Get the free NCUA 5300 - ncua

Show details

This document is the third quarter 2002 Call Report for credit unions, containing essential financial data and guidelines for reporting loan activity, investments, and other financial metrics.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ncua 5300 - ncua

Edit your ncua 5300 - ncua form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ncua 5300 - ncua form via URL. You can also download, print, or export forms to your preferred cloud storage service.

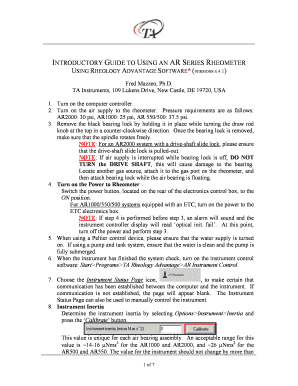

Editing ncua 5300 - ncua online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ncua 5300 - ncua. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ncua 5300 - ncua

How to fill out NCUA 5300

01

Obtain the NCUA 5300 form from the NCUA website or your credit union's compliance department.

02

Review the instructions provided with the form carefully.

03

Gather necessary financial data from your credit union, including balance sheets, income statements, and other relevant financial records.

04

Complete the form by filling in all required fields, including assets, liabilities, member equity, income, and expenses.

05

Verify accuracy of all entries to ensure compliance with reporting requirements.

06

Review your completed form against the instructions to ensure all parts of the form are answered.

07

Submit the completed form to NCUA by the specified deadline.

Who needs NCUA 5300?

01

Every federally insured credit union is required to file the NCUA 5300 report.

02

Credit unions seeking to maintain their federal insurance and comply with NCUA regulations need to complete this form.

Fill

form

: Try Risk Free

People Also Ask about

Is my money safe in a credit union right now?

If yours does — California Credit Union, Members 1st Credit Union, SchoolsFirst Federal Credit Union, Teachers Federal Credit Union and Schools Federal Credit Union all do — your deposit is as safe at your credit union as it would be at a big bank.

Is the NCUA safer than the FDIC?

Neither one is safer than the other. Both the NCUA and FDIC are backed by the federal government.

What happens if an NCUA credit union fails?

If a credit union is placed into liquidation, the NCUA's Asset Management and Assistance Center (AMAC) will oversee the liquidation and set up an asset management estate (AME) to manage assets, settle members' insurance claims, and attempt to recover value from the closed credit union's assets.

What is the legal lending limit for NCUA?

If the member shares are not assumed by another credit union, all verified member shares are typically paid within five days of a credit union's closure.

Is my money safe with NCUA?

Unless a greater amount is approved by the NCUA regional director, the aggregate amount of outstanding member business loans to any one member or group of associated members shall not exceed 15% of the credit union's reserves (less the allowance for Loan Losses account), or $75,000, whichever is higher.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NCUA 5300?

NCUA 5300 is a quarterly financial report that federally insured credit unions must file with the National Credit Union Administration (NCUA). It provides a comprehensive overview of the credit union's financial condition and performance.

Who is required to file NCUA 5300?

All federally insured credit unions are required to file NCUA 5300 on a quarterly basis.

How to fill out NCUA 5300?

To fill out NCUA 5300, credit unions must gather relevant financial information, complete the report using the provided template on the NCUA's website, and submit it electronically by the specified due date.

What is the purpose of NCUA 5300?

The purpose of NCUA 5300 is to ensure transparency and accountability among credit unions, enabling regulators to assess their financial health and stability.

What information must be reported on NCUA 5300?

The NCUA 5300 report requires information on assets, liabilities, net worth, loans, investments, shares, income, and expenses, among other financial metrics.

Fill out your ncua 5300 - ncua online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ncua 5300 - Ncua is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.