is 0.75% of the sales price for properties with a sales price that is $800,000.00 or less. 2. For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00 is taxed at a rate of 1.25%.

What is CT Form Op 236?

OP-236, Connecticut Real Estate Conveyance Tax Return. Page 1. Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is true, complete, and correct.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my op 236 form 2008 in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your op 236 form 2008 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I fill out the op 236 form 2008 form on my smartphone?

Use the pdfFiller mobile app to fill out and sign op 236 form 2008. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How can I fill out op 236 form 2008 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your op 236 form 2008 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is CT OP-236 Schedule A?

CT OP-236 Schedule A is a form used for reporting certain tax information in Connecticut, specifically related to the tax on other business activities and organizations.

Who is required to file CT OP-236 Schedule A?

Entities that engage in certain business activities or meet specific income thresholds in Connecticut are required to file CT OP-236 Schedule A.

How to fill out CT OP-236 Schedule A?

To fill out CT OP-236 Schedule A, one must provide details on the entity's business activities, financial information, and other relevant data as instructed in the form guidelines.

What is the purpose of CT OP-236 Schedule A?

The purpose of CT OP-236 Schedule A is to gather information for the state tax authorities to ensure proper compliance with state tax laws and to determine the tax liability of the entity.

What information must be reported on CT OP-236 Schedule A?

CT OP-236 Schedule A requires the reporting of entity identification information, income and expense details, and any applicable deductions or credits related to the entity's business activities.

Fill out your op 236 form 2008 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Op 236 Form 2008 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.